Is Ondo poised for a bigger price drop?

- ONDO’s price witnessed a massive correction over the last week caused by whale behavior.

- Despite the price volatility, the protocol continued to see growth in terms of TVL.

Ondo Finance [ONDO] recently benefitted massively due to the rising interest in protocols associated with Real World Assets(RWA). The momentum was primarily driven by whale investors.

Playtime over?

However, data indicated that ONDO’s price declined significantly over the past few days. After testing the $1.04 resistance level on the 4th of April, ONDO’s price declined by 25.29%.

During this period, the price of ONDO broke past the previously established higher highs and higher lows, causing the bullish trend initially showcased by the token to end.

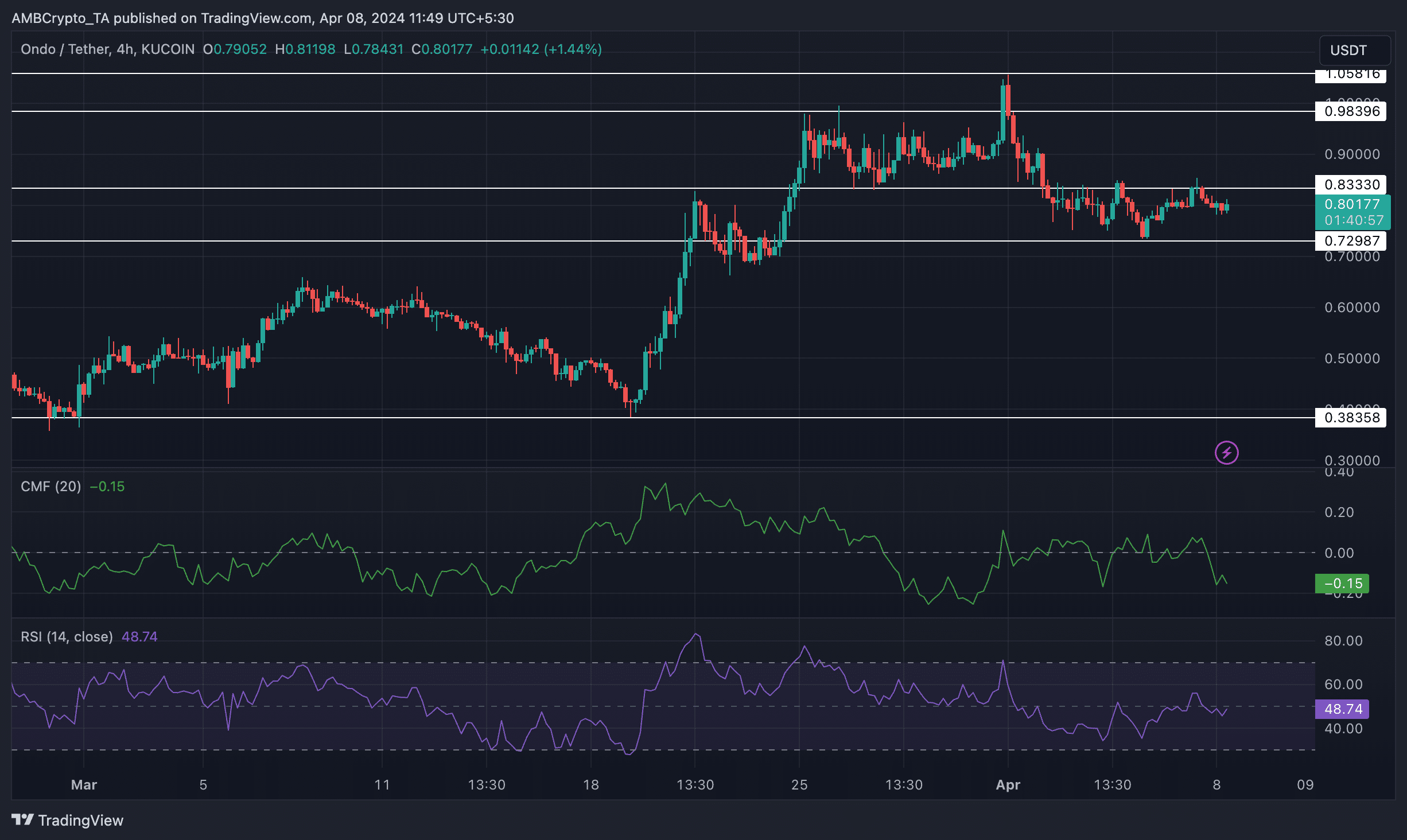

At the time of writing, ONDO was trading 23.32% below its all-time high at $0.8032. Furthermore, the CMF (Chaikin Money Flow) has fallen to -0.15. The CMF is a technical indicator that measures the flow of money into or out of a security over a specific period.

A negative CMF indicates a net outflow of money from the security, suggesting heightened selling pressure.

Moreover, the token’s RSI (Relative Strength Index) declined to 48.83. The RSI measures the speed and change of price movements.

A value below 50 typically indicates bearish momentum, suggesting that the bullish momentum behind ONDO has declined significantly.

Are whales to blame?

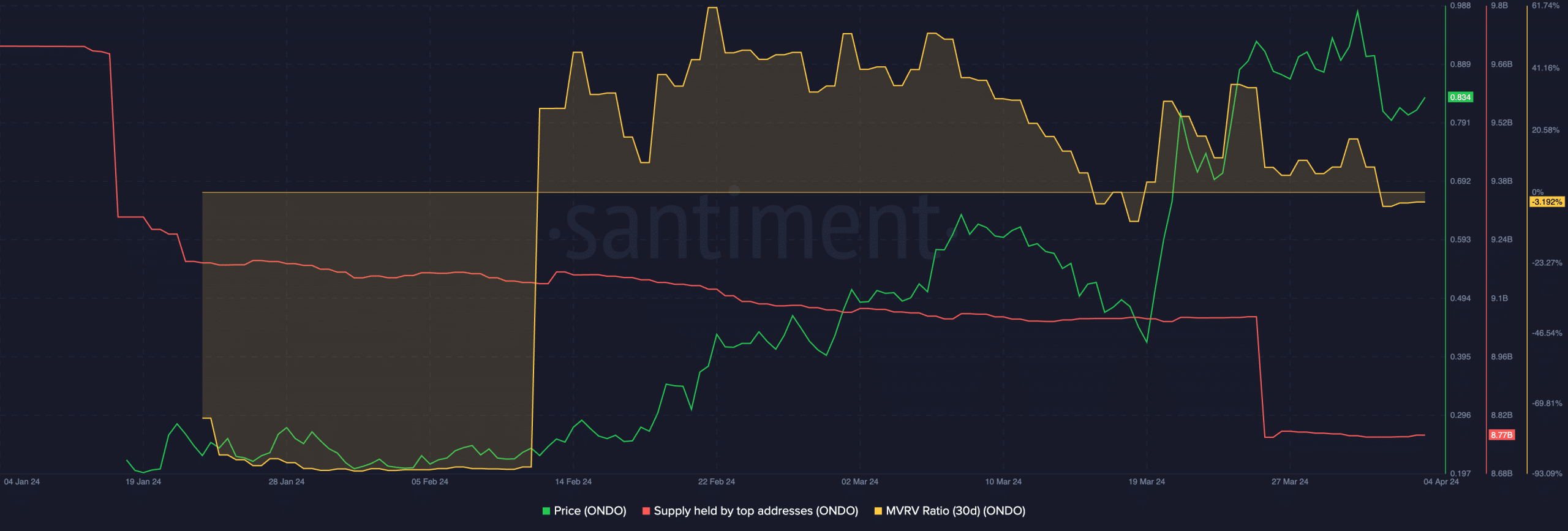

One of the reasons for the decline in ONDO’s price would be whales losing interest in ONDO. AMBCrypto’s analysis of Santiment’s data revealed that the supply of tokens being held by large holders had fallen materially.

This could only be caused by multiple whales selling their holdings for a profit, leaving retail investors to suffer losses.

Another indicator of the current state of ONDO holders would be the MVRV ratio for ONDO. The MVRV ratio fell along with the price, indicating that most holders were not profitable at the time of writing.

Is your portfolio green? Check the ONDO Profit Calculator

Traders faced the same fate as well. In the last few days, over $500,000 worth of long positions were liquidated. Because of this, the percentage of short positions taken against ONDO had grown.

ONDO’s future price movement will also be dictated by the state of its protocol and its performance. The Total Value Locked generated by the ONDO protocol had grown steadily over the last few days.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)