Is another Bitcoin bull run underway? This analyst thinks so

- Bitcoin might be poised for another bull cycle.

- This is based on readings from its NUPL, MVRV Ratio, and Puell Multiple.

Bitcoin [BTC] may be gearing up for another surge despite a recent pullback from its 2023 high of $44,000, pseudonymous CryptoQuant analyst Tarekonchain noted in a new report.

These indicators hint at another bullish rally

Tarekonchain assessed three key on-chain indicators and found that their values have gradually increased recently.

Based on these readings, the analyst concluded that

“the bear market for Bitcoin may be subsiding, making way for the early stages of a bull cycle.”

The first metric the analyst considered was BTC’s Net Unrealized Profit/Loss (NUPL). The NUPL metric determines whether BTC holders are currently experiencing unrealized gains or losses.

It compares the average purchase price of all BTCs investors hold to the current market price. When it rises above zero and remains in an uptrend, it means that BTC holders are in profit.

According to Tarekonchain a rising NUPL indicates an increasingly profitable market, often correlating with a bullish sentiment.

At 0.48, and in an uptrend, the analyst opined:

“The current trajectory of NUPL suggests an uplift in market optimism, which is a typical precursor to a bull market.”

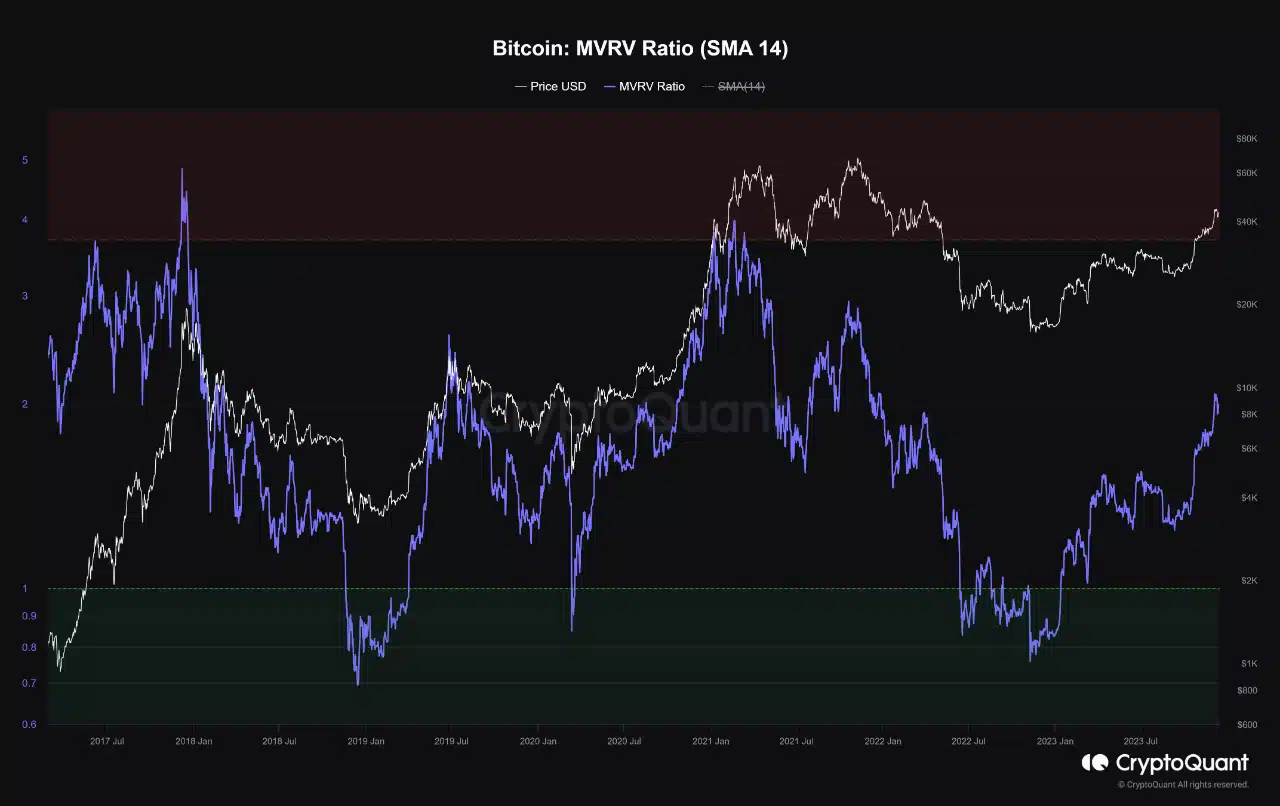

What the MVRV ratio says

Another metric assessed by the CryptoQuant analyst was BTC’s Market Value to Realized Value (MVRV) ratio.

An asset’s MVRV ratio tracks the ratio between the asset’s current market price and the average price of every coin or token of that asset acquired.

A positive MVRV ratio above one signals an asset is overvalued, while a negative MVRV value shows that the asset is undervalued. Assessed on a 30-day small moving average, BTC’s MVRV has risen by 11% in the last 30 days.

According to Tarekonchain:

“The recent upward movement in the MVRV ratio from these lower levels may signal that the market is transitioning from undervaluation to a phase where growth is anticipated, hinting at the start of a bull cycle.”

Lastly, the analyst considered BTC’s Puell Multiple. This indicator provides insights into the profitability of mining operations on the BTC network.

When the value of the metric rises, mining revenue is relatively high compared to the long-term average. On the other hand, a low Puell Multiple indicates that mining revenue is relatively low compared to the historical average.

Taking a cue from BTC’s historical performance, Tarekonchain noted that a low Puell Multiple often marks market bottoms, and many view it as an opportunity to accumulate the leading coin.

Read Bitcoin’s [BTC] Price Prediction 2023-24

With this indicator in an uptrend in recent times, the analyst concluded:

“A gradual increase in this multiple from its lower levels can be interpreted as a reduction in selling pressure and increased profitability for miners, aligning with the potential onset of a bull cycle.”