Jasmy coin price prediction: What’s next after the +25% range-breakout?

- JASMY posted +25% gains after breakout from a multi-month price consolidation.

- Apparently, the breakout happened due to speculation about Japan’s national ID system.

On 30th May, Jasmy coin [JASMY] broke above its multi-month price range and posted +25% gains.

The bullish breakout followed speculations on Apple’s planned integration of Japan’s ‘My Number’, a public project to streamline administrative services for Japanese citizens, such as social security and tax.

Traders speculated that Jasmy was involved since it is a Tokyo-based leader in private data security and blockchain integrations. But the firm hasn’t officially confirmed involvement with Japan’s ‘My Number’ project.

Jasmy coin price prediction: What are the next key targets to watch?

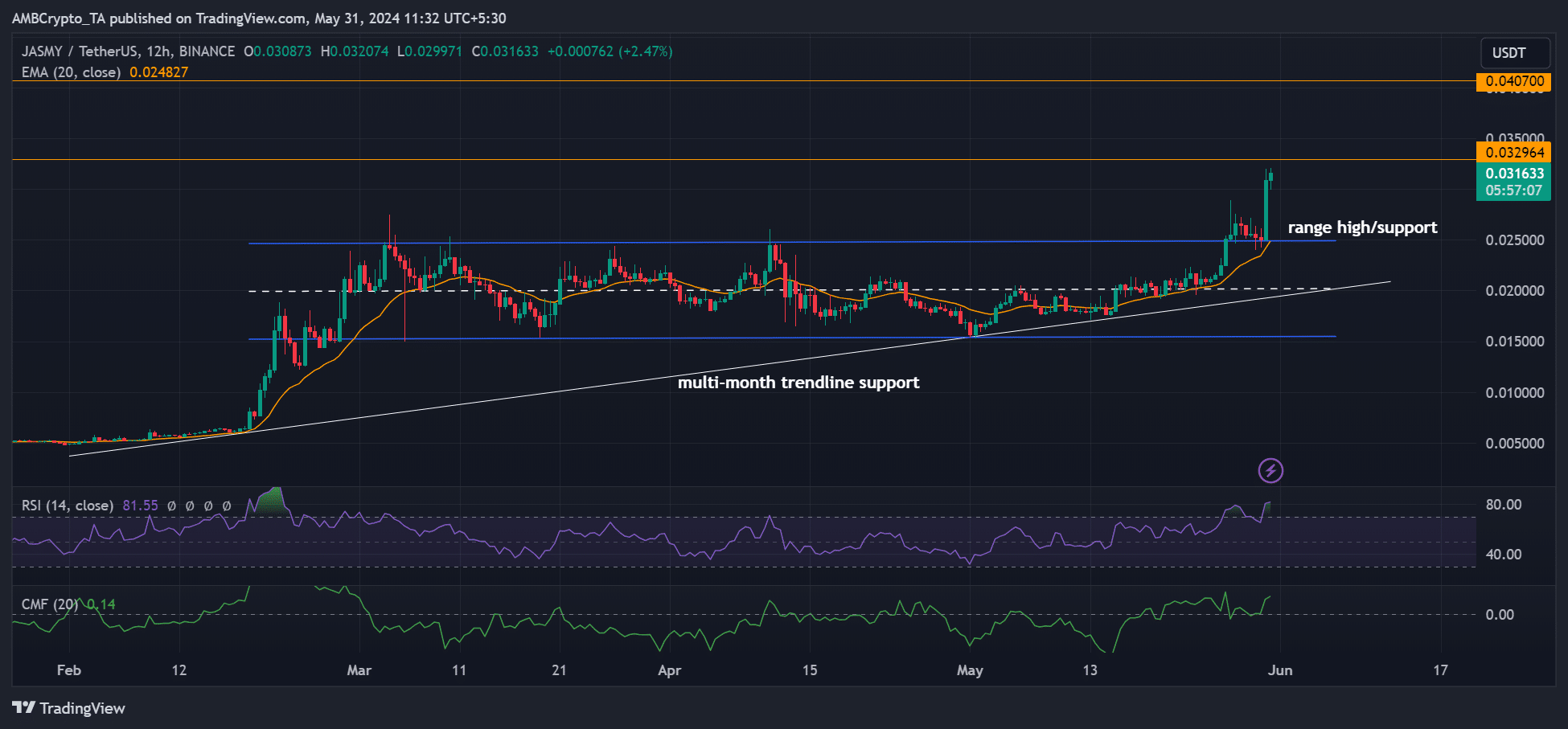

At press time, key price chart indicators on the 12-hour timeframe had bullish readings. The buying pressure was massive, as shown by the RSI (Relative Strength Index) overbought reading.

Similarly, the above-average CMF (Chaikin Money Flow) reading underscored that significant capital was pumped into JASMY over the past few hours.

However, the breakout faced an immediate hurdle at $0.033, previous support in March 2022. Should Japan’s ‘My Number’ narrative wane, the hurdle could be challenging to bulls.

If so, JASMY could retrace to the confluence of the previous range-high and 20-day EMA (Exponential Moving Average) or the multi-month trendline support.

However, an extended rally could see JASMY bulls grab +20% gains if they hit $0.04.

JASMY long-term holders were profitable – Will they sell?

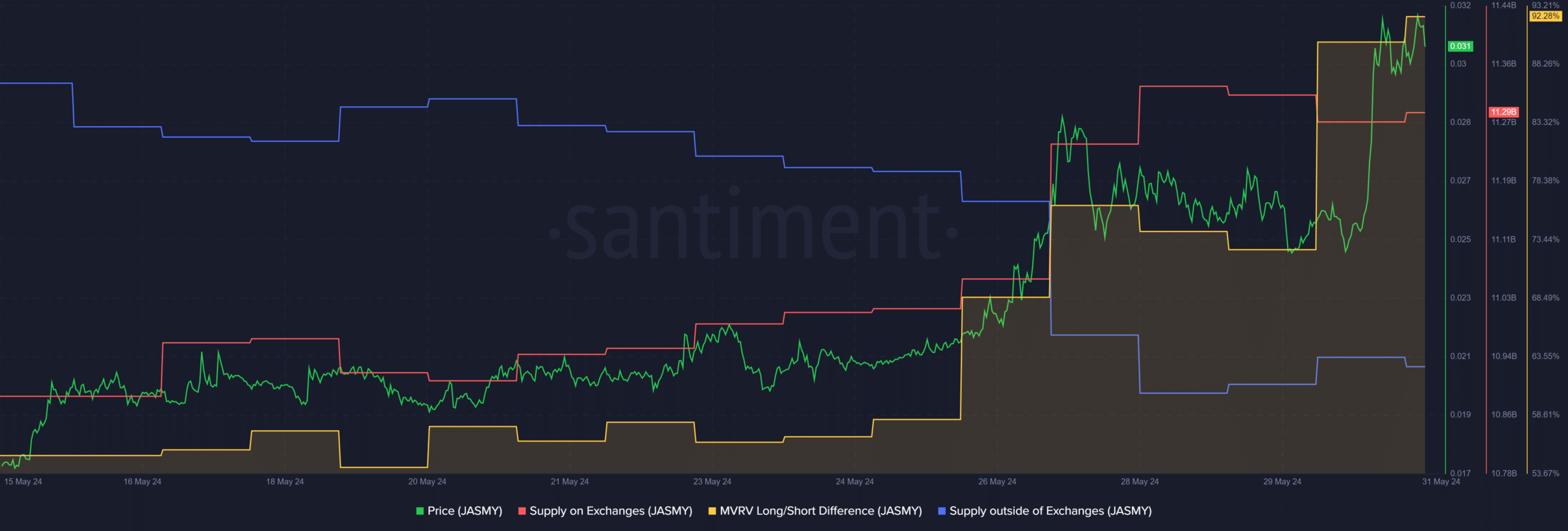

The JASMY rally seen at the end of May was marked by a surge in demand, as shown by a steady uptick in Supply outside Exchanges (blue line). It denoted accumulation occurred over the same period.

Similarly, sell pressure eased, as demonstrated by the declining Supply on Exchanges (red line).

Read Jasmycoin [JASMY] price prediction 2024-2025

However, the MVRV (Market Value to Realized Value) was positive at 92%, underscoring that most long-term holders (LTH) were profitable and could be tempted to book profits.

If the LTH cohort opted for profits, the pullback scenario described above could be plausible, making the $0.025 a key level to watch.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.