Is TRX at a local top? What the Sharpe ratio tells about its future

- Cryptoquant analysis of the Sharpe ratio suggests that TRX top is in.

- Evaluating whether the cryptocurrency is headed for a cliff.

Tron’s native cryptocurrency TRX has maintained strong bullish momentum so far in 2024, allowing it to achieve considerable gains. However, fresh analysis suggests that the cryptocurrency might be about to experience a sizable pullback.

A recent CryptoQuant analysis pointed out the possibility of bearish days ahead for TRX holders. This expectation was based on the cryptocurrency’s 180-day Sharpe ratio. The latter has history of pinpointing tops with considerable degree of accuracy.

According to the CryptoQuant assessment, the Sharpe ratio recently surged into a high risk level. Nevertheless, it noted that price could still push higher but prices above the current zone carry more downside risk.

TRX has been steadily rallying and was up by 120% so far this year. On top of that, it recently achieved a new ATH at $0.224 on 23rd November. Some sell pressure has taken place since then, curtailing the upside momentum. TRX exchanged hands at $0.20 at press time.

TRX was down by 10% from its recent peak to its press time price level. This may not necessarily signal that a wave of robust sell pressure has been taking place.

Evaluating TRX sell pressure

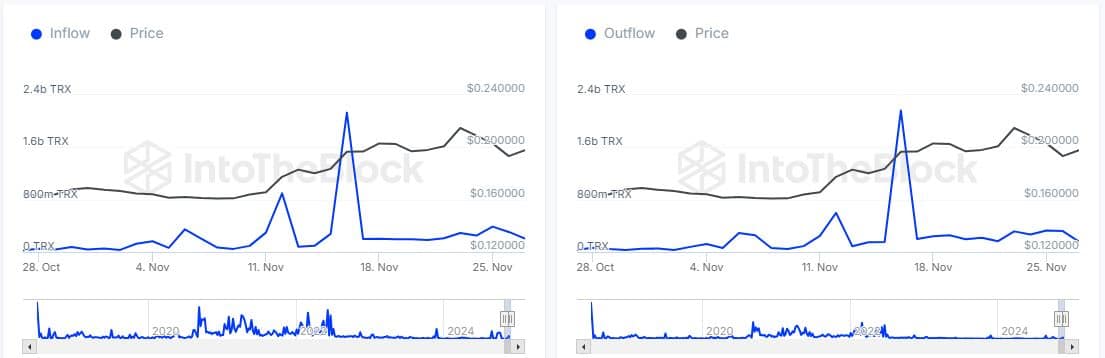

On-chain data revealed declining whale and institutional activity. For example, large holder inflows peaked at 2.13 billion TRX on 16 November. Meanwhile, large holder outflows were slightly higher at 2.16 billion TRX on the same day.

Large holder inflows have since dropped to 205.77 million as of 27 November. Large holder outflows also dropped to 159.87 million on the same day, meaning there was a net positive demand from whales.

However, it the figures also underscored the declining demand from the whales and institutional class.

Spot flows revealed that the TRX cryptocurrency outflows were notably higher than inflows since mid-November.

Note that the cryptocurrency had $5.27 million in positive flows on Wednesday. On the derivatives side of things, open interest peaked at $160.25 million on 24th November. This was significantly lower than its peak in August.

Source: Coinglass

The weak open interest this month confirms that the demand for TRX in the derivatives has been weak. Especially relative to open interest peaks especially during the previous bull market.

Read TRON’s [TRX] Price Prediction 2024-25

The low open interest and declining demand from whales, may support the idea of TRX sell Pressure in the short term. However, TRX has for the most part experienced weak sell pressure, paving the way for more upside.

This could continue playing out, facilitating more upside in the coming months.