Is 1INCH the latest to grab trader interest? These figures reveal that…

- 1inch’s volume from Ethereum layer 2 networks has recently been on the rise.

- The outcome suggests that Layer 2 usage is rapidly growing.

The 1inch network announced that it has achieved yet another important milestone in its pursuit of growth thanks to Arbitrum. The achievement reflected the network’s strategic plan and the success Ethereum Layer 2s are providing to DeFi protocols.

Is your portfolio green? Check out the 1INCH Profit Calculator

According to the announcement, 1inch’s on-chain volume on the Arbitrum network recently crossed the $10 billion mark. Why is this important?

Well, it confirms that 1inch has indeed found success through the Arbitrum layer 2. In addition, it highlights just how pivotal the Abritrum layer 2 has been in terms of facilitating those volumes.

? We are celebrating a new milestone: $10B+ in total volume on @arbitrum!

? #Arbitrum has long been the most popular L2 on #1inch by key blockchain indicators. A huge thank you to everyone using our dApp for the best swap rates.

? Dive into the stats: https://t.co/l8GKwIDgp7 pic.twitter.com/MmpRt513Tp

— 1inch Network (@1inch) September 25, 2023

The milestone is also a testament to the fact that traders are actively looking for the best swap rates. Meanwhile, 1Inch recently released its latest weekly stats and they reveal something interesting about layer 2 performance.

The Ethereum mainnet registered $289.67 billion in weekly volume after a $687 million improvement. It had 12.92 million swaps and 2.24 million users. Polygon, another layer 2 network averaged $20.77 billion in weekly volume during the week, a $47.93 million improvement from the previous week.

Optimism registered 3.72 billion in on-chain volume after a $22.28 million improvement from the previous week.

? 1inch Weekly Chain Stats #31

Curious about how #1inch is performing across supported blockchains? ? Check out our weekly stats! Week-over-week changes are shown in parentheses.

☯️ #1inchFusion: $11.28B in volume (+$146.04M) | 1.33M swaps (+21K) | 461.41K users (+6.51K)… pic.twitter.com/Onbk9DDnxN

— 1inch Network (@1inch) September 25, 2023

The 1INCH token sees demand improvement

The above findings confirmed that Ethereum Layer 2 networks continue to see more transaction activity. This growth was also reflected in the 1INCH token whose performance so far this month has mostly been bullish. In fact, the token has been gaining relative strength since it achieved a new historic low just after mid-August

1INCH exchanged hands at $0.26 at the time of writing. Its performance since mid-August suggests that it may have bottomed out and might be in the early stages of its bullish relief rally. However, the volatile nature of the market does not necessarily suggest that it is off the hook from the bears.

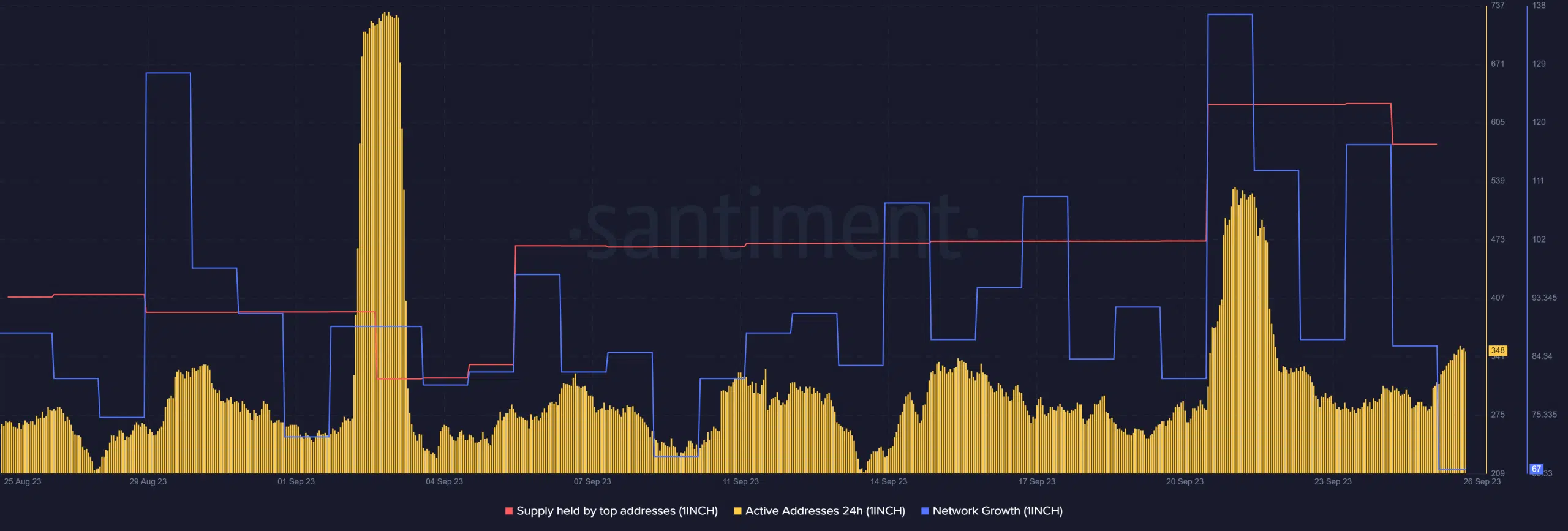

The improved relative strength reflected the upside that the RSI has achieved since 1INCH’s lowest price levels. This coincided with on-chain data which revealed that the whales have been buying. This was evident by the upside in whale activity that favored the bulls for the last few weeks.

How many are 1,10,100 1INCH tokens worth today

The supply held by whales recently peaked at a monthly high, suggesting that whales have been accumulating. The same metric registered slight outflows between 24 and 25 September.

1INCH’s network growth metric also soared to its four-week high on 21 September. This was the same day that 1inch registered its highest spike in daily active addresses during last week’s trading session.