It’s Bitcoin v. all, but here’s why it’s not ending anytime soon

Bitcoin as an asset has been astonishing to people all over the world given its unique characteristics. Since its launch, it has opened up a host of financial development opportunities.

In the years since, the digital currency has been compared to the likes of Gold, stocks, fiat, and whatnot. But this time, it appears to be that the comparison is bigger than you’d expect.

Bitcoin v. all?

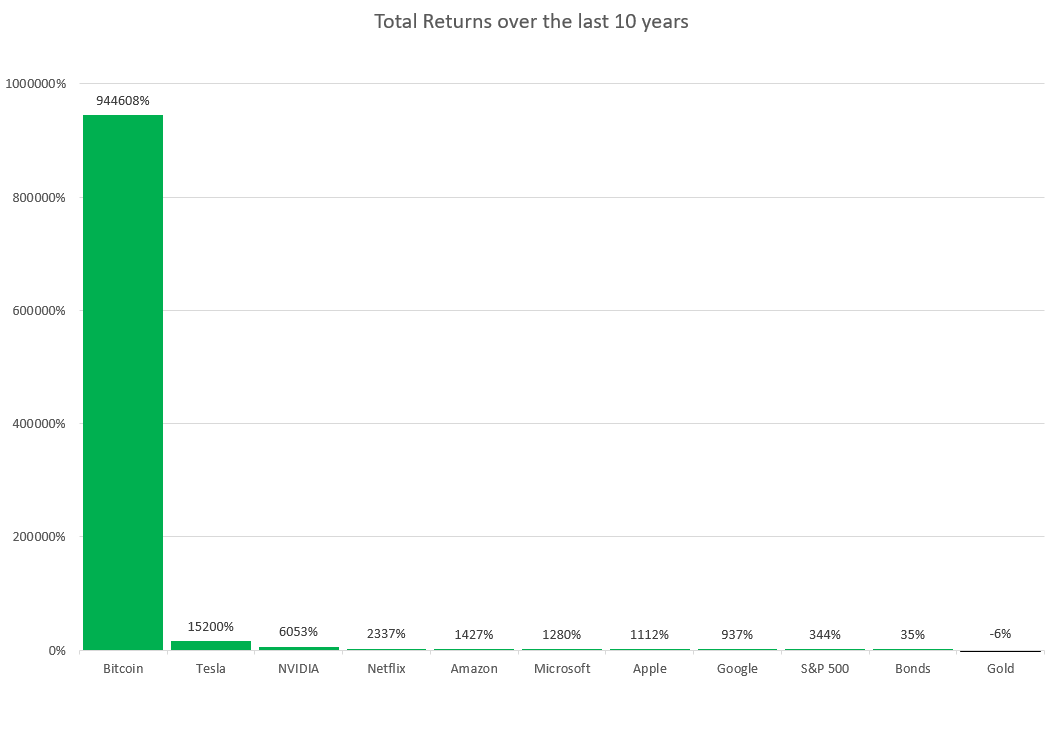

Bitcoin’s growth over the last 10 years has been unparalleled, especially when compared to other top investment options out there. However, what’s important here is that this growth wasn’t really visible until a few years ago.

Returns over the last decade | Source: Chris Bridgett

BTC took 6 years to hike from $3 to $10k. In the 4 years since, however, Bitcoin has hiked by 5.6x times, climbing as high as almost $65,000 at one point.

Bitcoin growth over the years | Source: TradingView – AMBCrypto

Surprisingly, the second-highest growth seen here comes from the most controversial owners of Bitcoin as well. Well, second-most controversial, with MicroStrategy leading the field.

Alas, the growth of Bitcoin has a direct connection with the need for decentralization. This need has also led to the increased adoption of digital assets worldwide.

For example, India, the country with the 7th largest user base in the world, has faced bank frauds worth $46.5 billion over the last 10-11 years. The emergence of cryptocurrencies might serve as a huge solution to this issue given blockchain technology’s immutability and decentralization.

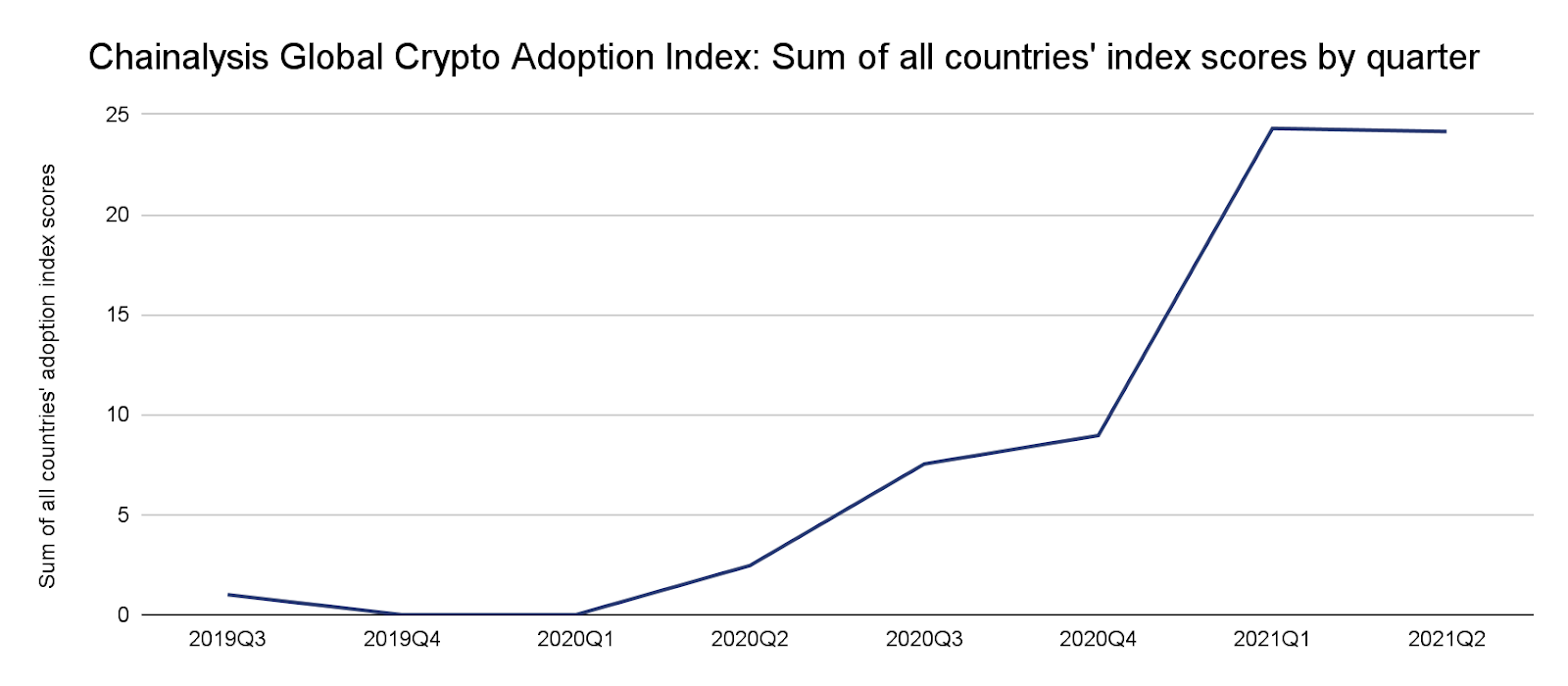

It provides transparency, independence, and most importantly, privacy, which is what first drove people towards it. In fact, in the last 2 years alone, crypto-adoption has risen by 3180%.

Such staggering growth has helped Bitcoin become mainstream and that’s how it attracted over 300 million users, as of June.

Global crypto users | Source: Triple A

These were the reasons people have been choosing it, now here’s why many haven’t either

Of the total population, crypto-users only represent 3.7% of all the people in the world.

Bitcoin adoption up by 3100% in the last 2 years | Source: Chainalysis

People are dubious enough as it is when it comes to investing money due to the FUD of losses. So, hesitance with respect to investing in an asset whose volatility makes and breaks people every day makes sense.

In fact, many people believe that safety is only assured in other assets, especially when most regulators hold this view too.

The U.S. Securities and Exchange Commission (SEC), for instance, can manage to prevent or avenge any kind of fraud conducted most of the time But it also holds the power to control any and every stock that exists in the market. Such power might also encourage the growth of corruption in the market.

Now, this does not mean that the SEC is guilty of anything or deserves to have allegations thrown at it. The system may be working, but the factor of human error cannot be overlooked.

This is exactly why decentralization is the need of the hour so that no one has to be dependent on any individual or group of individuals. Investors also are relieved of any fear such as theft, accidents, overtaking, etc. thanks to the 51% attack clause. This prevents anyone from stealing from the blockchain or controlling it in any way, thus reducing crime and corruption.

Can Bitcoin transform finance and investment?

That question is a stretch. It cannot be answered as a yes or no, especially since crypto-adoption has only recently increased.

However, the age-old discussion of Bitcoin simply being a fad or FUD no longer applies since Bitcoin has become a practical financial instrument worldwide. Alas, the fear of any unfavorable change still looms over investors’ heads.

Bitcoin alone cannot do this as its primary function is still serving as an SOV. That is why reliance on other crypto-chains and assets is increasing as well.

Even so, we shouldn’t expect any worldwide crypto-coverage going forward anytime soon. Especially since apprehensions about cryptocurrencies are yet to be solved, given their novelty and development demands.