Is Ethereum likely to flip bitcoin anytime soon? If yes, here’s the how, when and how long?

It’s been a good year for Ethereum, the crypto-market’s biggest altcoin. When 2021 began, ETH was valued at just over $720 on the charts. At the time of writing, however, the altcoin was trading just over $3,093, with the crypto registering YTD returns of over 275%.

Now, quite a few factors have contributed to ETH surging as it did this year, with the same fueling even higher expectations. What these factors have also done is catalyzed opinion in favor and in opposition of one key question – Is ETH likely to flip BTC anytime soon?

This was one of the subjects of discussion during a recent interview hosted by Su Zhu and Hasu with CryptoCobain. The popular trader and analyst believes that now, “the bull case for Ethereum is stronger than ever.”

This, he said, can be attributed to developments around ETH 2.0 and the growing interest in spaces like DeFi. “A lot of improvement in Ethereum tokenomics” has also fueled Ethereum’s bull run, he added.

Is this enough to flip Bitcoin in the future though? Yes, CryptoCobain argued, with the analyst suggesting that while such a flip will be temporary, it will be “inevitable” because Ethereum has a more expansive macro-view than Bitcoin.

While there have been talks of ETH flipping BTC in the past, most in the community share the view that such a scenario will only be temporary. Su Zhu and CryptoCobain are the ones to have this opinion, with the latter going on to suggest that ETH flipping BTC will raise questions about sustainability, owing to which, selling pressure in the altcoin’s market will hike to levels unseen before.

Asserting that such a flip, if it does happen, should be stronger, the trader went on to say,

“What’s important is to see where the altcoin’s price settles after the market’s parabolic rise. If you have a parabolic rise and then you have a new floor settling that’s 100% or 50% above the previous floor, I think that’s way more important than the peak flipping.”

How realistic is a scenario where ETH flips BTC? Despite the fact that Ethereum is the world’s largest altcoin, its market cap was just over $319 billion. At the time of writing, that of BTC’s was over $1 trillion. While that is a huge gap, according to many including the aforementioned, this can be expected to be bridged soon thanks to the fact that “lots of people are underexposed to Ethereum.”

With a surge in institutional adoption expected on the back of major banks now taking an interest in the blockchain, this assertion is likely to come true.

On the contrary, perhaps looking at the market cap alone won’t suffice. After all, Ethereum, historically, has always underperformed when compared to Bitcoin on two counts – Market cap and Google Search Interest.

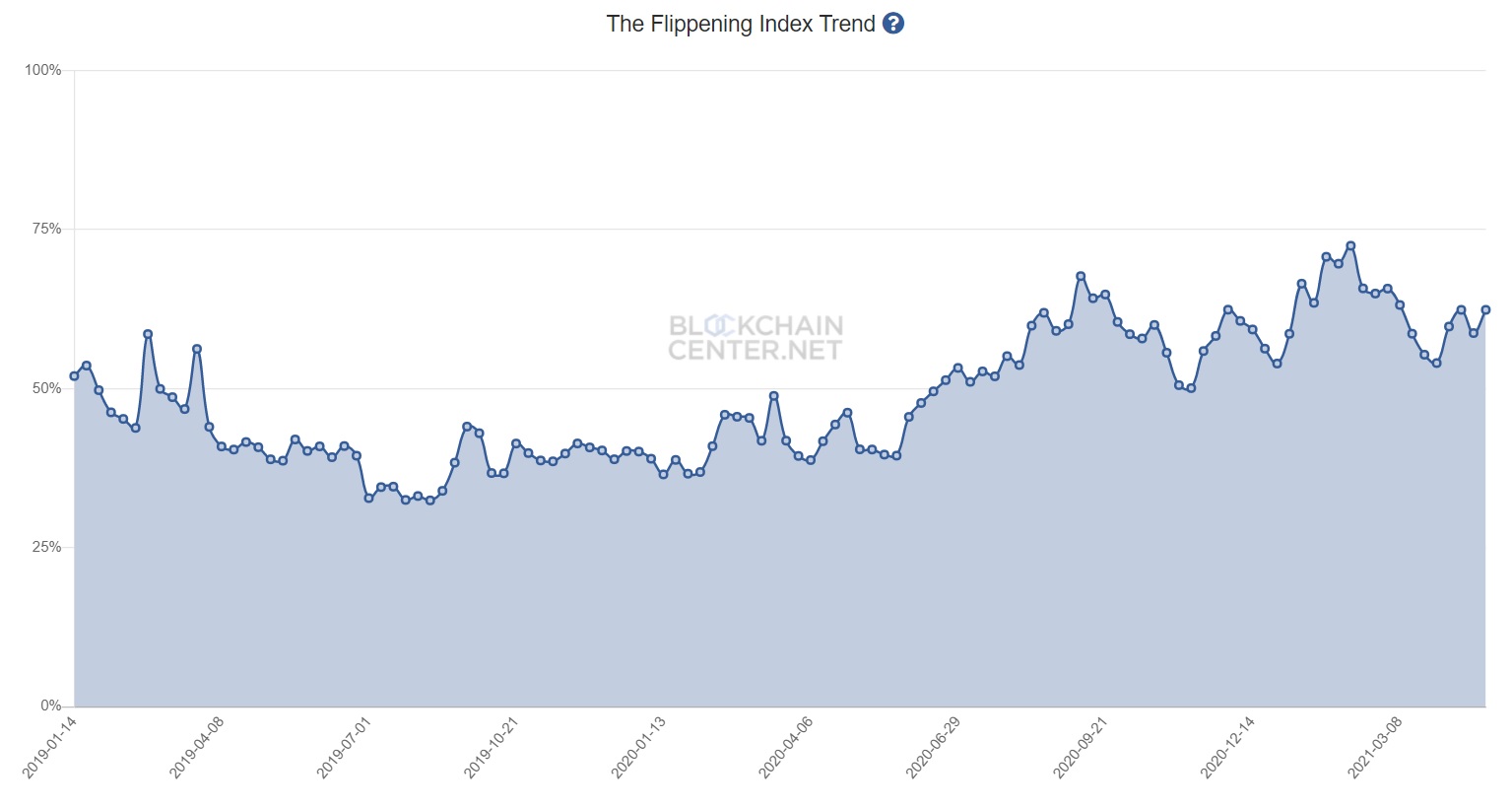

A look at the Flippening Index, perhaps, would be a better idea to ascertain the probability of something like this happening. According to the same, the average of these metrics has risen from 40.45 in early May to 62.37, at the time of writing. Back in February, when the alt first started to breach its previous ATHs, the same was as high as 72.45.

Source: BlockchainCenter

What’s more, ETH has already flipped BTC on the question of transaction count, with the metric of transaction volume doing the same quite a few times over the past few months too. Other metrics such as trading volume and active addresses have risen too.

Ergo, while there is still a long way to go, it would seem that Ethereum, at press time, is on the right track.

Will ETH flipping Bitcoin be good for crypto though? That is a question for another time, perhaps for a time when it is a little more approachable. According to egirl Capital’s @loomdart, however,

Some could argue that "its just the natural progression of things" but Gold has been #1 SoV for like 1000's of years before $BTC came in and broke its trust

having something "flip" $BTC so soon just doesn't look good, but interested in others thoughts on this

— loomy21????? (@loomdart) April 26, 2021

![Sei [SEI]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-13-400x240.webp)