Is a price correction imminent for Ethereum

- ETH’s social dominance has climbed to its highest since February.

- Readings from the coin’s daily price movements suggest that it might not be due for a price correction.

Ethereum’s [ETH] social dominance has risen to its highest in seven months, according to data from Santiment.

?️ #Ethereum has dropped to $1,570, & #crypto's #2 market cap asset has become an increasingly polarizing topic. Currently at its lowest fee levels of 2023, traders are growing impatient. Rising #bearish sentiment is a good sign of an impending turnaround. https://t.co/WwmO7hXga7 pic.twitter.com/7JJaiiSZSo

— Santiment (@santimentfeed) October 9, 2023

Read Ethereum’s [ETH] Price Prediction 2023-24

At press time, information retrieved from the data provider put the coin’s social dominance at 10.53%. This represented 10% of all crypto asset discussions recorded so far this month and the coin’s highest social dominance since February.

Why the chit-chat?

In the past 24 hours, ETH’s price has slipped from $1630 to exchange hands at $1,587 at press time. The last time the leading altcoin traded below $1600 was on 27 September.

According to Santiment, with the coin’s value seeking newer lows, “traders are growing impatient,” causing bearish sentiments to grow.

Generally, a surge in a coin’s social activity during a period marked by surging bearish sentiments often precipitates a price correction. As noted by Santiment,

“Rising bearish sentiment is a good sign of an impending turnaround.”

However, a look at the coin’s price movements on a daily chart suggested that ETH might not be poised for a significant rebound in the short term.

For one, since the month started, Ether accumulation amongst daily traders has trended downward. Key momentum indicators have since shifted from positions above their respective center lines to register values below 50 as of the current moment.

For example, ETH’s Relative Strength Index (RSI) and Money Flow Index (MFI) were southbound at 42.46 and 40.16, respectively, at press time.

Lending credence to the above position, the coin’s on-balance volume (OBV) has fallen by 1% since the month started. A decline in an asset’s OBV suggests that there is more selling volume than buying volume. It often signals that bearish sentiment is increasing and that the coin’s price is likely to decline further.

How much are 1,10,100 ETHs worth today?

Moreover, ETH’s Chaikin Money Flow (CMF) was a negative -0.11 at press time. A CMF value below zero is a sign of weakness in the market as it highlights the extent of liquidity exiting from the coin.

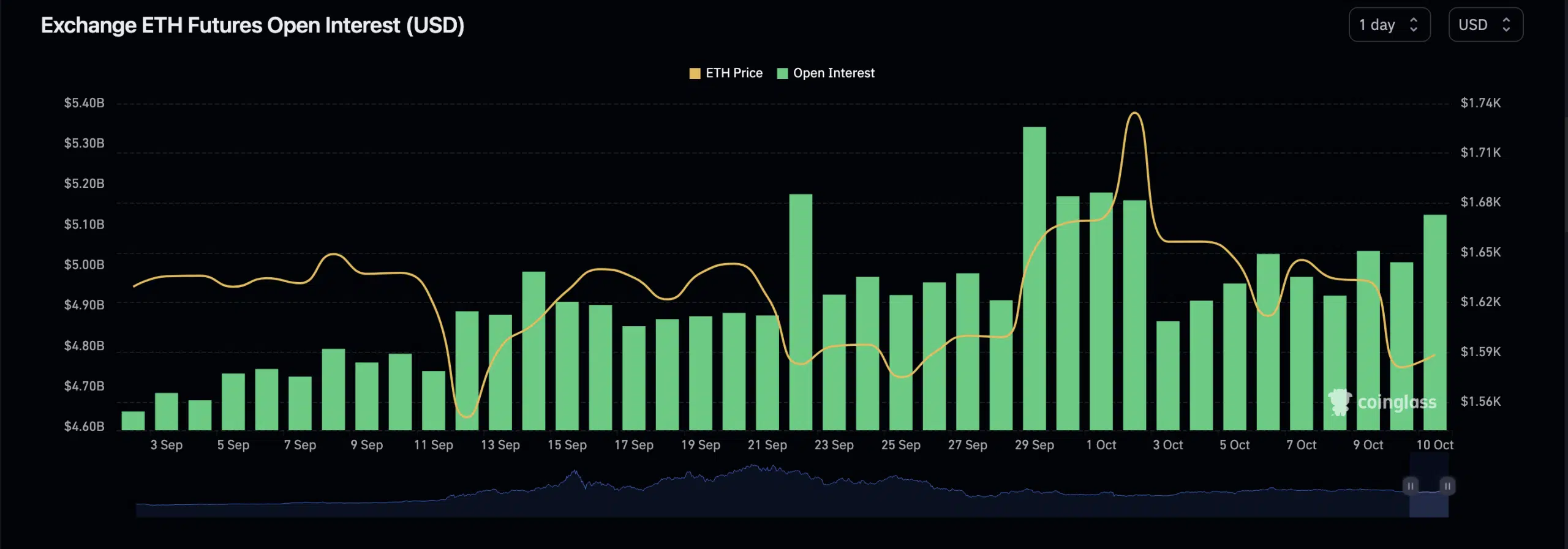

Data from Coinglass showed that the bearish sentiments extend to the coin’s futures market, as its Open Interest has trailed downward since the month began. At $5.12 billion at press time, ETH’s Open Interest has fallen by almost 2% in the past ten days.