Is it time to consider altcoins? Key indicator flashes ‘BUY’ signal!

- A popular analysts believe that the altcoin sector is in a ‘buy’ zone for mid-term investors right now

- BTC and USDT dominance didn’t quite align with such a bullish outlook

The altcoin sector recorded a sustained sell-off in early 2025, with top cryptos like Solana [SOL] and Ethereum [ETH] shedding +65% of their values. However, that might change soon after a key indicator flashed a ‘BUY’ signal.

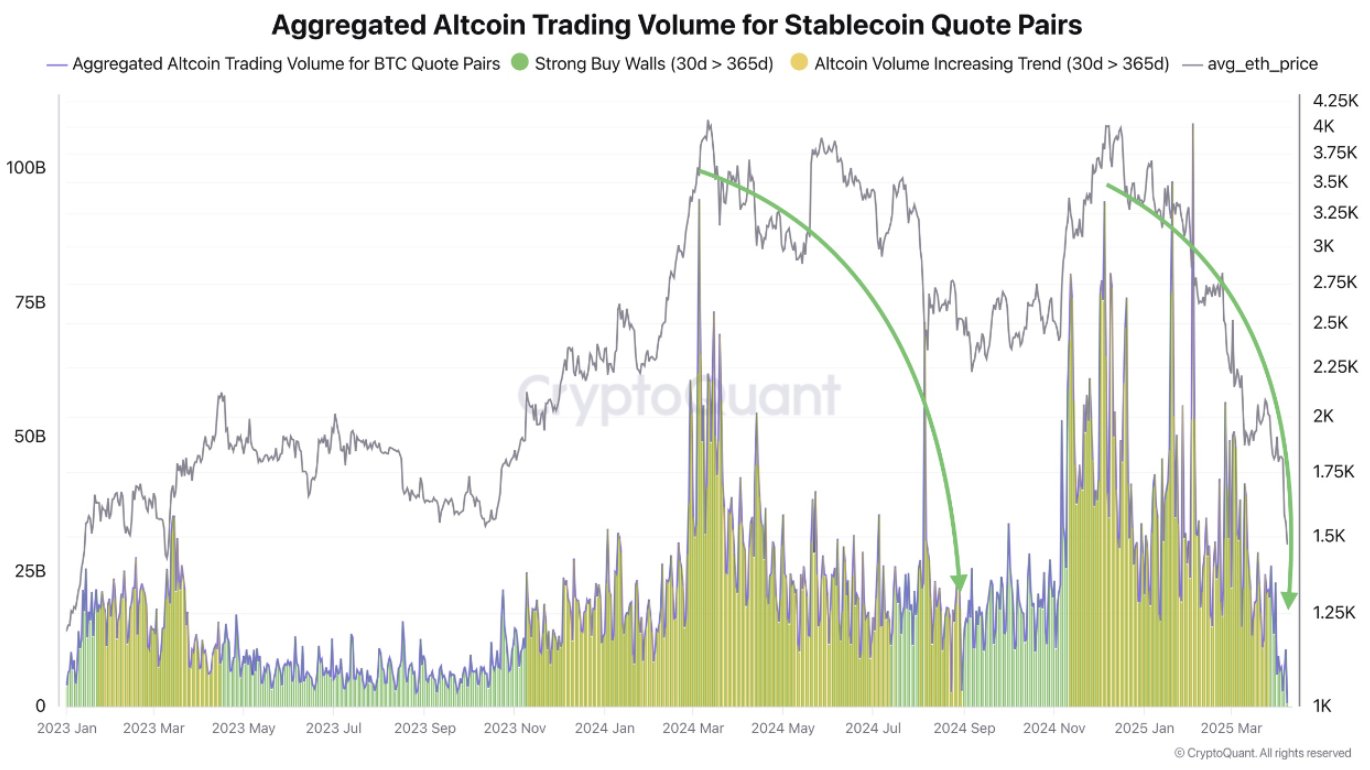

CryptoQuant analyst DarkFost revealed that it might be a great time to slowly enter altcoin positions with a “mid-term” outlook. In doing so, he cited the aggregate altcoin trading volume positioning.

“We’ve entered a buying zone, which is defined by the 30-day moving average falling below the annual average… last time we reached these levels was in September 2023, right after the bear market ended.”

Simply put, the indicator’s low readings mirrored the undervalued market conditions just before the altcoin sector exploded in late 2023.

Hence, the question – Do other altcoin momentum signals agree with this particular outlook?

Assessing Bitcoin and USDT’s dominance

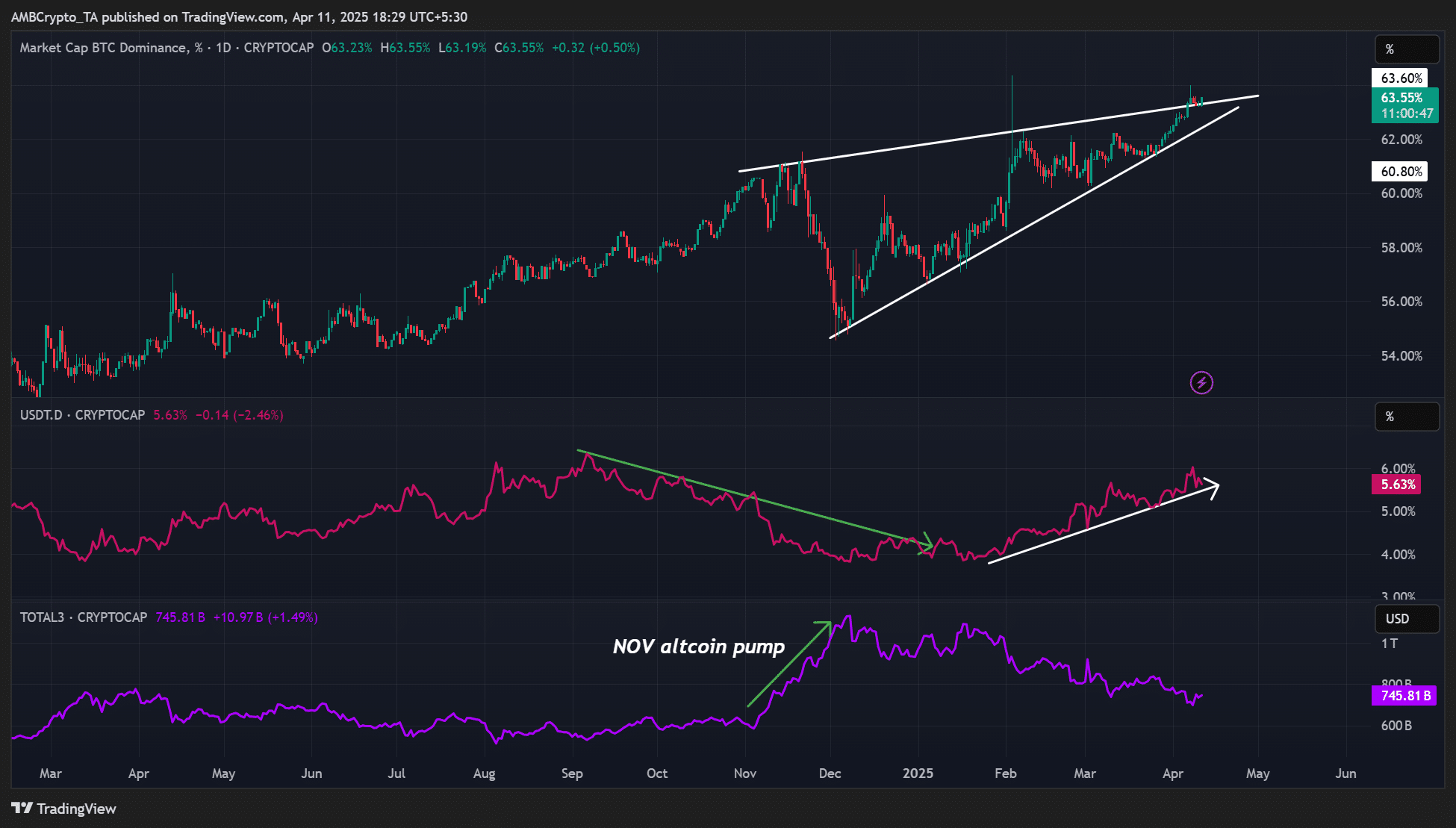

Some key indicators for altcoin momentum are BTC (BTC.D) and Tether USDT dominance (USDT.D).

In last November’s altcoin explosive run, USDT.D dropped, meaning speculators swapped stablecoins for their favorite altcoin gems. At the same time, this led to capital rotation from BTC to altcoins. Hence, BTC.D fell.

However, in 2025, BTC.D climbed higher to 63.5%, suggesting that capital was parked in BTC from altcoins. Additionally, USDT.D rose from 4% to 5.6%, underscoring cautious traders fleeing to stablecoins to preserve capital from Q1 drawdowns.

Based on the press time readings, it would seem that speculators have not been keen to jump into the altcoin sector. However, this could change in a favorable macro environment.

That being said, the RSI heatmap and funding rates revealed that the altcoin sector was undervalued and had less froth (less leverage). This seemed to be in line with DarkFost’s outlook.

In late 2024, funding rates hit 50-80% (orange), signaling strong bullish sentiment and over-leverage. This often leads to sharp pullbacks in case of liquidations. However, press time funding rates were below 10% across several altcoins, hinting at a stable market that could rally higher under positive catalysts.

Worth pointing out though that some select outliers outperformed BTC over the past week and 30 days of trading. Onyxcoin [XCN] and Fartcoin saw over 100% gains in the past week. Others, like Curve DAO [CRV], have surged by nearly 50% over the past month.