Story [IP] eyes $5.15 resistance – Failure could send it back to $3.88

- Story [IP] has formed a range between $3.88 and $5.15.

- A move beyond $5 could send prices soaring once again.

Story [IP] has gained 23.5% in the past 24 hours. At a time when Bitcoin [BTC] and the crypto market were sliding lower, the increased demand for the L1 native token was encouraging.

Trading volume has also increased — the daily volume is up 133% compared to the previous day.

Yet, the $5.1 level has opposed the bulls’ progress in recent days. It could be the case that IP bulls would be rebuffed from the key resistance once more.

The token generation event (TGE) occurred only two weeks ago, and 25% of the total 1B IP supply is in circulation.

This meant that the price action data lacked history. The linear unlock over the next year meant that no new vast token unlocks would occur, and the unlocks thereafter are scheduled to be linear too.

A range formation for IP

The range formation between $3.88 and $5.15 was highlighted in white. The mid-range level at $4.5 has served as both resistance and support over the past few days.

At press time, the bulls were knocking on the doors of the range highs.

The OBV has trended higher in recent days, but in the past few hours, it began to slump. The RSI on the 2-hour chart remained above 60 to signal strong upward momentum.

A trading session close above $5.26 would be an encouraging sign, as it would show a market structure shift. As things stand, a drop to the $4.5 and $3.88 was possible.

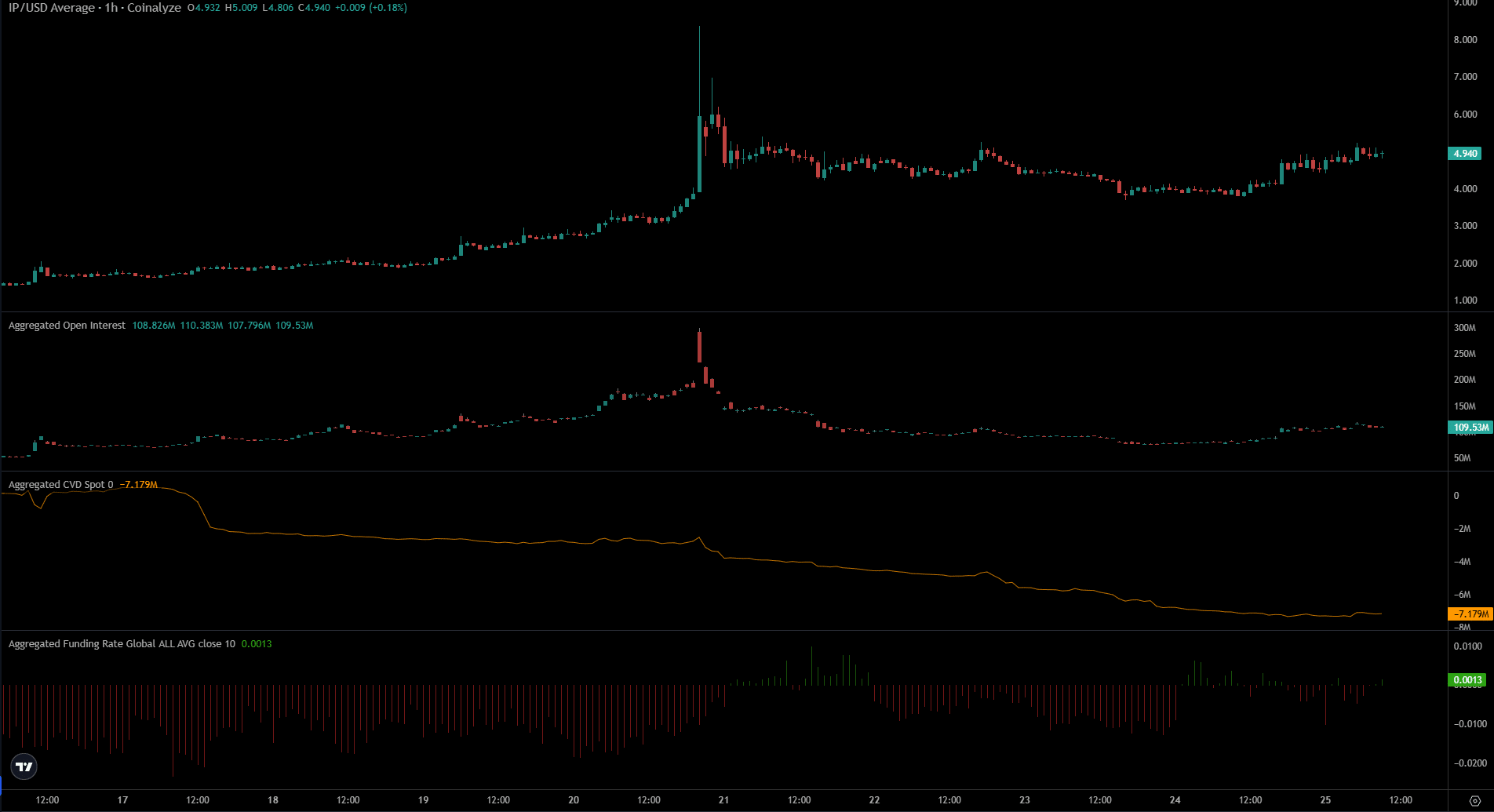

Source: Coinalyze

The likelihood of a price drop was increased by the falling spot CVD, which highlighted weak demand. The Funding Rate has hovered around the zero mark over the past 24 hours, and at press time was slightly negative.

The Open Interest’s trend has also flattened as IP tested the range highs. This showed that speculators were not eager to go long, reflecting a lack of bullish conviction.

However, by itself, this does not show a retracement is due. The inference from the OI was that the IP token likely needed more time before it was ready to resume its uptrend.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion