Is Bitcoin’s short-term realized cap showing signs of resistance?

- BTC’s realized capitalization for newly acquired coins continued to face resistance at 8%.

- The coin’s value has risen by almost 10% in the last month.

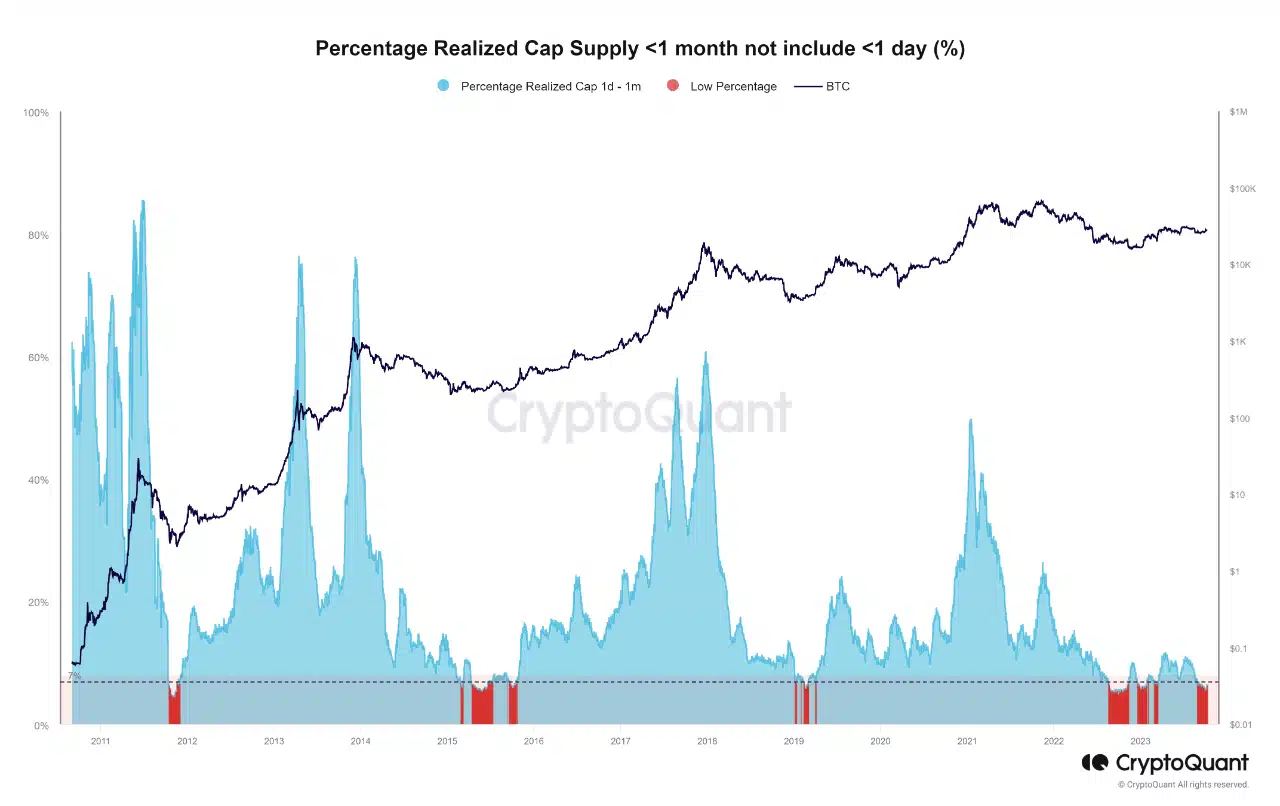

The realized capitalization of short-term Bitcoins [BTC] (under one month) has reached a new recovery level after a substantial decline. Still, according to a new report by CryptoQuant analyst Binh Dang, it continues to face resistance.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

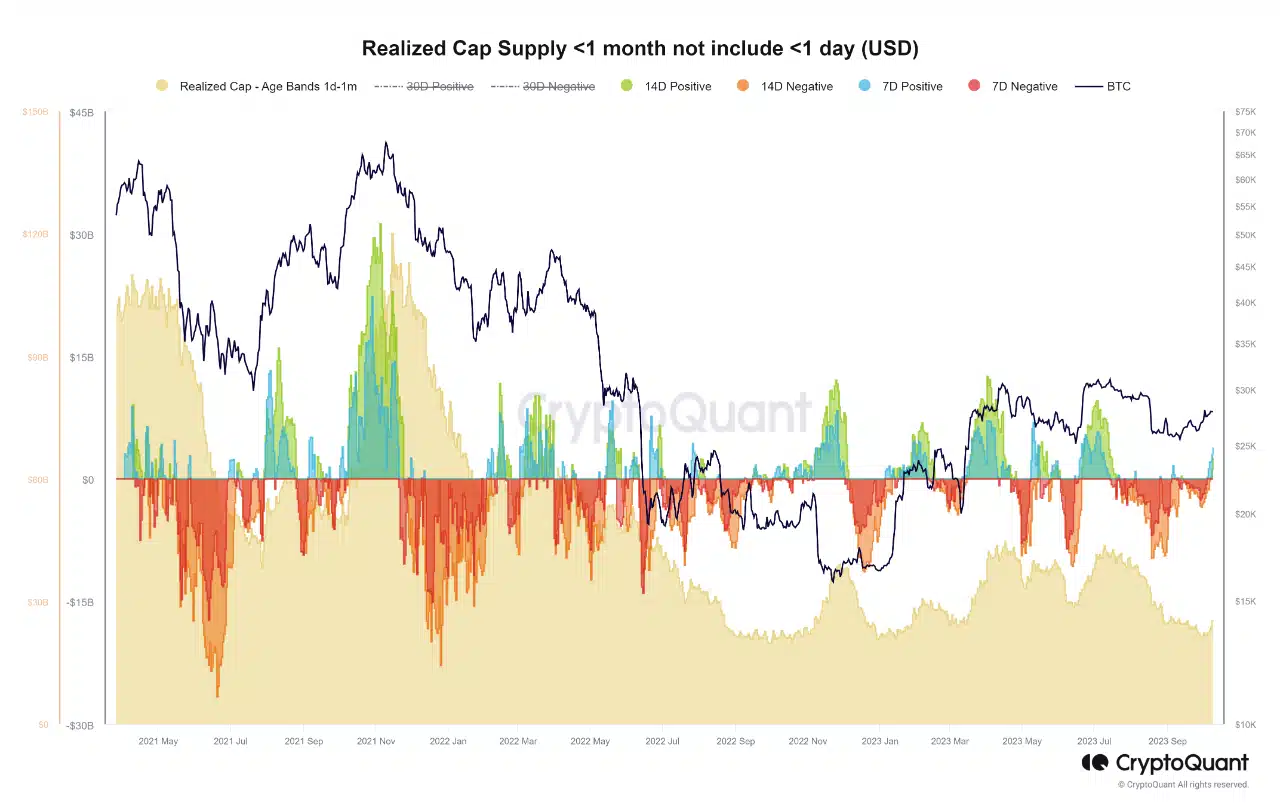

Dang assessed recently acquired BTCs (coins existing from 24 hours to 1 month) and found that the realized capitalization of this age band has always been impacted by the coin’s price fluctuations.

In previous cycles, growth in the BTC market was marked by the consistent rise in the realized capitalization within this group. According to Dang, this indicated a surge in new investors or increased capital inflows for accumulating fresh unspent outputs.

However, in the current market, while the metric has recovered slightly in the past few months, it “hasn’t surpassed the < 8% threshold.”

Moreover, the analyst spotted a similar pattern of low recovery in realized capitalization in USD for this age band. He noted:

“During late 2022’s bottom, this group’s Realized Cap decreased to ~$19.8B and recovered to ~$44B when BTC peaked at $30K-31K. However, it has since fallen back to ~$20B and is recovering slightly.”

The current positions of both metrics showed that while the leading coin BTC remains in a recovery phase, the recovery remains fragile and a number of factors, including macroeconomic and geopolitical issues, have persistently derailed the same.

This is evident in the coin’s sideways movement in the past few months and the significant recovery faced at the $30,000 price level.

According to Dang, this signaled that the BTC market would likely remain uncertain for the rest of the year.

“The market will likely remain uncertain if these data don’t show significant and positive trends from now until the year’s end. The volatility will be unpredictable, so newcomers should not expect continuous and strong price increases as in the first half of this year.”

BTC in the last month

BTC exchanged hands at $27,592 at press time. According to data from CoinMarketCap, the coin’s value has seen a 7% uptick in the last month.

Is your portfolio green? Check out the BTC Profit Calculator

During that period, its futures Open Interest has risen too. When BTC’s open interest increases, it means that the total number of BTC futures contracts that have not been settled has increased.

It signals increased demand for BTC in the last month and that more investors are opening new positions.