Is Satoshi’s Bitcoin stash safe? ETF inflows might soon rival his holdings!

- Bitcoin ETFs are accumulating significant inflows, nearing $20 billion in net inflows

- Bitcoin was valued at $67,847 at press time – A sign of strong resilience amid market developments

As Bitcoin [BTC] ETFs continue their impressive streak of inflows, accumulating $253.6 million on 11 October, $555.9 million on 14 October, and $371 million on 15 October, the momentum is unmistakable.

Eric Balchunas’ remarks spark concern

Seeing this, Eric Balchunas, a prominent ETF analyst at Bloomberg, made a bold prediction.

He believes that BTC ETFs are poised to surpass Satoshi Nakamoto, the enigmatic creator of Bitcoin, as the largest holders of the flagship cryptocurrency by Christmas.

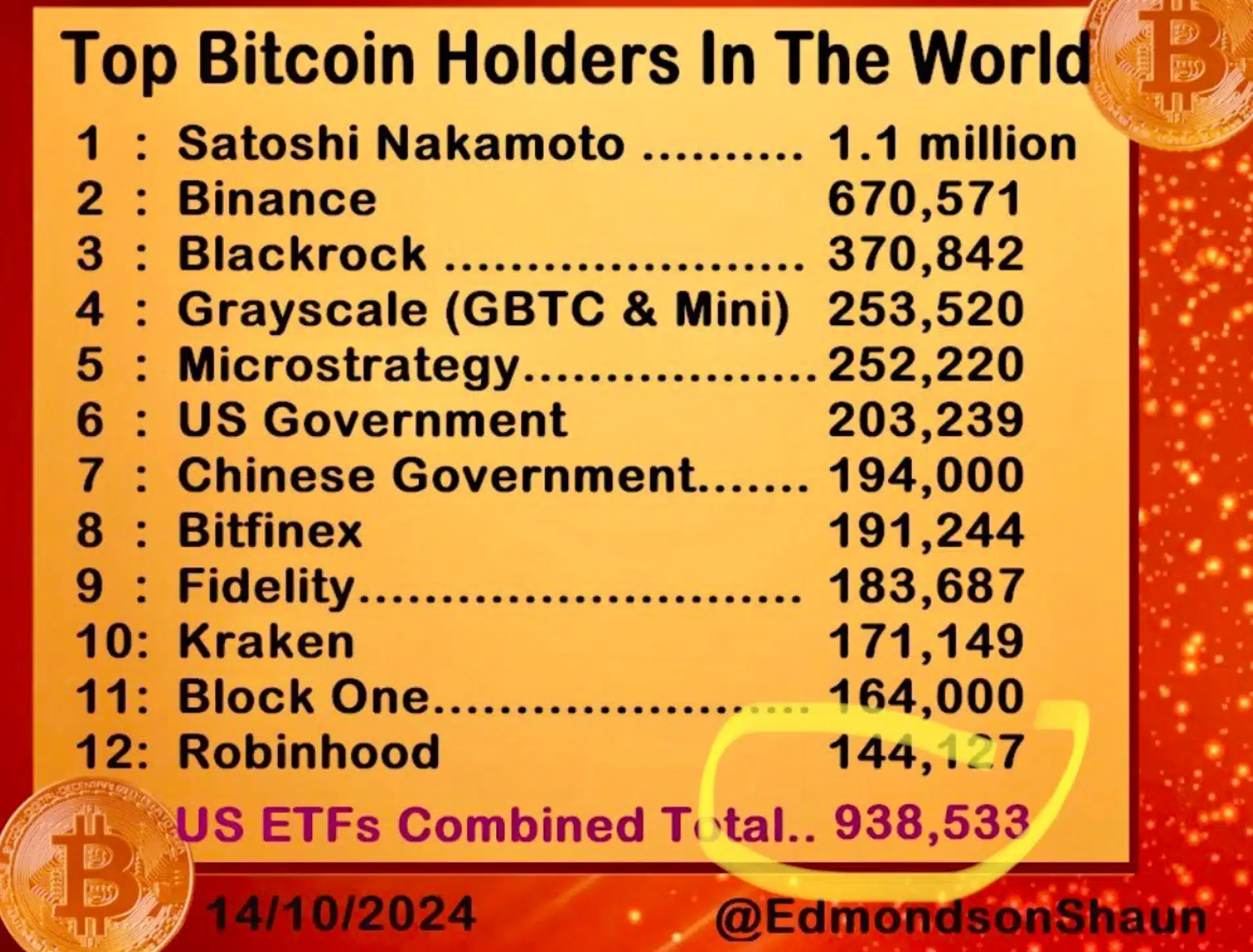

“Monster flow day for the bitcoin ETFs, over half a billion, total net flows (most imp number) hair away from $20b. They now 94% of way to holding 1mil btc and 85% away from passing Satoshi as largest holder in world- legit shot to hit milestone by Xmas. Ht @EdmondsonShaun.”

Currently, the total holdings of Bitcoin ETFs are an impressive 938,533 BTC.

How is the community reacting?

According to Farside Investors, Bitcoin ETFs are nearing the significant milestone of $20 billion in net inflows.

Here, it’s worth noting that analysts believe Satoshi Nakamoto possesses around 1.1 million BTC – A benchmark that institutional Bitcoin ETFs are swiftly closing in on.

Owing to the rapid inflows and growing interest in these investment vehicles, it appears increasingly plausible that BTC ETFs will soon rival Nakamoto’s holdings.

However, an X user painted a different picture when he said,

“There is no definitive proof Satoshi owns 1 million BTC.”

Another X user soon chimed in, noting,

“How can we have such monster inflows, but weak price action?”

However, this argument was soon dismissed by David Lawant, Head of Research at cryptocurrency brokerage FalconX. He claimed,

“There is a statistically significant relationship between changes in ETF flows and prices, but it’s not a strong one. The correlation coefficient is 0.30, which means that less than 10% of the change in prices can be explained by the change in net flows.”

What else happened in connection to Bitcoin?

Interestingly, this news broke just a day later after a dormant Bitcoin whale from the Satoshi era resurfaced, sparking intrigue in the crypto community.

The wallet, which first mined its coins back in 2009, made waves by transferring approximately $630,000 worth of BTC to Kraken on 14 October.