Litecoin cracks this key level amid its recovery

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- LTC’s recovery faltered below a previous lower high of $97.6.

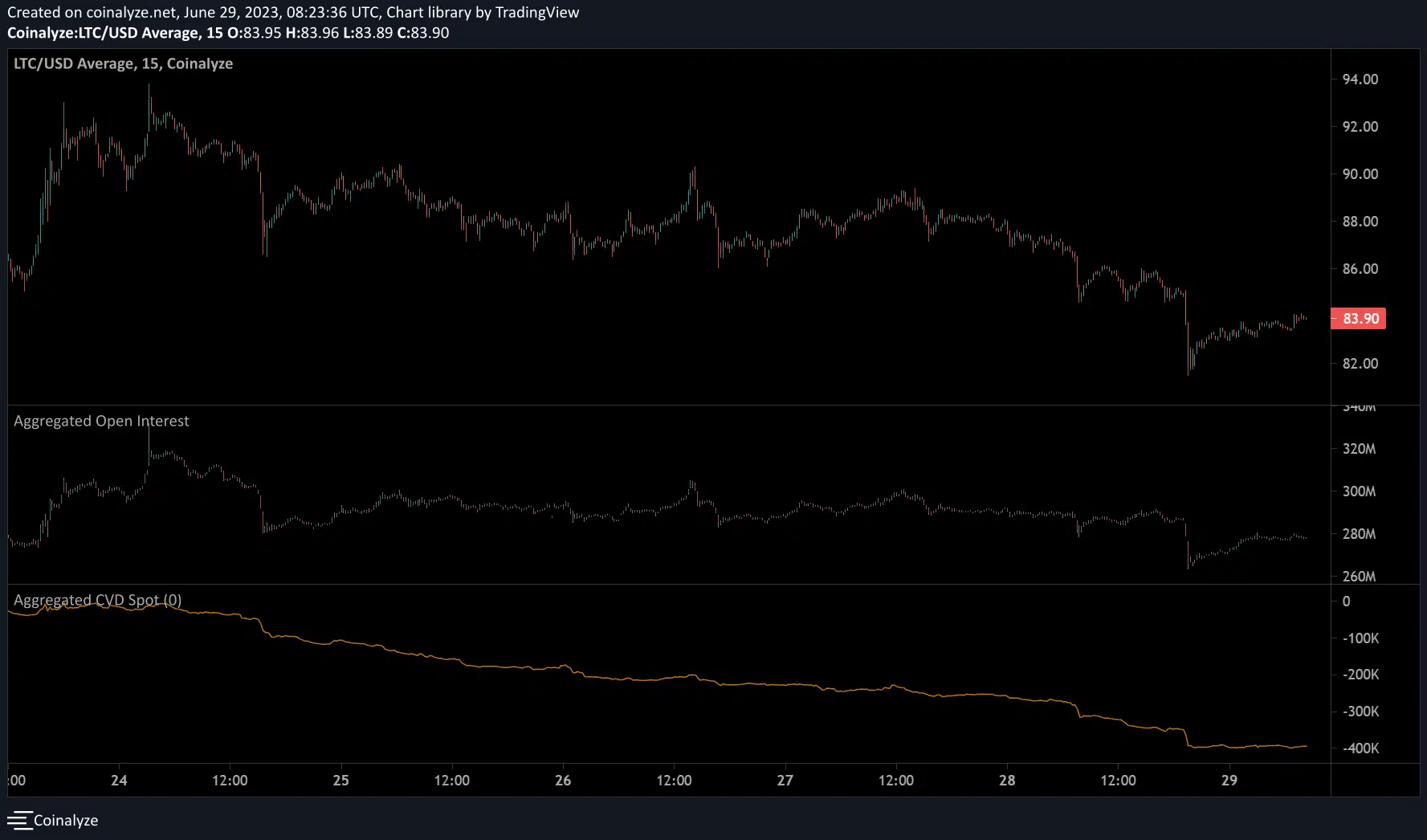

- An uptick in Open Interest rates and flat CVD suggested a potential pivot.

Litecoin [LTC] sustained a 5.73% loss on 28 June, following the hawkish stance by US Fed Chair Jerome Powell and EU counterparts during the ECB Forum on Central Banking 2023 meeting. Interestingly, Bitcoin [BTC] eased to $29.85k and bounced back to the $30k zone as bulls remained adamant.

Is your portfolio green? Check out the LTC Profit Calculator

But LTC breached key support, tipping sellers to gain more upper hand. Bulls can watch out for these levels if sellers consolidate the market further.

A reclaim of $85.6 or a drop lower?

LTC’s daily chart was bearish after failing to clear out the previous lower high of $97.56. Instead, LTC dropped lower and cracked the $85.55 support – a key level since late March.

The RSI retraced and slightly dipped below the 50-mark, denoting a significant buying pressure decline. However, OBV has been making new higher highs since March; denoting demand remained steady ahead of LTC halving in August 2023.

A reclaim of $85.55 will confirm the bullish intent. However, a move above the recent lower high of $93.80 will give the bulls an unfair advantage. But bulls must watch out for the bearish region from $95 – $103 (red).

Conversely, LTC could drop lower to the demand zone near $75 if bulls fail to clear the $85.55 hurdle. In such a scenario, bulls could wait for a reclaim of the key low of $75.20 before making moves.

Open Interest rates improved amidst a flat CVD

How much are 1,10,100 LTCs worth today?

On the 15-minute chart, the CVD (Cumulative Volume Delta) declined massively but eased as of the time of writing, as shown by the “flat” line. It shows selling volumes increased in the same period but eased at the time of writing.

The Open Interest (OI) rates also dropped but showed some improvement. Taken together, it suggests a potential price pivot that can only be confirmed by a reclaim of the $85.55 support.