Is RUNE’s price potential in the short term healthy for investors

Thorchain, a popular DeFi protocol went through a rough patch following a series of hacks. These exploits resulted in mammoth losses of over $10,000,000. The native token, RUNE, likewise suffered massively.

Interestingly, Thorchain experienced a good rally in the last 40 days. The native token of this decentralized cross-chain bridge rose from its 2022 low at around $3 with 30% intra-day rallies to its current levels. In fact, at press time, RUNE traded above the $9 mark with a 6% in 24 hours.

Thor: Love and Thunder

According to analyst Alerzio from research firm Santiment, RUNE’s current rally has traders wondering if the token will be able to sustain its gains. Well, on that note, it should be considered that Thorchain’s trading volume has increased parallel to its recent rally and hit one-year highs.

The trading volume increased parallel to the rally. This amount of volume is the highest since April 2021.

Is there any opportunity to go further or not? Well, the analyst believed that RUNE’s current rally has been “healthy”. As the price moved upwards, the token’s trading volume followed it.

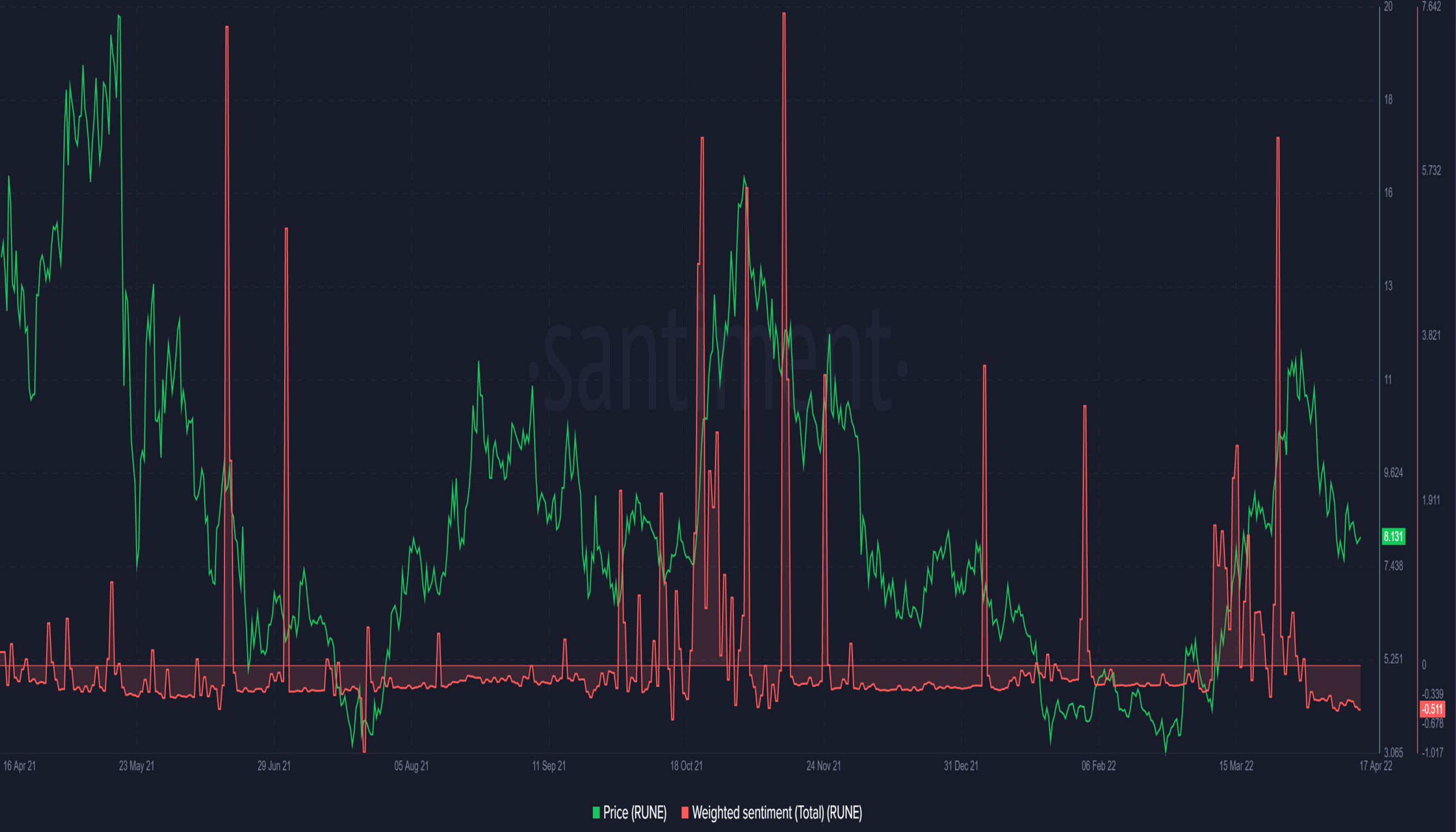

Moving on to weighted sentiment. Negative sentiment took hold after the following 2-week RUNE correction- this was a sign of capitulation.

The weighted sentiment stood in the negative area at around the -0.51 mark. Contrary to the popular opinion, this could be considered as a good sign, because it can be an indication of the fact that the greed was out and the probability of further correction was low.

In addition, the futures market seems to support the bulls as funding rates on Binance and FTX were barely returning from the negative territory into positive on the recent price action. The analyst added,

“Binance’s funding rate is positive (not too much) while FTX’s funding rate is about to get into the positive areas. this can be considered as a “not very good, but not too bad” signal.”

Any concerns ahead?

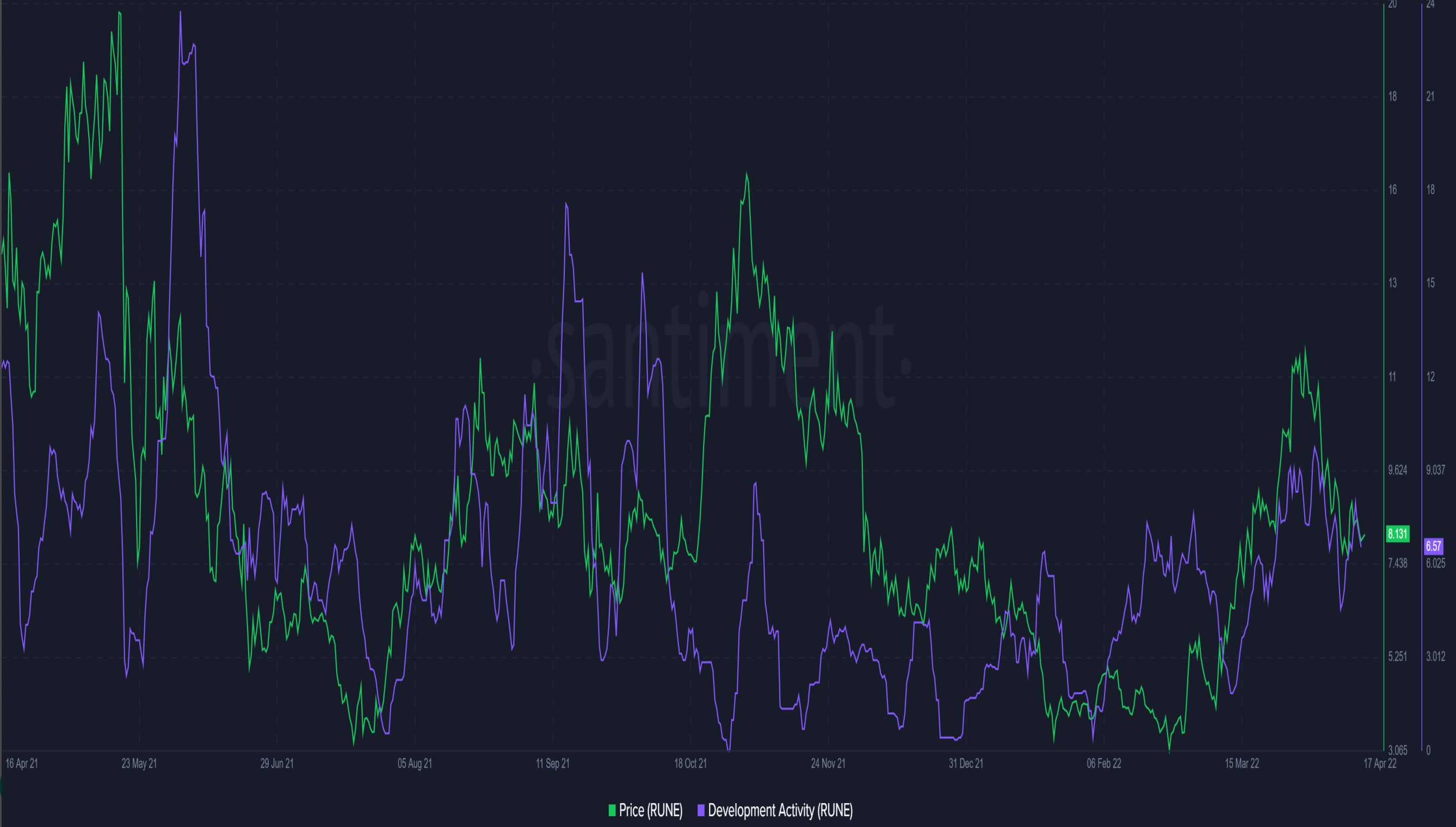

Well, for one, THORChain (RUNE) developer activity could be a long-term obstacle for RUNE’s price.

There are not many new ideas and improvement proposals happening “through Thorchain’s GitHub and other platforms that the data is driven from.”

Overall,

“RUNE’s previous rally was a healthy one. there is still some price potential in short term, but the outlook for long term hodling is not good enough because there is not enough development activity.”

Further, the cryptocurrency could revisit its lows if the bulls are unable to push past the $10 in the short term or if the crypto market takes another bearish turn.