Is Lido’s dominance in the liquid staking market at risk? Recent data suggests…

- Lido’s market share declines as Coinbase enters the liquid staking market.

- Competitors offer better APR rates and declining network growth affects the Lido token.

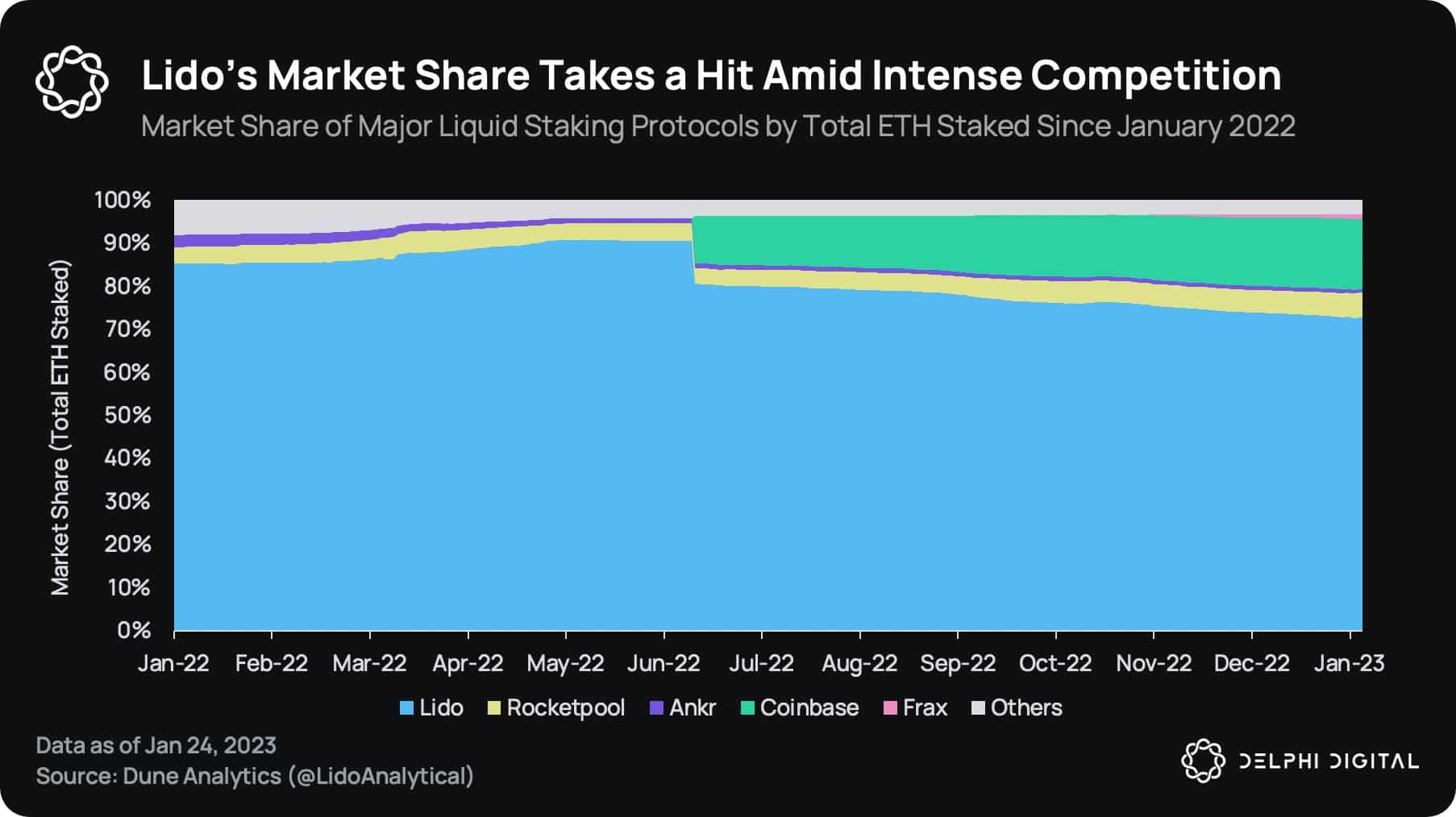

According to Delphi Digital’s recent data, Lido’s market share declined significantly over the last year. This can be attributed to the entry of Coinbase into the liquid staking derivatives market in June 2022. Prior to this, Lido held a market share of 85%, but this has now dropped to 73%.

Realistic or not, here’s LDO’s market cap in BTC’s terms

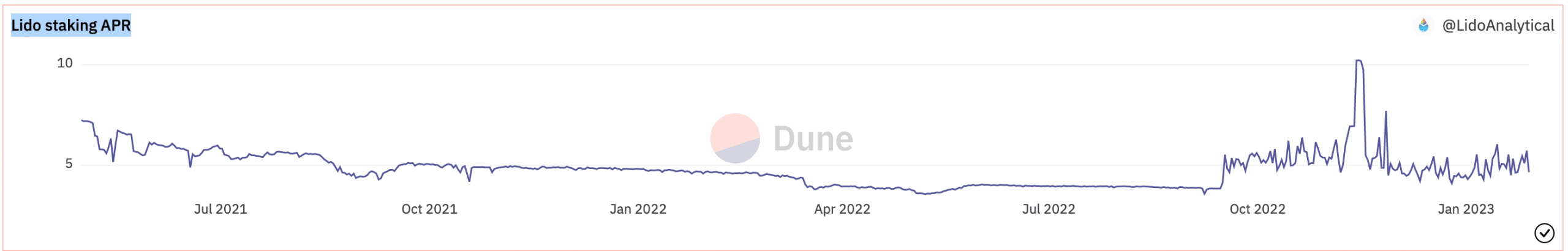

No APReciation

Furthermore, the number of new ETH staked deposits on Lido also decreased. At the beginning of last year, 80% of all new staked deposits were placed on Lido.

However, as of now, that number has fallen to less than 40%. One of the reasons for this decline could be the decreasing annual percentage rate (APR) provided by Lido to its users.

Notably, a decline in the interest in staking ETH with Lido could drive away users from the protocol and impact the protocol negatively over time.

Other competitors, such as Frax Finance, outcompeted Lido in this regard. Frax, at the time of writing, was providing its users with an APR of 7.92%, while Lido was providing an APR of just 5.11%.

Large LDO investors flee

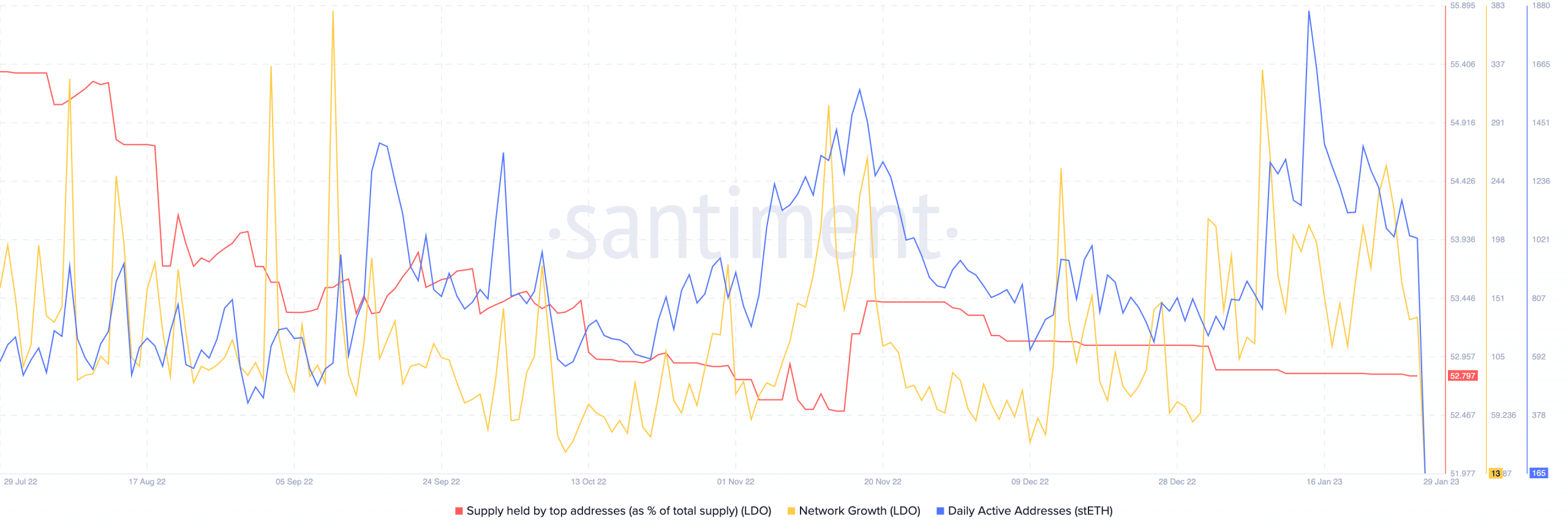

According to Santiment’s data, the percentage of large holders of LDO decreased significantly over the last month.

The network growth of the token was also affected during this period. A decreasing network growth for the LDO token suggested that the number of times LDO was transferred for the first time among new addresses declined. This implied that new users were perhaps not buying LDO at its current price.

Is your portfolio green? Check out the Lido Profit Calculator

The activity of staked ETH also fell during this period, which could affect Lido’s ecosystem negatively.

Overall, the data suggest that Lido‘s market dominance is being threatened by the entry of Coinbase and other competitors offering better APR rates.

While the price of LDO has increased in the short term, the declining network growth and decrease in new ETH-staked deposits could be cause for concern in the long run.

That said, at the time of writing, the price of LDO, which was $2.29, decreased by 5.53% in the last 24 hours according to CoinMarketCap.