IOTA, Litecoin, Polkadot Price Analysis: 23 April

The altcoin market has seen increased bearish momentum in the past few days. With Bitcoin dropping to price levels below the key $50k mark, the altcoin market was soon to follow suit with popular coins like IOTA, Litecoin, and Polkadot registering significant drops in the past 24-hours.

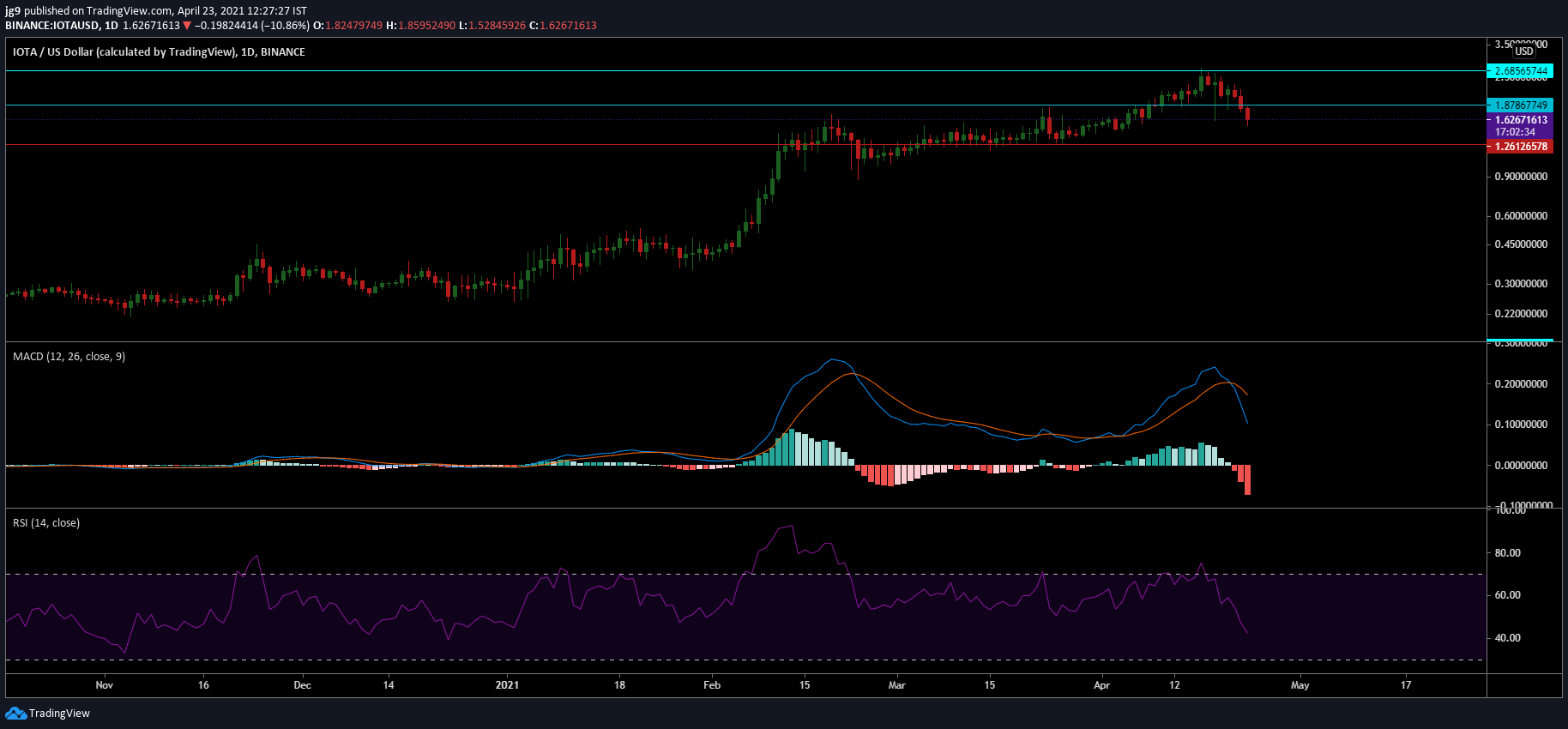

IOTA

Source: IOTA/USD, TradingView

IOTA’s price has seen a substantial drop in price amounting to 23 percent in the past day and close to 30 percent in the week. The coin traded at $1.63 and had a market capitalization of over $4.5 billion making it the 26th largest cryptocurrency in the market.

IOTA has now flipped its key support at $1.8 into resistance and if the coin were to see a further price drop, it may soon head into the $1.26 price range where it has considerable amount of support. However, if its immediate resistance were to be breached, then the coin may move towards the $2.6 price range.

Technical indicators for the coin look bearish. MACD indicator underwent a bearish crossover with the signal line going past the MACD line. At the moment there are no signs of a reversal. RSI also shared a similar outlook as it heads well into the oversold zone.

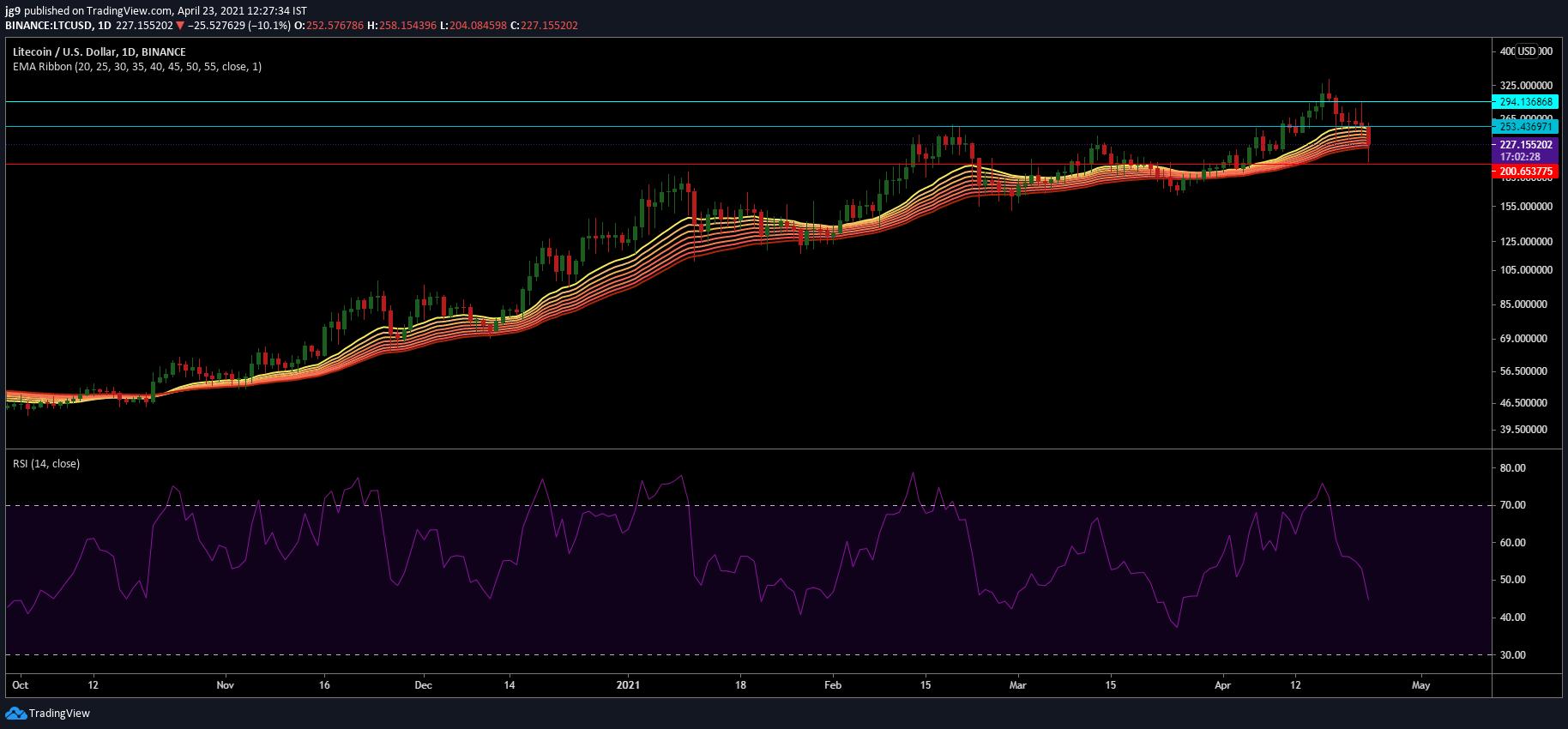

Litecoin [LTC]

Source: LTC/USD, TradingView

Litecoin’s price action was no different. The coin lost over 14 percent in the past 24-hours and currently trades at $224 with a market cap of over $14.7 billion. If the bearish pressure were to sustain, then LTC may soon test the $200 level – the coin’s next support level. However, if a trend reversal were to take place, then it is quite likely that a move to $253 may occur in the coming 48 hours.

EMA ribbons are offering a bit of support at LTC’s current price range and may help arrest the bearish momentum in its market. RSI indicator, on the other hand, continued to drop towards the oversold zone – indicating that the price drop may continue in the short term.

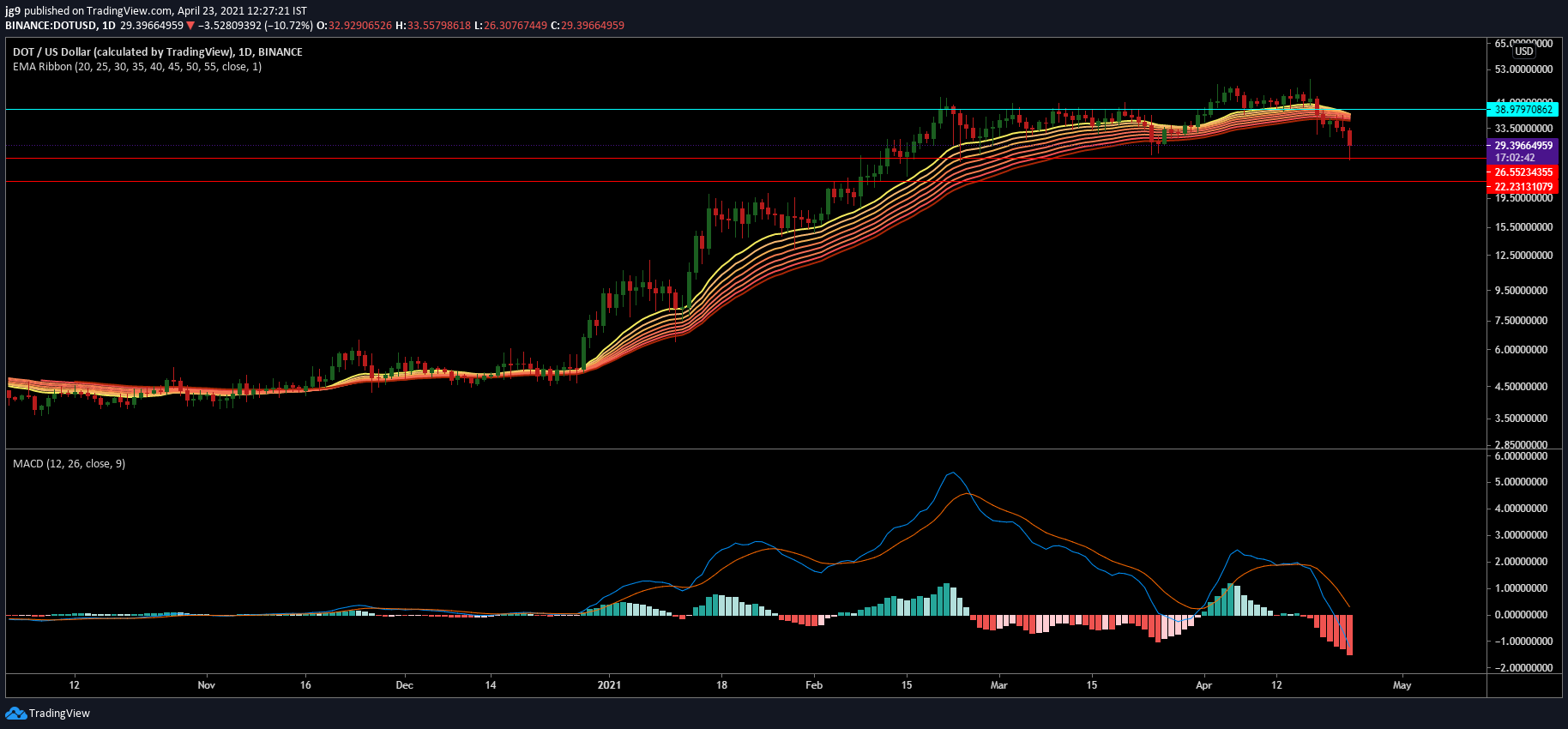

Polkadot [DOT]

Source: DOT/USD, TradingView

Polkadot’s price was now close to testing support at $26.5 and was trading at $29 after having lost over 14 percent of its value in the past day’s time. The coin has strong resistance around the $38 price level if it were to arrest its bearishness and move upwards. However, if the bearish momentum were to persist, a drop to $22 cannot be discounted.

MACD indicator underwent a bearish crossover with the signal line going past the MACD line. However, a reversal doesn’t seem likely at the moment. EMA ribbons have now settled above the coin’s present trading price and are likely to offer a bit of resistance around the $35-$38 price range.