Is Ethereum facing selling pressure from whales?

- Ethereum’s balance on exchanges reached a new 5-year low.

- Supply held by top addresses increased, and metrics looked bullish on ETH.

Ethereum [ETH] has once again crossed the $1,800 mark and was fast approaching $2,000 at press time. However, despite its green chart, whales seem to have been selling their assets. A decline in whale holdings could increase selling pressure on ETH, which is not a good sign as it could cause a price correction. So, should investors expect ETH’s uptrend to end soon?

Ethereum whales are selling

Glassnode Alerts posted a tweet on 28 May, which hinted that big players in the crypto space were selling their holdings. As per the tweet, the number of Ethereum wallets holding over 10 coins reached a five-month low of 348,187. The previous five-month low of 348,199 was observed on 27 May.

? #Ethereum $ETH Number of Addresses Holding 10+ Coins just reached a 5-month low of 348,187

Previous 5-month low of 348,199 was observed on 27 May 2023

View metric:https://t.co/6ggy1nLbSD pic.twitter.com/MipYKVV5sP

— glassnode alerts (@glassnodealerts) May 28, 2023

Adding to the story

Though the aforementioned data suggested a sell off from the whales, it was not true throughout. For instance, ETH’s balance on exchanges reached a five-year low of 17,323,196.249 ETH. This indicated that the token was definitely not under selling pressure, rather, investors were actually accumulating.

? #Ethereum $ETH Balance on Exchanges just reached a 5-year low of 17,323,196.249 ETH

View metric:https://t.co/1dCpD2ey8E pic.twitter.com/UjQic8Vbkk

— glassnode alerts (@glassnodealerts) May 28, 2023

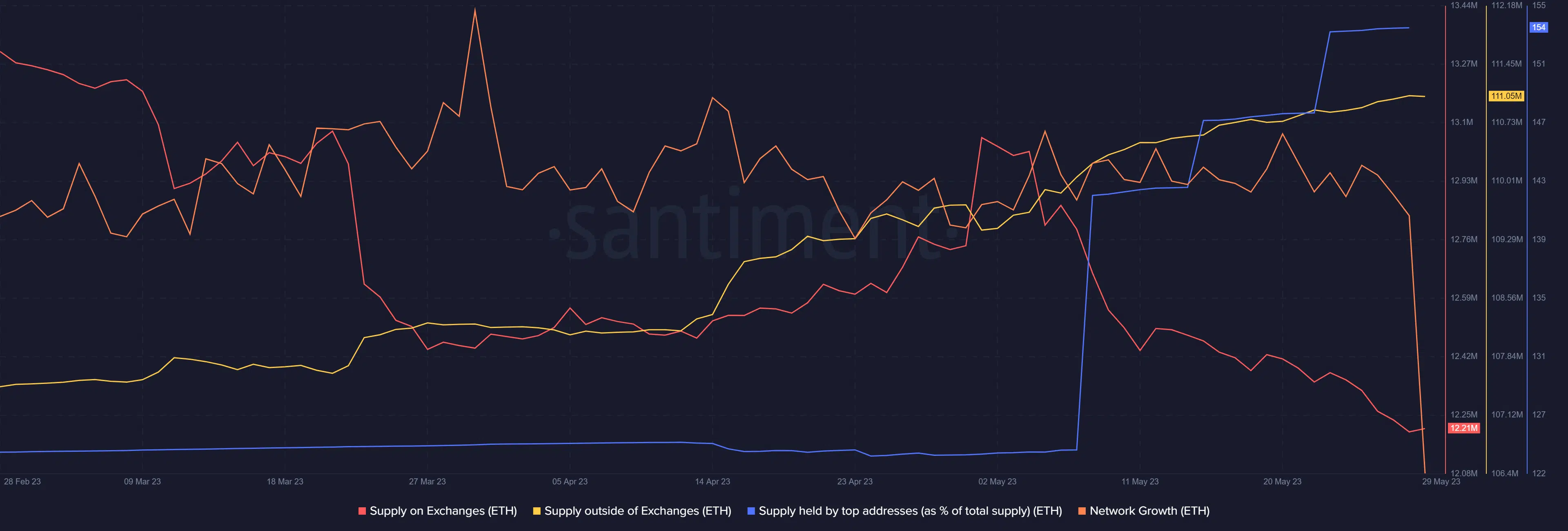

As per Santiment’s chart, ETH’s supply on exchanges has dipped substantially while its supply outside of exchanges has risen. Additionally, the supply held by top addresses also increased, further proving the investors were accumulating. Ethereum’s network growth was also relatively high. A high network growth means that more new addresses were created to transfer the token.

ETH’s chart turns green

After several days of sideways price movement, ETH finally excited the community by registering promising gains. As per CoinMarketCap, ETH’s price increased by nearly 6% in the last seven days and over 2% in the last 24 hours. At press time, it was trading at $1,907.53, with a market cap of over $229 billion.

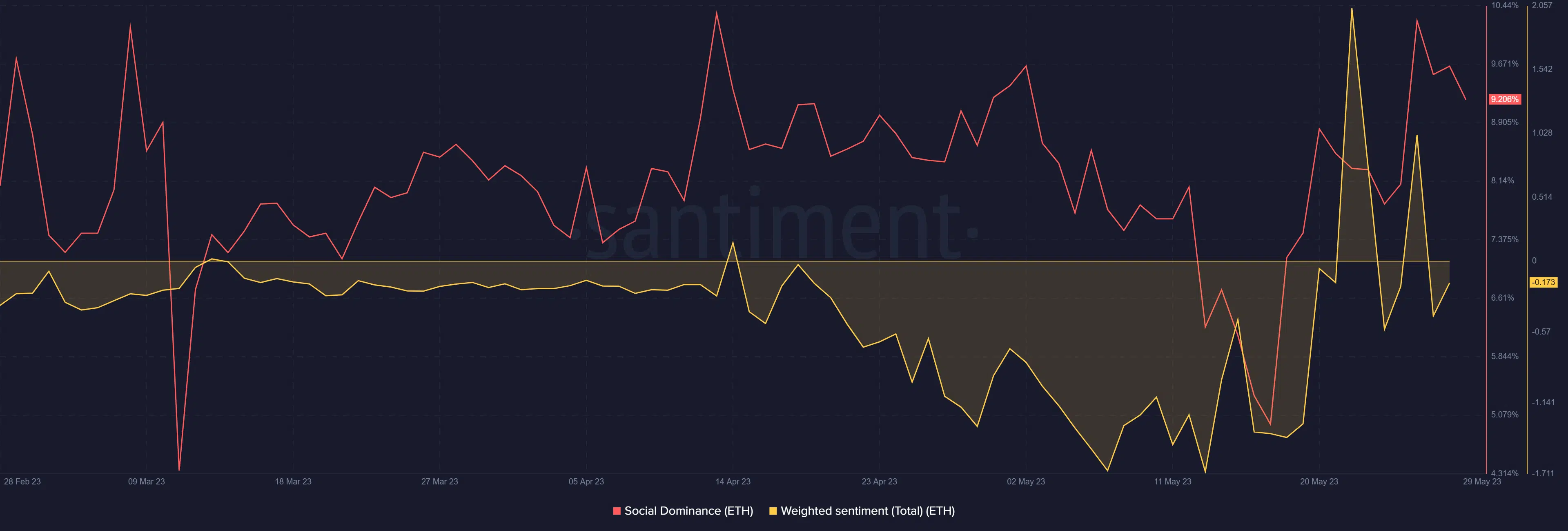

Thanks to the hike in price, sentiment around ETH also improved, as evident from the spike in its weighted sentiment. Ethereum’s social dominance was also relatively high, reflecting its popularity in the crypto space.

Realistic or not, here’s ETH market cap in BTC’s terms

The derivatives market looks bullish

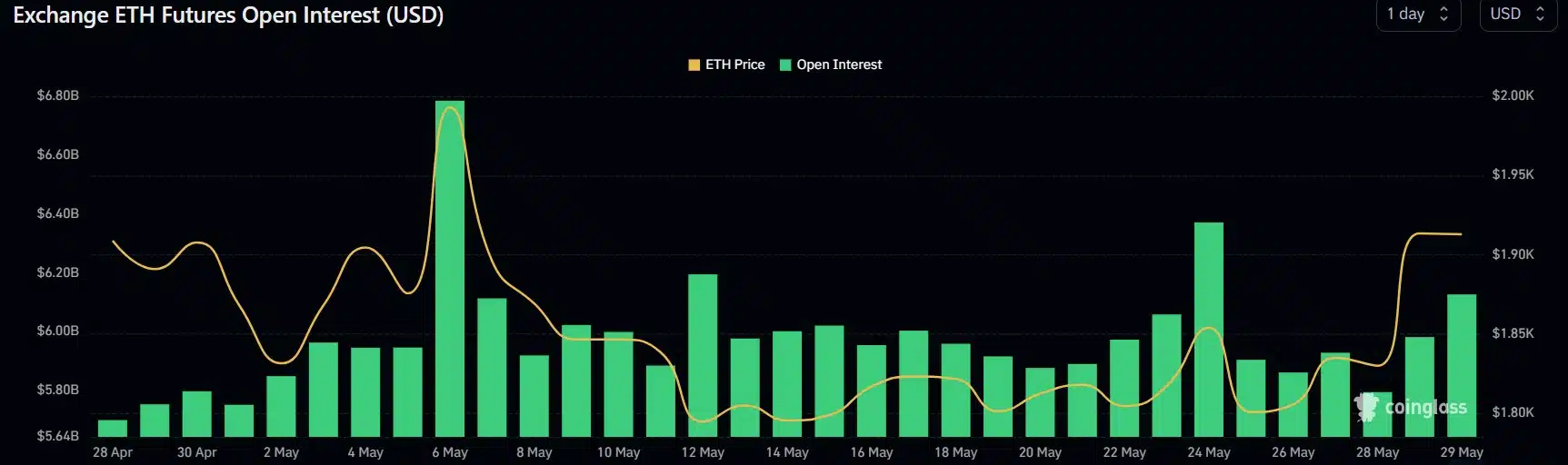

A look at ETH’s position in the derivatives market gave hope for a further uptrend in the coming days. According to Coinglass, ETH’s open interest registered an increase on 29 May. An uptick in open interest means that new money is flowing into the marketplace, suggesting that the price trend might continue for longer.

Additionally, at press time, ETH’s funding rate was also green, indicating that long position traders were dominant and were willing to pay short-position traders.