Is Aave Companies’ latest acquisition an attempt to boost AAVE’s price action

- Aave Companies confirmed the acquisition of Sonar, a Web3 social gaming application

- AAVE’s price continued to decline and remained significantly unprofitable

Aave Companies, the developers of DeFi protocol Aave and decentralized social network Lens Protocol, announced the acquisition of web3 social gaming application Sonar on 5 December.

Following the acquisition, Sonar would be integrated with Lens Protocol. As a result, Sonar users and its Moji NFT holders will be able to mint their Lens account profiles at claim.lens.xyz for the next two weeks.

Read Aave’s [AAVE] Price Prediction 2023-2024

Sonar’s co-founders, Ben South Lee and Randolph Lee, the company’s Head of Growth Armand Saramout, and engineer Paul Xu will join Lens’ development team following the acquisition. They aim to,

“Focus on building mobile consumer-facing social applications powered by Lens as well as other web3 consumer applications launching in 2023.”

AAVE on the chain

According to data from CoinMarketCap, AAVE traded at $63.97 at press time. Due to the impact of FTX’s sudden collapse, the token’s price declined by 30% in November.

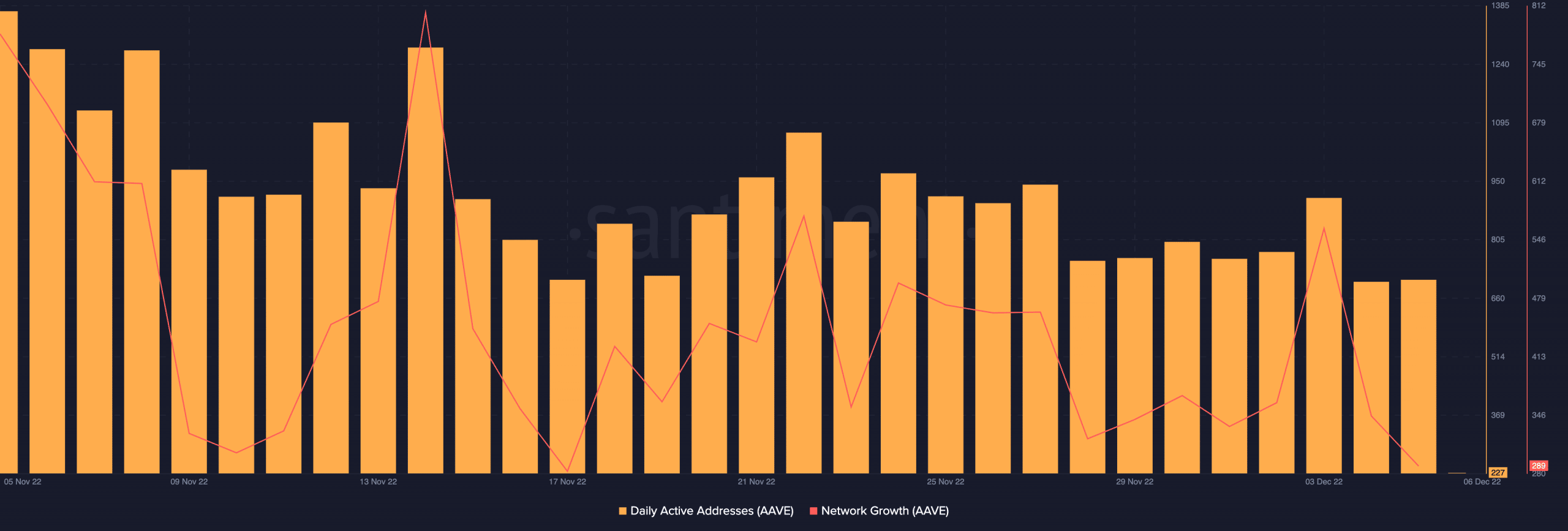

Additionally, daily active addresses and new demand for AAVE dropped drastically. As per data from Santiment, last month witnessed the count of unique addresses that traded fall by 83%. Likewise, the count of new addresses that joined the network daily declined by 63%.

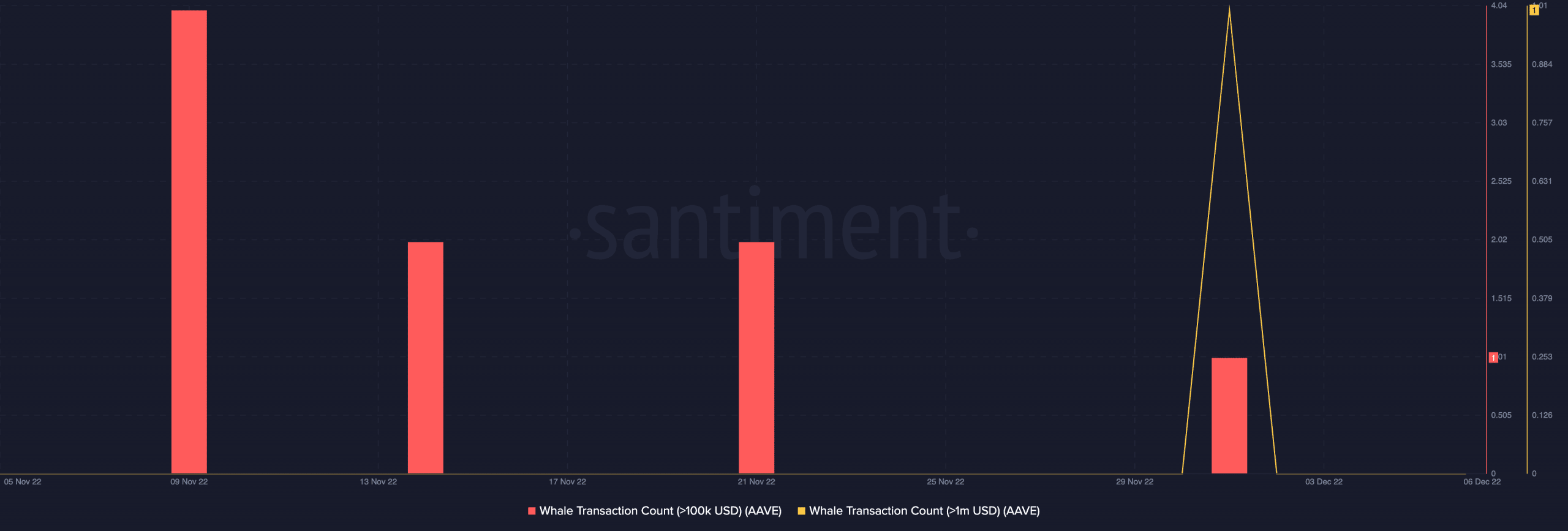

However, within that same period, AAVE recorded a drought of whale transactions. Data from Santiment revealed that in the last 30 days, only nine whale transactions exceeded $100,000.

Moreover, whale transactions of over $1 million were almost non-existent within the period under review – only one transaction was completed in the last 30 days.

Furthermore, holding AAVE has been significantly unprofitable for its investors in the last month. In fact, this has been the situation since the beginning of the year. As of this writing, AAVE’s Market Value to Realized Value (MVRV) posted a negative value of -77.57%. This showed that sell-offs at their current price would only return losses on such an investment.

With a non-stop decline in price, investors’ sentiment remained negative at press time.

![Sonic [S] sees $1.4 billion liquidity surge as network upgrade sparks investor interest](https://ambcrypto.com/wp-content/uploads/2025/03/F0D8CF78-0B88-471B-BD85-84A9F049FDBA-400x240.webp)