Is Bitcoin bear season here as $200 million worth BTC liquidated in the last 24 hours

Traders counted their losses during the intraday trading session in the cryptocurrency market on 19 August as the bloodbath led to over $600 million in liquidations, data from Coinglass revealed. The series of liquidations that ensued led the global cryptocurrency market capitalization to decline by 5.8% in the last 24 hours, according to CoinGecko.

According to data from Coinglass, in the past 24 hours, 112,987 traders have been liquidated. As a result, total liquidations in the cryptocurrency market stood at $562 million and counting at press time. Thus, long liquidations made up to $479 million of the total liquidations. In comparison, short liquidations accounted for $82 million of the total liquidations in the last 24 hours.

The king coin, Bitcoin [BTC], led the market with the most liquidation in the last 24 hours, as $218 million (10,000 BTC) has been taken off the market. Currently trading at $21,154.55 with a 7% price decline in the last 24 hours, the market downturn on 19 August forced the leading coin to fall below the $22,000 price mark to touch a low at the $21,000 price mark.

Dancing with the bears

Interestingly, despite the market downturn that forced BTC to close the trading session of 19 August with an 8% decline, trading volume on the network went up by over 70%. Still up by 55% in the last 24 hours, the lack of a corresponding price uptick within the same period points to buyers’ exhaustion.

This point is further corroborated by the position of the coin’s Relative Strength Index (RSI) and Money Flow Index (MFI) on a daily chart. As of this writing, these two key indicators were spotted in a downtrend inching towards the oversold region. The RSI and the MFI were both pegged at 36.

Far from over?

A further price downside might mark BTC’s trading activity in the next few days as data from Santiment revealed more BTC coins exiting exchanges than are being sent in. The Exchange Flow Balance on a daily chart posted a negative -722. Such a position is usually followed by a further decline in the price of an asset.

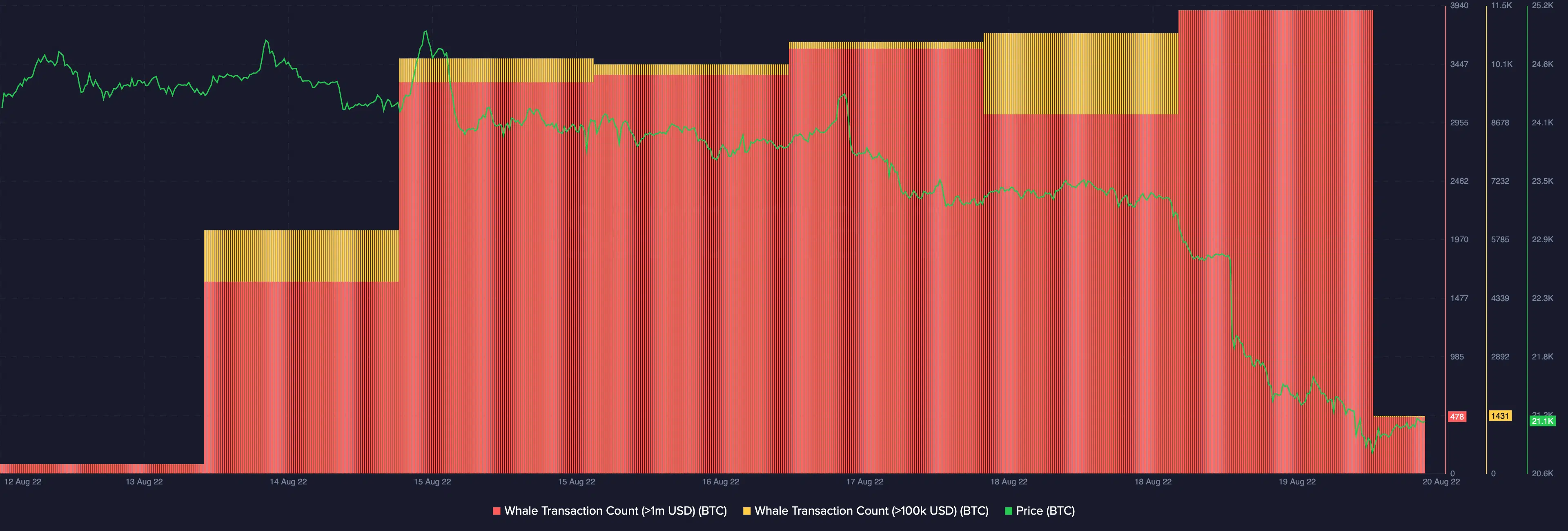

As price plummeted on 19 August, the count for the transactions executed by whales on the BTC network fell. As of this writing, the transactions count for whale transactions of $100,000 and above had dropped by over 80%. For whale transactions of $1 million and above, this had also fallen by 87% by press time.

At press time, BTC’s weighted sentiment posted a negative value of -0.343 for traders looking to trade against the market.