Is Binance’s new collaboration with Curve risky? This data suggests…

- Binance proposed to add their utility token wBETH to Curve Finance’s gauge controller.

- Sentiment started to decline as daily activity began to fall.

Crypto exchange Binance has been very proactive in terms of making developments to its network and collaborating with various other protocols. Recently, Binance proposed to add wBETH to Curve Finance’s gauge controller.

Is your portfolio green? Check the BNB Profit Calculator

wBETH is a utility token created by Binance which enables users to stake their Ethereum [ETH] holdings. This will be added to Curve’s Gauge Controller.

The Guage Contoller is a tool that manages the performance of cryptocurrency trades on the Curve.fi exchange. It adjusts the amount of liquidity available in each pool and incentivizes users to provide liquidity to certain pools to ensure there is always enough liquidity available for traders.

The motivation behind adding wBETH/ETH pool to the Gauge Controller was that it had the potential of attracting new users, and deepen liquidity for both wBETH and ETH.

It would also allow Curve to expand its role in DeFi and attract more users seeking liquidity mining returns.

However, this move could have negative consequences as well. Supremacy, a crypto security agency, discovered a potential risk in Binance’s plan to add wBETH to the Gauge Controller.

1/ @binance's earn team at @CurveFinance launched a proposal to add $wBETH to the Gauge Controller, and our research team decided to perform a centralized risk assessment of $wBETH. In that assessment, we identified a potential risks.https://t.co/bjjmvVNXsj

— Supremacy (@Supremacy_CA) May 4, 2023

The risk comes from a feature in the WrapTokenV1BSC contract of the BNB Chain [BNB] that could transfer all ETH Reserves.

This means if the owner’s account is compromised, it could lead to serious harm. Binance responded by saying their finance department has control of the private keys of accounts and that they have taken steps to secure it, which may reduce the risk.

Word on the street

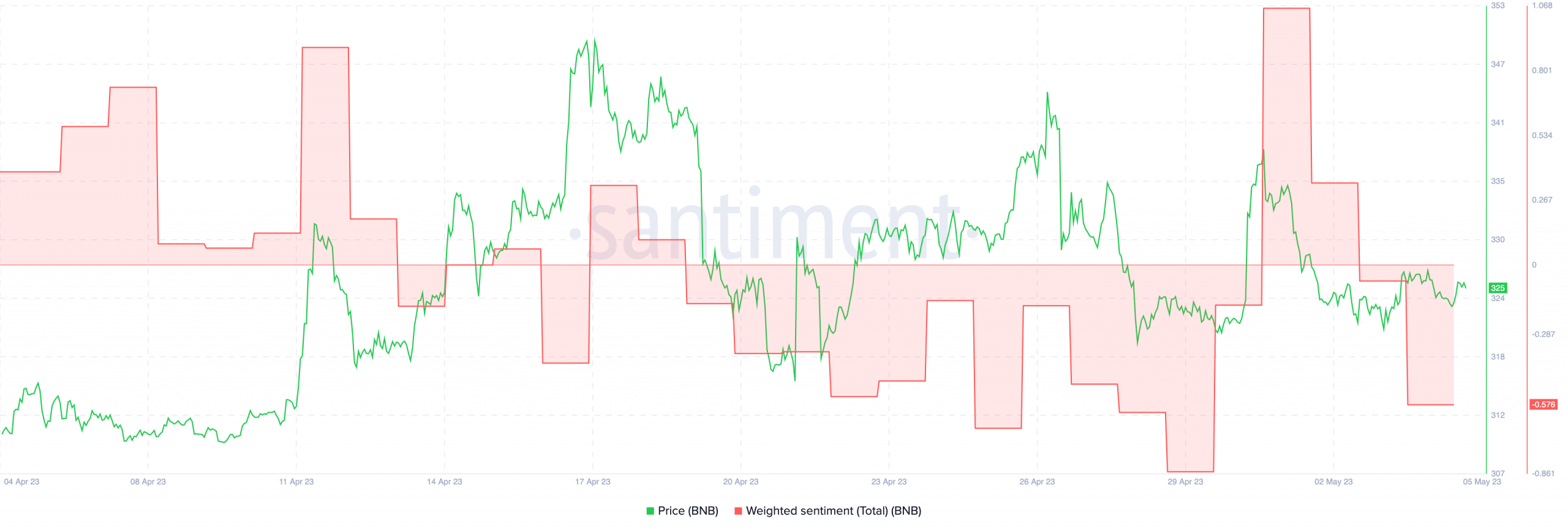

If attackers are able to exploit these vulnerabilities, it could have a negative impact on the overall sentiment around Binance. At press time, the weighted sentiment around Binance turned negative.

This implied that negative comments about Binance outnumbered the positive ones.

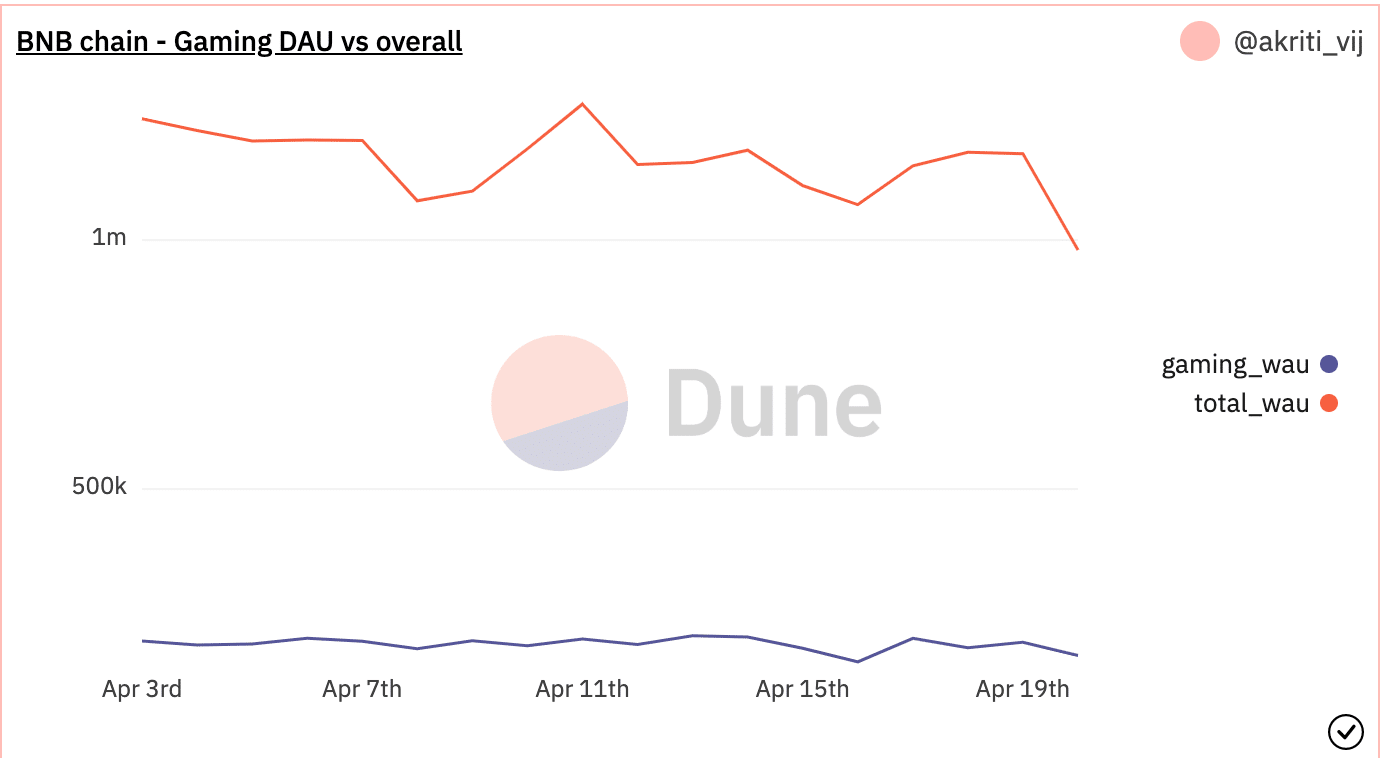

Another alarming indicator was the declining interest in Binance’s gaming activity. According to Dune Analytics’ data, the daily active gamers fell considerably.

Read BNB’s Price Prediction 2023-24

This affected the overall activity on the network as well. The daily active users on Binance over the last month dropped from 1.2 million to 980,95.

If the trend of declining activity continues, it could impact the protocol negatively in the long term.