Is there more to Litecoin’s pre-halving hype?

- LTC has seen a surge of nearly 40% over the last five days

- Upcoming halving event might be a major reason for the spike in price

Litecoin’s value has surged as the highly anticipated halving event approaches, bringing joy to many holders who now find themselves in a profitable position. Nevertheless, this upward momentum might also signal a potential downside for the cryptocurrency’s price trajectory.

– Realistic or not, here’s LTC market cap in BTC’s terms

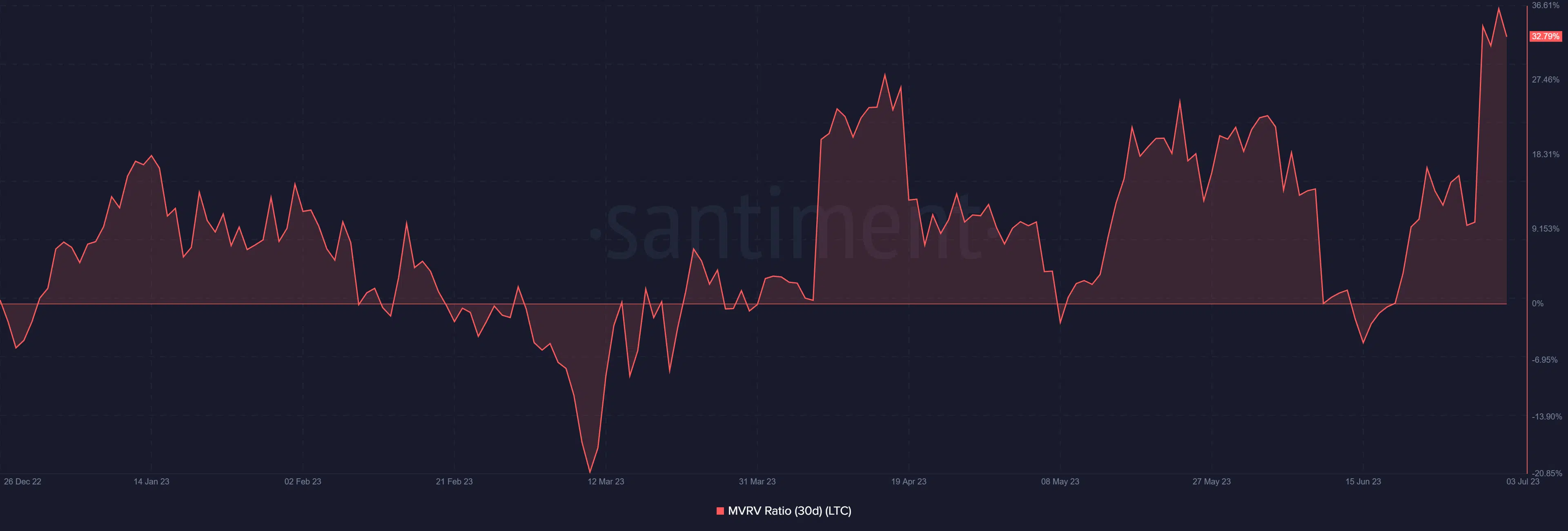

Litecoin’s price, MVRV hike

Over the last five days, Litecoin has seen a remarkable surge in value, soaring by nearly 40% according to its daily timeframe chart. This surge was the highest recorded in over a year, making it a significant milestone.

Litecoin was trading at approximately $110.8, although it had also seen a decline of over 2%. Despite this recent dip, however, it remained in the overbought zone and its price continued to exceed its short and long Moving Averages (yellow and blue lines).

Furthermore, the latest price spike has significantly impacted Litecoin’s 30-day Market Value to Realized Value ratio (MVRV). For instance, data from Santiment revealed that Litecoin’s MVRV stood at over 32%.

However, considering the current state of the MVRV and the positioning of the Relative Strength Index (RSI), it is plausible to expect a potential downtrend in Litecoin’s price soon.

Additionally, while analyzing the price chart’s RSI, it became apparent that a downtrend was underway. Also, the MVRV indicated signs of decline, suggesting a decrease in the value of LTC holdings.

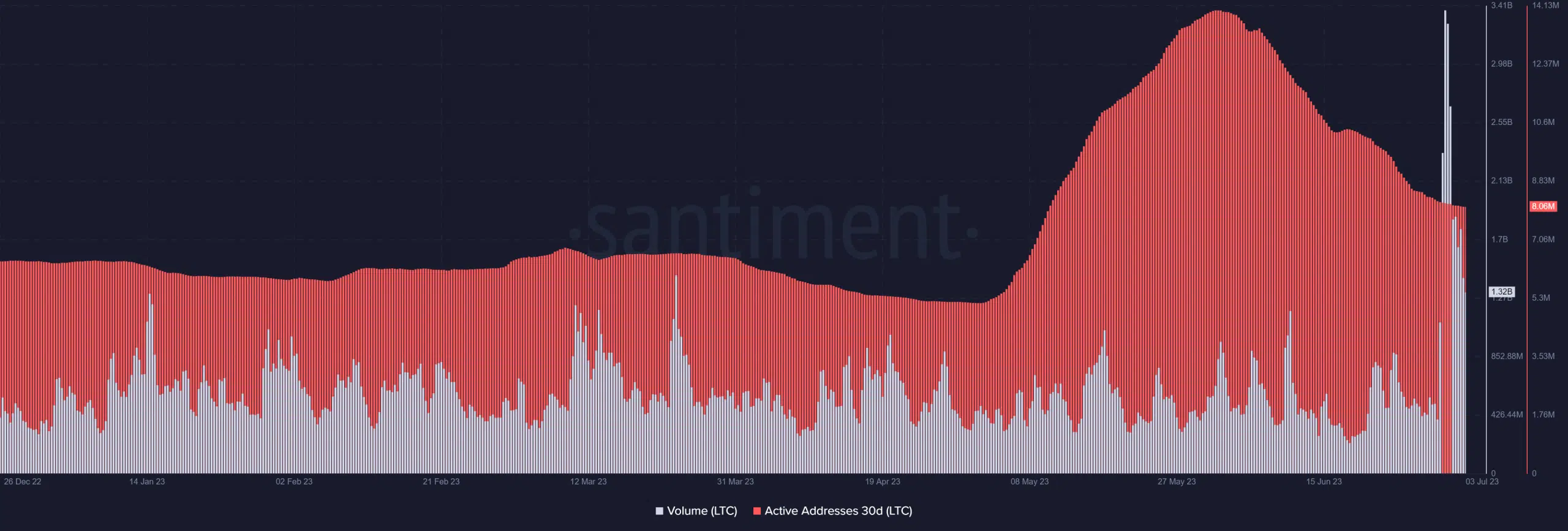

LTC’s volume, active addresses show divergence

As the price of Litecoin appreciated, another notable metric that saw a significant hike was its trading volume. According to data provided by Santiment, Litecoin noted a remarkable spike in trading volume, hitting a record high, mirroring the surge in price.

At the time of writing, although the volume had declined slightly, it remained above 1.3 billion.

However, the situation appeared different when the number of active addresses was examined. Looking at the 30-day active addresses metric on Santiment, there has been a noticeable decline.

In fact, the number of active addresses stood at around 8 million. In contrast, it touched almost 14 million in June before the decline began.

Pre-halving surge?

The recent surge in Litecoin’s value could be attributed, at least in part, to the highly anticipated halving event. The halving event occurs approximately every four years or after every 840,000 blocks mined. During this event, the block reward is reduced by half. This process continues until the block reward per block reaches zero, estimated at around 2142.

Currently, the block reward for Litecoin is 12.5 coins per block but would decrease to 6.25 coins per block after the halving takes place. The next halving event is scheduled to occur in less than 30 days.

– How much are 1,10,100 LTCs worth today

Other ‘positives?’

According to Coinglass, there is a prevailing positive sentiment regarding the price trajectory of Litecoin. For instance, LTC’s funding rate on major exchanges flashed a positive value.

This suggested that traders held expectations of a potential price hike in the future. However, the upcoming weeks will be crucial in determining whether the current movement is a result of pre-halving FOMO (Fear Of Missing Out) or if the positive trend can be sustained over time.