Is Ethereum better positioned if Bitcoin is more volatile

2021 is not the same as 2017. While this particular statement has been redundantly used, it is essential to understand the ‘why’ of it. 2017 had a predominant Bitcoin presence while in 2021, Ethereum and other altcoins have brought legitimate liquidity.

The volatility tussle between BTC and ETH was a point of discussion as both assets rallied towards their respective all-time highs over the past few months. However, the volatility aspect is somewhat of a pendulum, one which swings both ways during a particular period.

Bitcoin v. Ethereum – What are we looking at?

Before analyzing the current market structure, let us look at the 1st time BTC and ETH respectively breached this price point. For Bitcoin, the surge above $50,000 took place in February itself, during the initial January rally. There were immediate corrections to $42,000 before it rallied back above.

For Ethereum, the movement above $3300 happened swiftly in the month of April, when the asset breezed past the price range.

The only similarity between both assets during that particular time was that both fell below the aforementioned range in the month of May.

Is the gauntlet moving in a different direction?

So, the common narrative observed over the past few weeks has been the volatility pull of Ethereum with respect to Bitcoin. Since April, the realized volatility spread between ETH-BTC has been extremely favorable to the altcoin.

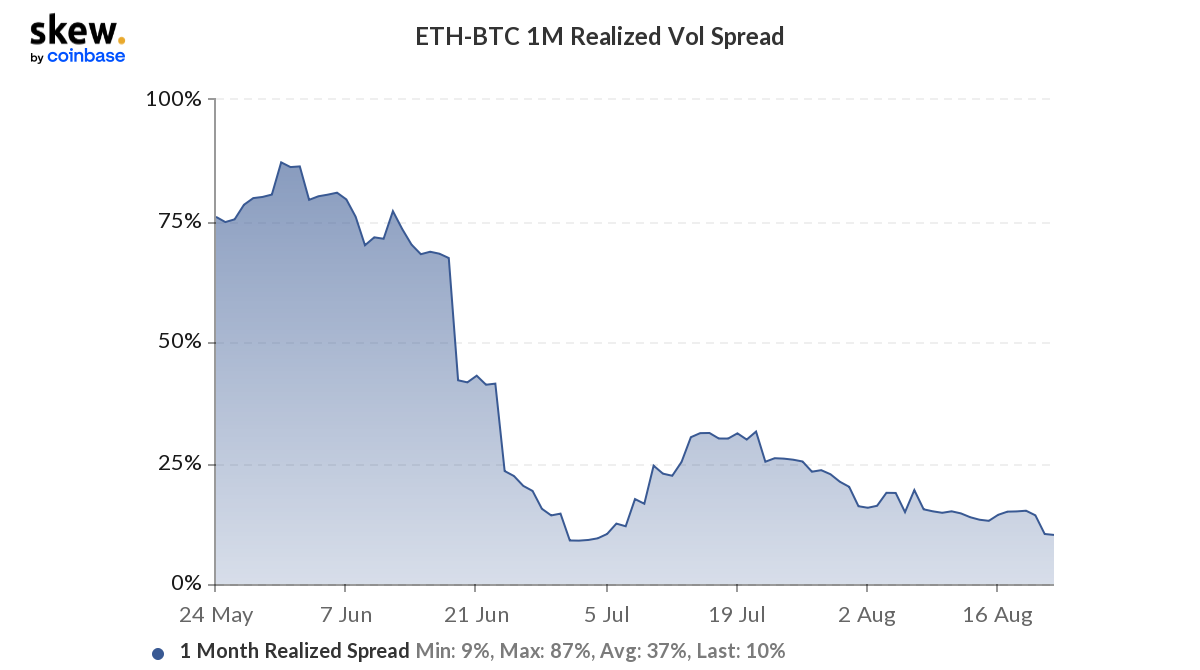

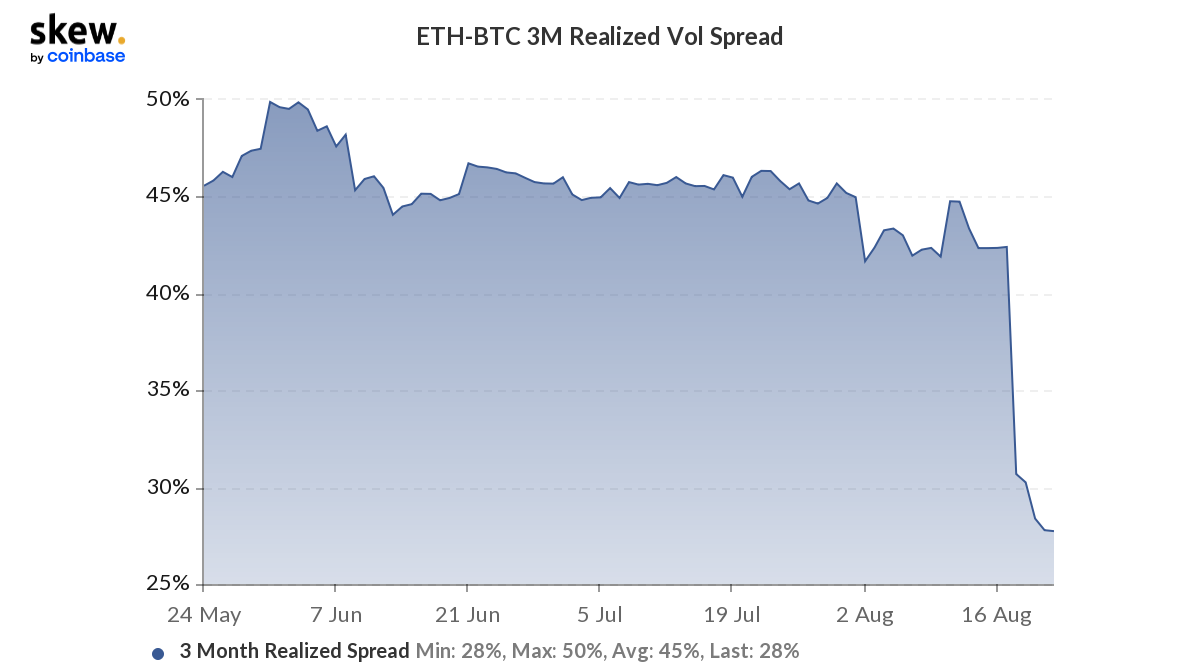

However, now the tide is seemingly shifting again. According to ETH-BTC 1M and the 3M Realized Volatility spread, the ratio has dropped violently, indicating that Bitcoin might just be more volatile at press time.

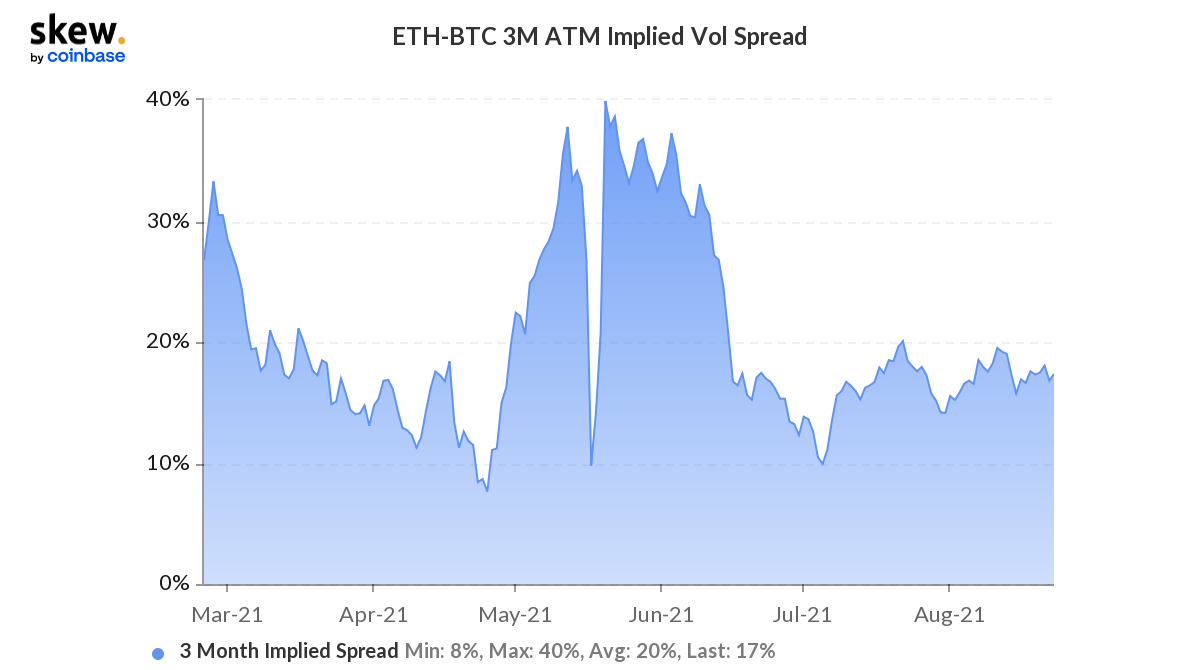

However, with respect to the Implied Volatility Spread, Bitcoin has been expected to outperform Ethereum in terms of turbulence since the May breakout.

How does the volatility aspect matter?

There are two sides to the coin here. With Bitcoin, a higher volatility environment is less troublesome for the asset because of its brand. While ETH has a strong presence in the community, it does not facilitate the same sentiment as Bitcoin in terms of attraction and adoption. This particular situation allows Bitcoin to possibly avoid strong corrections, but Ethereum is on the other side.

In terms of functionality, Ethereum might have blown Bitcoin out of the water. At press time, Ethereum had 160 million unique addresses while Bitcoin had only >700k addresses. However, historically, Ethereum has been susceptible to massive corrections. This, often puts its volatility advantage to a point of regret.

Right now, the market is reaching a critical stage, it may move forward or consolidate. As far as Ethereum is concerned, it might be glad to take a step back as Bitcoin appears to be more volatile.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)