Is Litecoin overvalued? Exploring demand amid lowered prices

- Litecoin was multiple times oversold compared to Bitcoin and Ethereum.

- LTC saw a surge in retail demand, but whales were still on the sidelines.

August was perhaps the most anticipated month for Litecoin [LTC] holders due to the halving. However, the month is coming to its conclusion, and LTC’s price continued to favor the bears.

Read about Litecoin’s [LTC] Price Prediction 2023-24

Litecoin’s bearish bias suggested a loss of excitement among holders. However, the cryptocurrency, which is often described as digital silver, has undergone a substantial discount since its July high. So, is it undervalued, or should traders anticipate more downside?

For starters, LTC’s $65.47 press time price represented a 63% premium from its lowest point at its lowest price point during crypto winter. On the other hand, it was at a 43% discount from its highest price point in July.

While LTC’s discount from July highs represented a healthy discount, it was much steeper if we contemplated its historic high. The cryptocurrency peaked at around $417 during the height of the 2021 bull run. Its press time price represented a 41% discount from its 2021 peak.

We decided to compare Litecoin’s downside with that of Bitcoin and found something interesting. BTC was only down by roughly 62% from its ATH. Meanwhile, in the same time period, ETH was at a 675% discount from its historic high.

Based on the ATH discounts, we can conclude that LTC is more overvalued than its counterparts.

Is LTC securing significant demand?

Note that Litecoin bears seems to be on recess after dominating since July. The price is also in oversold territory and also in a support level previously tested in March. Technically, we should see some accumulation in this region considering the support and oversold conditions as well as the sizable discount.

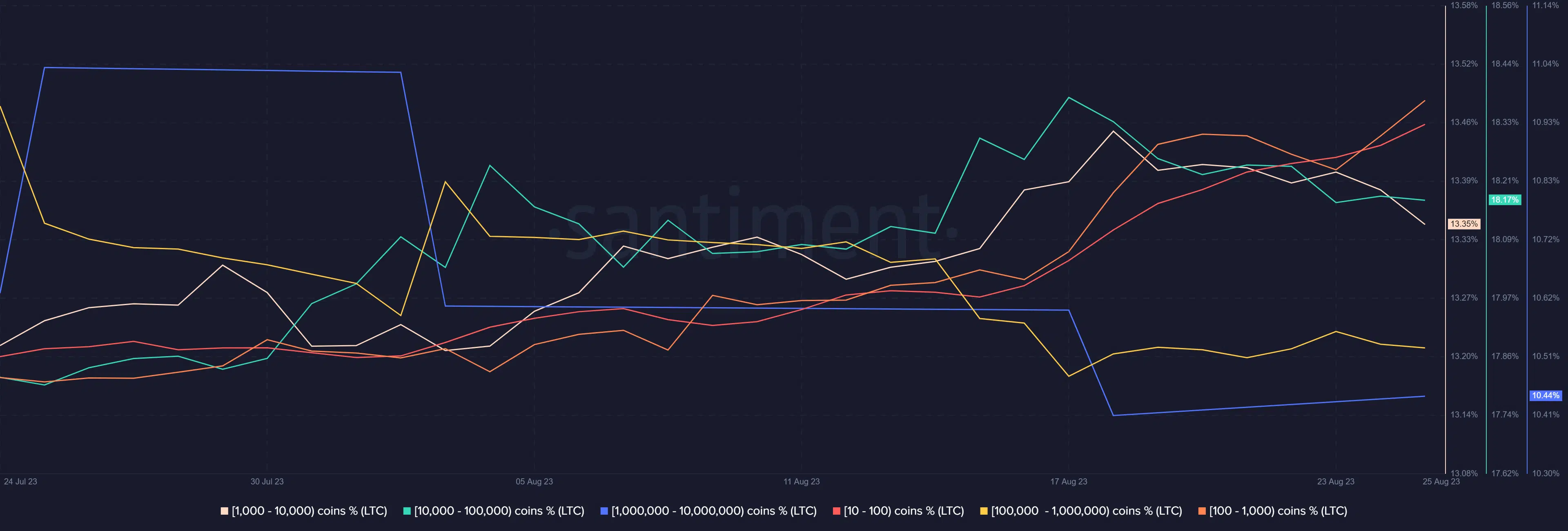

LTC’s supply distribution metric revealed something interesting. Retail traders have been buying the dip, as seen by the upside in addresses holding between 10 and 1,000 LTC (denoted in red and orange).

On the other hand, whale addresses registered net outflows in the last 10 days (addresses denoted in green, pink, and blue).

Is your portfolio green? Check out the LTC Profit Calculator

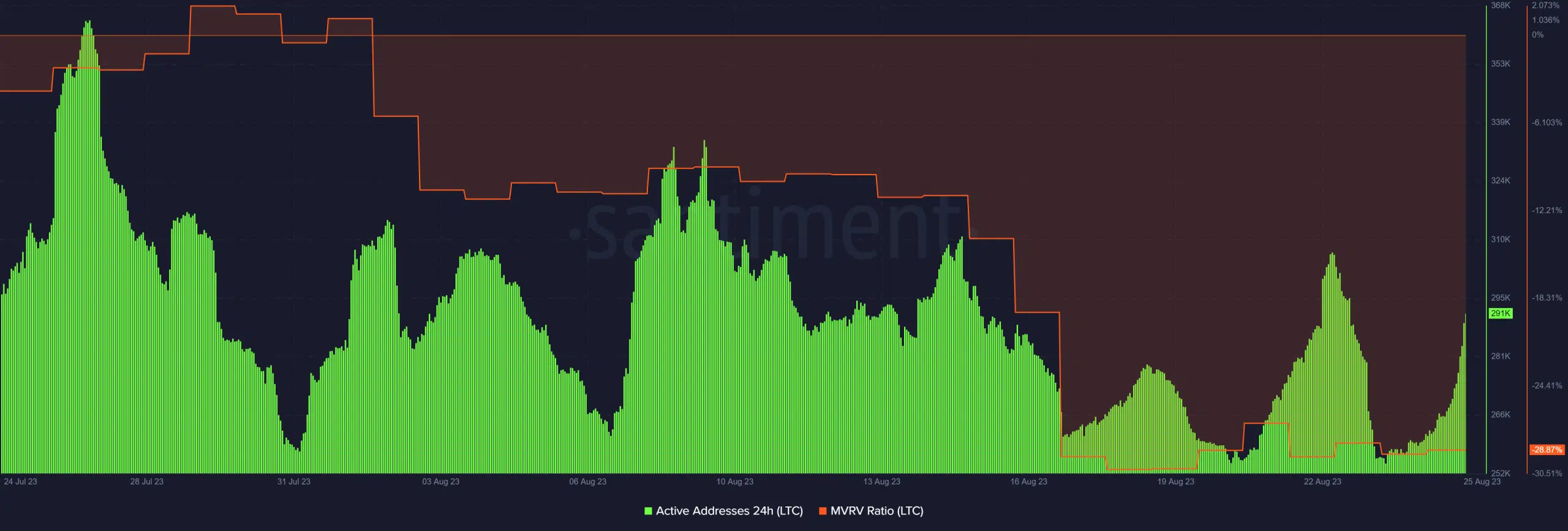

The above observation confirmed that whales were still sitting by the sidelines, thus holding back the bulls. Daily active addresses have notably declined in the last few days compared to the levels observed at the start of August.

At press time, Litecoin’s MVRV ratio was down to its lowest level in the last four weeks. This meant there was less incentive to sell below this level. Nevertheless, it does not guarantee that the price won’t go down further.