Is Lido DAO set for a trend reversal after a 483% rally

One of the best performers of the month, Lido DAO, has exceeded expectations in matters of price recovery. Well, thanks to the wild volatility faced by the altcoin.

Unfortunately, LDOs’ move upwards might stop eventually. And, in the next few days, LDO holders might note a decline in their portfolio.

Lido DAO to go back down?

Well, a consolidation is definitely on the cards, in case, LDO refrains from declining.

The reason behind this is not speculation or a bearish attitude. But the saturation of buying pressure which was responsible for the rally up until now.

In fact, two weeks ago, LDO was in a 10-day long period of consolidation after it had peaked into the overbought zone.

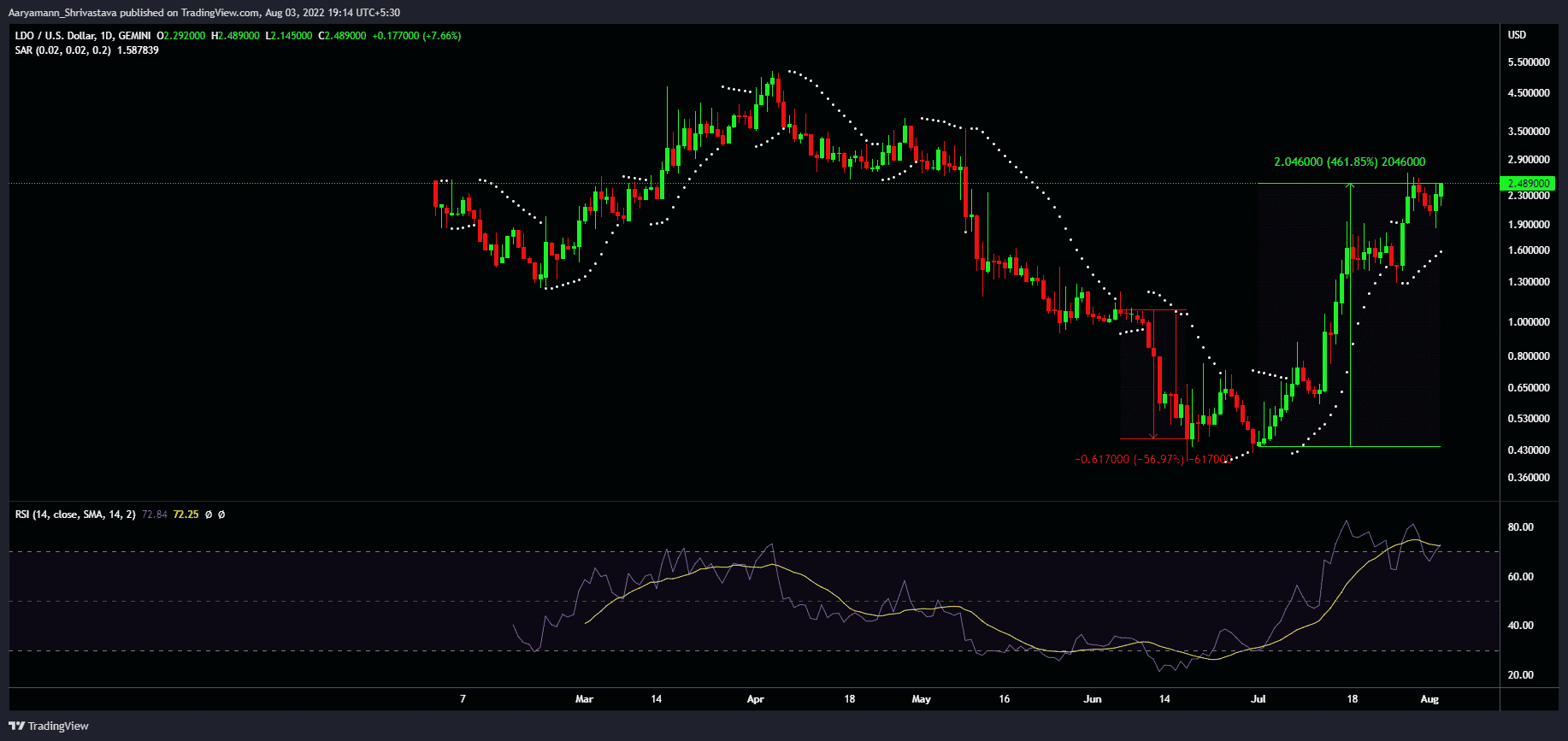

As evinced by the Relative Strength Index (RSI), a similar instance took place last week. And, LDO fell by almost 15%, only to recover it all in the previous 24 hours of press time. Thus, bringing the rally to 483.07%.

Now, once again, the indicator is heading into the overbought zone. Given historical cues, a trend reversal will be set in motion soon.

Lido DAO price action | Source: TradingView – AMBCrypto

Notably, some investors have been anticipating this, which is why in the last 20 days, over $25.8 million worth of LDO has been sold to exchanges.

However, LDO holders do not have to worry about a trend reversal since the altcoin is in a safe spot.

Lido DAO selling by investors | Source: Santiment – AMBCrypto

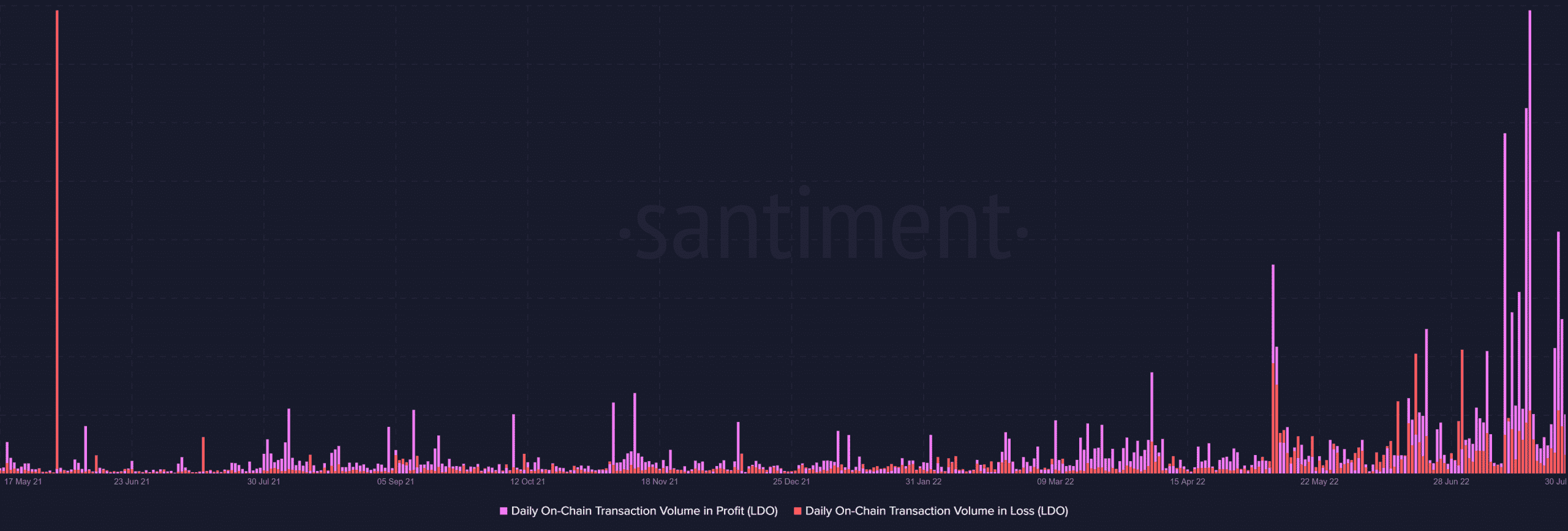

Even if prices do correct slightly, investors will HODL their supply until recovery hits as their transactions over the last two months have been in excessive profits. Something that they would not want to lose by selling at a lower price.

Moreover, at one point in the month, over $40.38 million worth of LDO transactions reaped profits for investors.

Lido DAO transactions in profit | Source: Santiment – AMBCrypto

But beyond profits, LDO will also find support from external factors such as the arrival of The Merge on Ethereum (expected between 6 August to 12 August).

After the final testnet merge, the Goerli/Prater, takes place on 4 August, Ethereum will be set to welcome Proof of Stake. Thus, involuntarily benefitting LDO.

Final testnet merge is scheduled pic.twitter.com/l4hjeWVIPa

— Cobie (@cobie) July 28, 2022