Is Injective decoupling from the market

- INJ has managed to go above several resistance levels in the last few days.

- Whale holdings dropped but other metrics looked bullish

Injective [INJ] has been acting differently from the rest of the cryptos as its price went up while the value of other cryptos plummeted. This happened as the token managed to go over a key resistance level in the recent past.

So, should investors expect the token to pump further or should they be cautious for a price correction?

A quick look at Injective’s journey

While the market remained under bears’ influence, Injective chose to move the other way around as its price surged. To be precise, according to CoinMarketCap, INJ was up by more than 21% in just the last 24 hours.

At the time of writing, it was trading at $26.08 with a market capitalization of over $2.1 billion.

Rekt Capital, a popular Twitter handle that posts analysis about cryptos, recently posted a tweet mentioning INJ. As per the tweet, Injective went above a key resistance level at $21. Therefore, the chances of INJ showcasing a massive bull rally seem likely!

Injective has done it

Revisited the last major resistance before new All Time High & Price Discovery mode

Just needs to reclaim this red resistance as support to rally to new All Time Highs

Until then INJ will remain inside the orange-red range#INJ #Crypto #Injective https://t.co/4IcUphgcTT pic.twitter.com/yeLWRO14n3

— Rekt Capital (@rektcapital) December 11, 2023

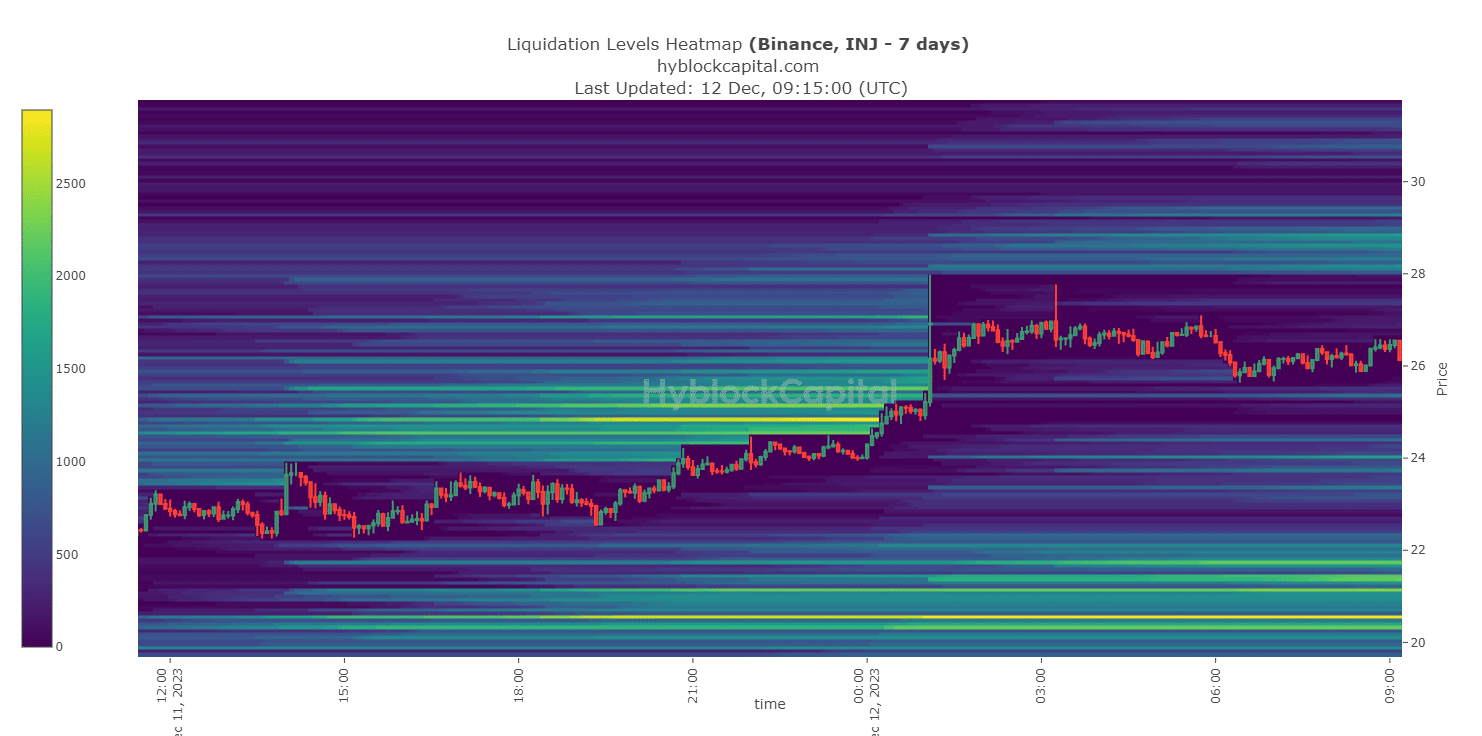

Interestingly, the token has managed to go above several resistance levels in the last few days. According to Hyblock Capital’s chart, INJ has gone above several levels in spite of liquidation, such as the $25 mark.

Should you expect INJ to pump further?

In order to understand whether investors should expect INJ to pump further, AMBCrypto checked INJ’s daily chart.

As per the analysis, INJ’s Money Flow Index (MFI) and Relative Strength Index (RSI) both reached overbought zones, which is a bearish signal.

The token’s price also touched the upper limit of the Bollinger Bands’ upper limit, increasing the chances of a price correction.

What metrics suggest..

While most market indicators suggested a price correction, its on-chain metrics looked bullish. For example, while its price rose, its trading volume also went up.

People were also talking about Injective as its social volume spiked, as did its weighted sentiments.

AMBCrypto then took a look at Injective’s supply. We found that INJ’s supply on exchanges registered a massive drop last week while its supply outside of exchanges remained stable. This clearly signified higher buying pressure.

Realistic or not, here’s INJ’s market cap in BTC terms

The token’s MVRV ratio also increased last week, which is a typical bullish signal. Whale activity around the token also remained high.

However, the whales might have sold their holdings as the supply held by top addresses remained flat last week, despite a hike in whale transactions.