Is Bitcoin the new gold? What the data suggests

- Bitcoin’s co-relation with gold has reached new heights.

- At press time, traders had a positive outlook towards BTC.

Amidst economic uncertainty, traders are searching for ways to safeguard their wealth. Usually, gold has been their go-to choice during troubled times. However, there’s been a recent shift in the financial landscape.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Gold rush

Bitcoin [BTC] was gaining popularity as an investment in the past few weeks. Additionally, its connection with gold reached its highest level since the banking crisis earlier this year.

This correlation between BTC and gold boosted positive sentiment around Bitcoin. It is increasingly being viewed as a hedge against economic uncertainty.

BTC's correlation to gold is the highest that it's been since the banking crisis earlier this year pic.twitter.com/tF5juTJx1k

— Will Clemente (@WClementeIII) October 28, 2023

At the time of writing, Bitcoin was priced at $34,100. Both its price and trading activity experienced substantial surges in recent days. However, there was a drop in overall sentiment about BTC.

This implied that negative feelings and comments about Bitcoin were starting to outnumber the positive ones. This mismatch between Bitcoin’s price and the sentiment surrounding may lead to a bearish trend in the future.

Miners are happy

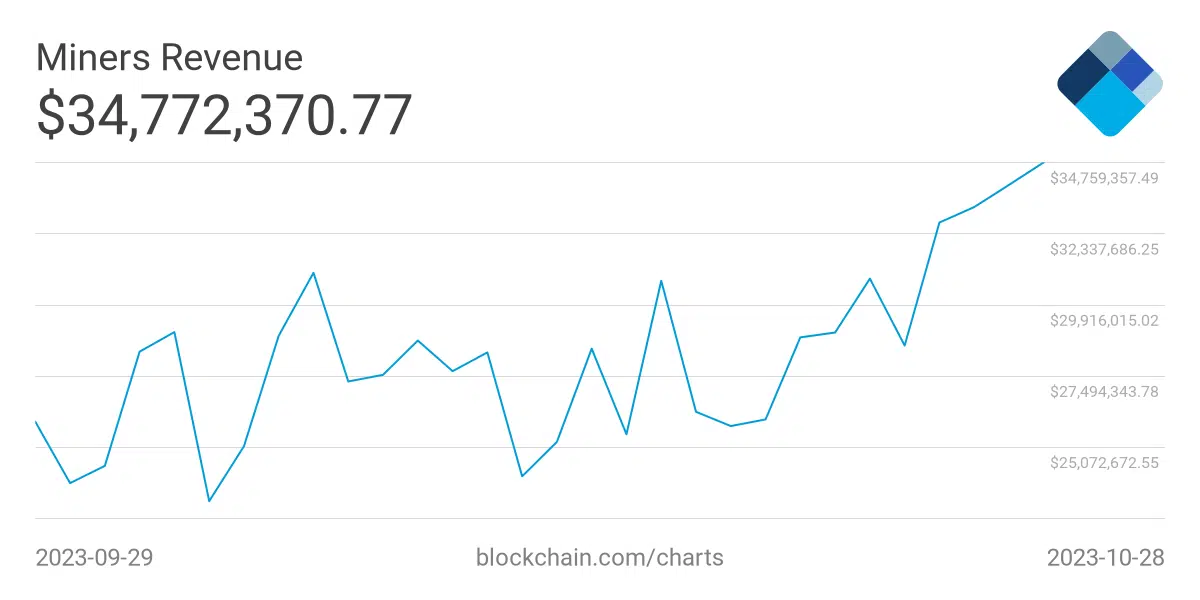

Another important factor that could play a huge role in Bitcoin’s selling pressure is the behavior of Bitcoin miners. These miners validate transactions and secure the network. Recently, miner revenue grew significantly, indicating that miners were earning more.

This spike in miner revenue is important for Bitcoin’s stability. When miners are making substantial profits, they are less likely to sell their holdings. This in turn reduces selling pressure on the market.

Additionally, mining difficulty has also saw a large surge. This difficulty measures the computational effort required to mine new Bitcoins. As the difficulty level rises, mining new coins becomes more challenging. This ends up impacting the overall supply of Bitcoin.

With the rising mining difficulty, the creation of new Bitcoins slows down. This could potentially lead to increased scarcity. This factor has previously been linked with upward price movements.

Is your portfolio green? Check out the BTC Profit Calculator

Traders go long

Turning to the sentiment of traders, their belief was high. At the time of writing, long positions made up 54.2% of all trades, according to Coinglass. This suggested a bullish sentiment among traders.

This hopeful outlook showed the growing interest in Bitcoin despite neutral price movements. It is yet to be seen if these traders will maintain their positions in the future.