Is AAVE set to maintain its lead in DeFi race of the future

AAVE has so far maintained a healthy lead as the top DeFi borrowing and lending protocol by market cap. But does it still maintain its position now that more competition is flowing into the segment?

Well, AAVE currently holds the top spot as the largest decentralized lending and borrowing market by market cap.

It has the first mover advantage over its competition and this means it had more time to develop and execute.

Although this advantage was critical to its success, the competition continues to intensify as newer players enter the segment.

AAVE’s competitive advantage may come from other areas especially now that DeFi is in its exponential growth phase.

There have been major challenges along the way despite the fast-paced growth.

DeFi attacks have been the biggest challenge for the DeFi space. According to a Messari report, smart contract hacks on DeFi bridges had the lion’s share of DeFi hacks.

Smart contract vulnerabilities on bridges have contributed more to the total amount stolen from DeFi than the rest non-bridged DeFi attacks combined. pic.twitter.com/b6dvjiMUo4

— Messari (@MessariCrypto) September 1, 2022

Remaining ahead of the curve

AAVE has already been working towards overcoming the aforementioned challenge.

The DeFi lending protocol plan for overcoming those challenges is going through Config, a new tool for smart contract development. However, this tool will be available for all DeFi protocols as part of a plan to fortify the entire segment.

1/6 Today we’re excited to announce Config, an easy-to-use dev tool for any DeFi Protocol.

We first built Config as a clean, clear visualizer of the Aave Protocol risk parameters, and generalized it for any protocol with global parameters. pic.twitter.com/lOcikC5VvW

— Newt (?,?) (@wearenewt) August 31, 2022

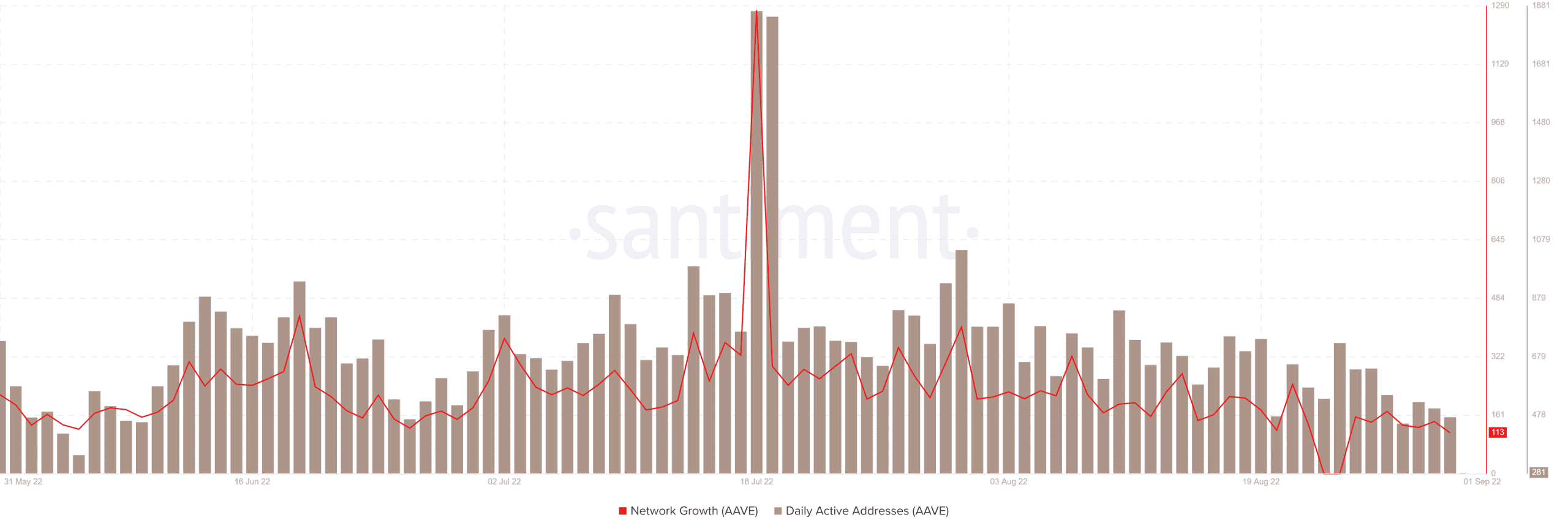

AAVE needs to boost growth in order to stay ahead of the curve. Its growth metrics indicate that it slowed down in the last six weeks. This performance reflects the woes that befell the DeFi segment in May and June.

Both the network growth and the number of active addresses metrics entered a decline phase after 18 July. In fact, AAVE is attempting to make its DeFi lending platform more interesting through the GHO stablecoin.

This part of its plan will provide comprehensive solutions that will also lower costs for users.

Although it is the oldest DeFi lending protocol, AAVE remains relevant and competitive. It has already proved popular among users and developers continue to innovate and address challenges that they face along the way.

This is a recipe that many DeFi users look for, and it will be interesting to see how the AAVE protocol will innovate in order to remain on top of its game.