How Vitalik Buterin’s plans for Ethereum came to fruition

- Buterin’s proposal to restrict the maximum supply to 120,204,432 was rejected earlier.

- As of this writing, 120,203,611 ETH coins were in circulation.

Ethereum’s [ETH] supply dipped below the hard cap proposed by co-founder Vitalik Buterin some five years ago, sparking discussions about the asset’s monetary policy within the community.

Noted Ethereum developer Evan Van Ness took to social platform X to draw attention to this intriguing development.

Vitalik’s dream comes to life!

Buterin’s proposal to restrict the maximum supply to 120,204,432 was rejected in April 2018. However, little did he know that his objectives would ultimately come to fruition albeit through a different approach.

As of this writing, 120,203,611 ETH coins were in circulation, AMBCrypto discovered using ultra sound money data.

Unlike Bitcoin [BTC], ETH doesn’t have an issuance limit. Buterin’s case for limiting ETH supply stemmed from concerns about centralization in the then proof-of-work (PoW) mechanism, as well as a desire to improve the coin’s long-term market prospects.

As per the proposal, the supply would exponentially approach the max cap and the rewards would exponentially approach zero, much on the lines of Bitcoin.

However, much water has flown under the bridge. Three years after his suggestion was dismissed, Ethereum implemented EIP-1559 as part of the London Hardfork. This included burning a portion of gas fees paid to miners, thus driving coins out of circulation.

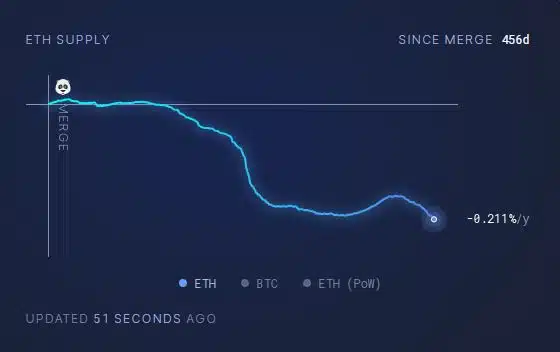

A year later, the Merge was executed, marking a shift from the PoW to the proof-of-stake (PoS) model. The pivotal event applied considerable deflationary pressure on ETH.

As seen by AMBCrypto, more than 307,000 ETH have exited circulation since the event, causing the net supply to shrink at an annual rate of 0.211%. The circulating supply was projected to drop to 117 million by the end of December 2025.

Read ETH’s Price Prediction 2023-24

ETH looks set to push higher

As of this writing, ETH stayed strong above $2,200, according to CoinMarketCap data. Profit-taking by weak hands pulled the crypto down by more than 3% over the week.

However, the broader sentiment still tilted towards buying. AMBCrypto’s examination of Hyblock Capital revealed a predominantly greedy ETH market. This could continue to sustain the momentum in the days to come.