Is Ethereum competing with Bitcoin as a store of value?

Ethereum’s price is up by over 8 percent in the past 24 hours and is currently trading above the $1500 level. The increase in price comes at a time when Bitcoin is making a slow recovery. This puts Ethereum ahead of Bitcoin in terms of its recovery run.

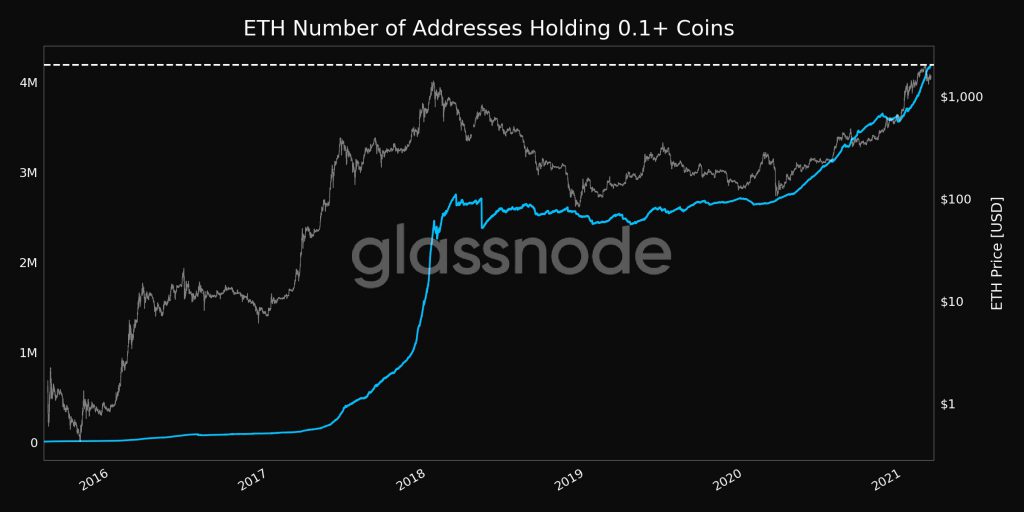

What differentiates Ethereum from Bitcoin, is the fact that it is not as highly volatile as most Defi projects and altcoins that offer double-digit gains in the span of a few hours such as – SUSHI, YFI, LINK, etc. Instead, it is a close competitor to Bitcoin, and its price trends tend to be very close to Bitcoin. ETHBTC is usually a mid or high-time frame trade, putting it in direct competition with BTC. Just at the same time, where Bitcoin’s active addresses are increasing, Ethereum’s non-zero balance addresses (0.1+) have hit an ATH based on data from Glassnode.

Source: Glassnode

The number of ETH transfers or transactions on the network has dropped, however, after recently hitting a local bottom the price is rebounding and may test the ATH if there is enough volatility. Based on the above chart from Glassnode, in 2020 the number of non-zero addresses increased significantly till it hit a high. In 2021, the growth is relatively faster.

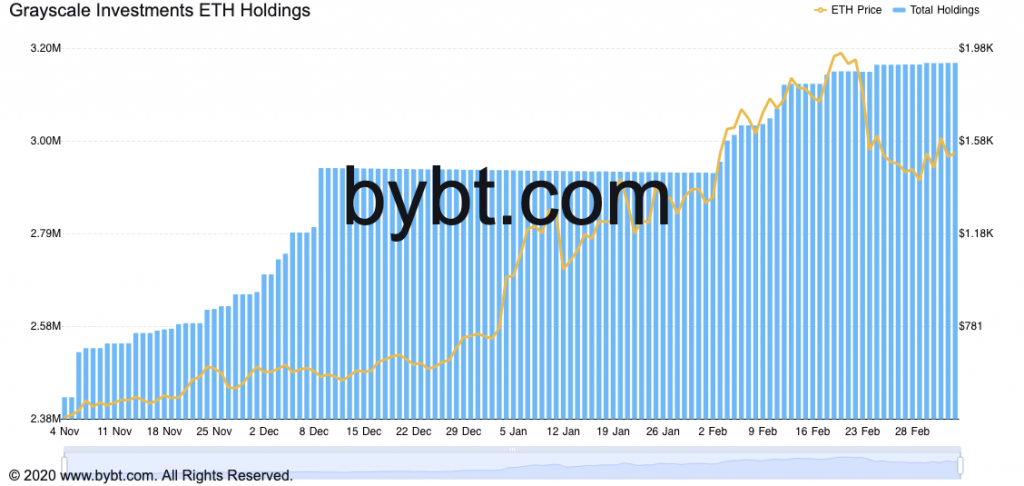

The institutional investment flow that led to a surge in demand for Bitcoin, is now driving Ethereum’s price narrative as Grayscale increased its ETH holdings. With CME’s ETH futures launch, more institutions are buying Ethereum and adding to their holdings, at the same time, increasing the demand for ETH 2.0 in the short term. The price may have remained rangebound in the past, however, despite its correlation with Bitcoin it is no longer rangebound and is trading at $1550.

Source: Bybt

Due to its increased correlation with S&P 500, Bitcoin’s price may drop in the short-term, when stocks experience a sell-off, however that is not the case with Ethereum. With Vitalik’s latest announcement and institutions lining up to buy Ethereum, the price is likely to continue the upward trend. Investors may find ETH a better store of value since it does not have the same volatility as BTC but offers similar returns and CME ETH futures have made it mainstream for institutions. Ethereum 2.0’s price action and returns may prove to investors that it is a better store of value when compared to Bitcoin.