Is Litecoin due for a cooling off after the recent rally? Findings suggest…

- Litecoin bulls grow weaker as overall market sentiment indicates a slowdown after a recent upside.

- LTC sell pressure starts growing as key indicators confirm a bearish bias among investors.

Litecoin [LTC] just concluded a bullish week during which its price action almost pushed to a new monthly high. However, LTC bulls are already running low on the momentum which means that last week’s upside might be cut short.

Is your portfolio green? Check out the Litecoin Profit Calculator

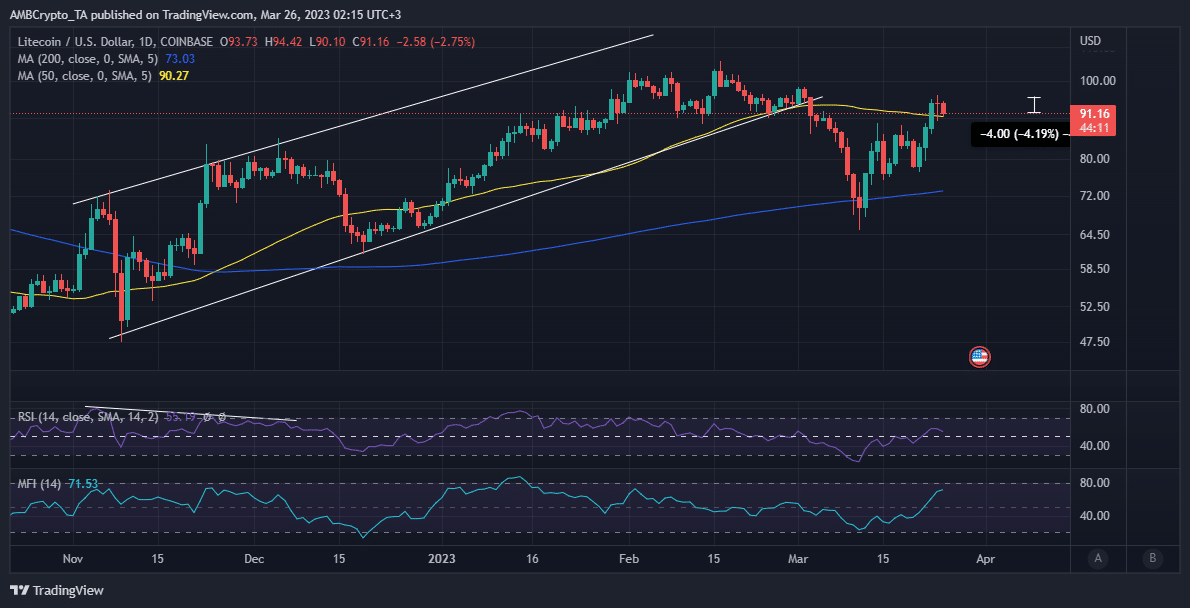

LTC managed to push as high as $96.11 on 24 March. It traded at $92.16 after a slight pullback by almost 5% in the last two days.

The pivot was also slightly shy of the $98 resistance level. A closer look at the price movements reveals that the pivot occurred after the price of Litecoin briefly pushed above the 50-day moving average.

It is to be noted that Bitcoin’s [BTC] RSI managed to push above the 50% level but, at press time, it had already leveled out. This was a sign that the probability of a continuous upside just got a bit lower.

The most likely reason for the untimely return of sell pressure is that Litecoin is still heavily correlated to Bitcoin. This means LTC’s price action will likely be more influenced by the overall market tide rather than by organic demand.

What should Litecoin investors expect as a new week rolls in?

Litecoin’s potential pullback will depend on whether sellers have enough incentive to offload some of their holdings.

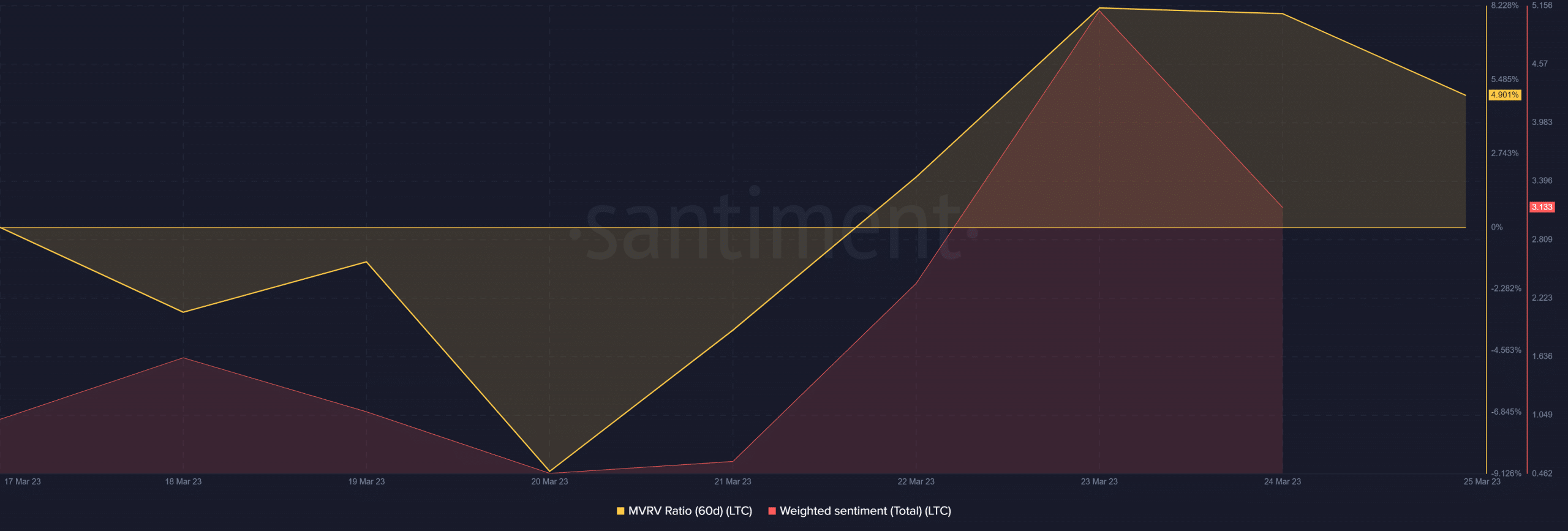

For example, LTC’s 60-day MVRV ratio confirms that quite a substantial number of holders are now in profit. A sizable retracement is on the cards if most of those holders are incentivized to sell.

Litecoin’s weighted sentiment also pivoted, confirming that traders, at press time, were changing their minds about the cryptocurrency. In other words, bearish expectations were rising.

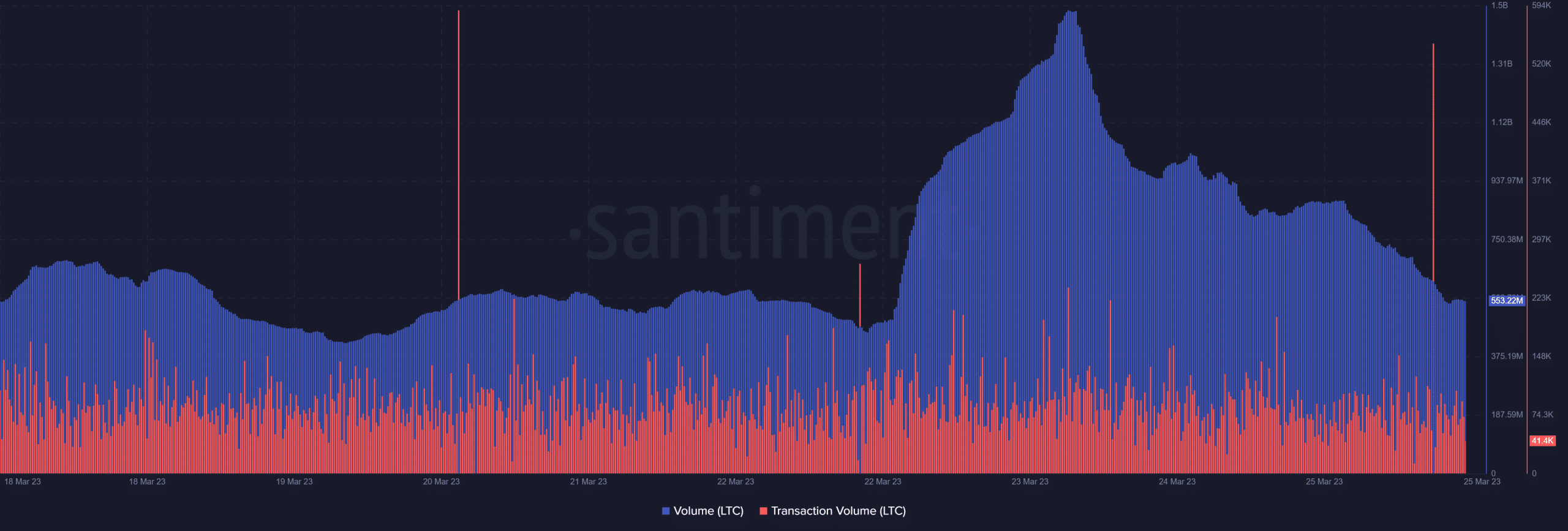

Sell pressure remained low as indicated by a lack of a strong surge in volume.

There was one major observation regarding Litecoin that may offer some insights into the price action. Transaction volume had its second-largest weekly spike in the last 24 hours.

The last time it delivered a large spike was the same time that the price bounced back on 20 March.

How many are 1,10,100 LTCs worth today?

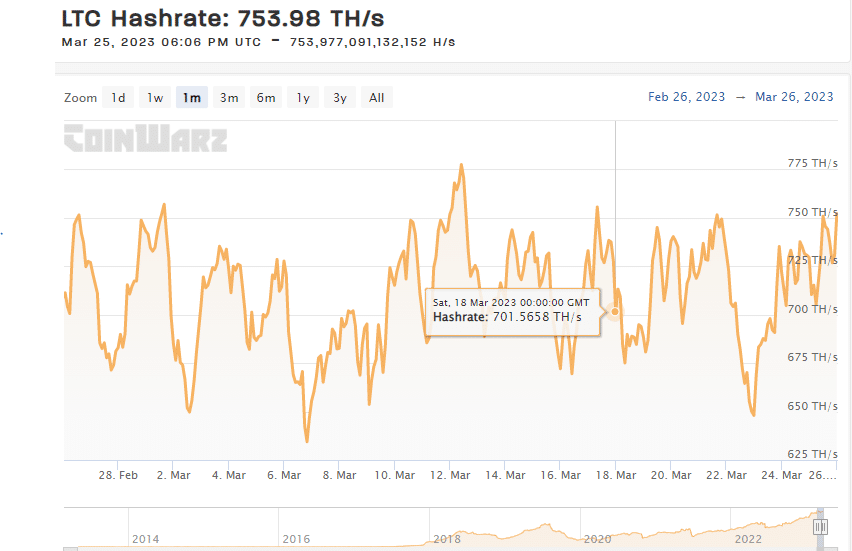

Another key observation regarding Litecoin is that its hash rate managed to stay above 700 TH/s for most of March. There have been incidents where it dropped below that level but it bounced back each time.

Well, as far as the latest Litecoin-related announcement is concerned, people can now sell their old coins in exchange for LTC. This will be possible at Coinstar outlets.

Reminder, you can just walk into the supermarket and pick up some $LTC on your way home.#Litecoin ⚡ pic.twitter.com/OIm3NnK1gl

— Litecoin (@litecoin) March 24, 2023