Jupiter breaks trading volume record on Solana – Impact on SOL?

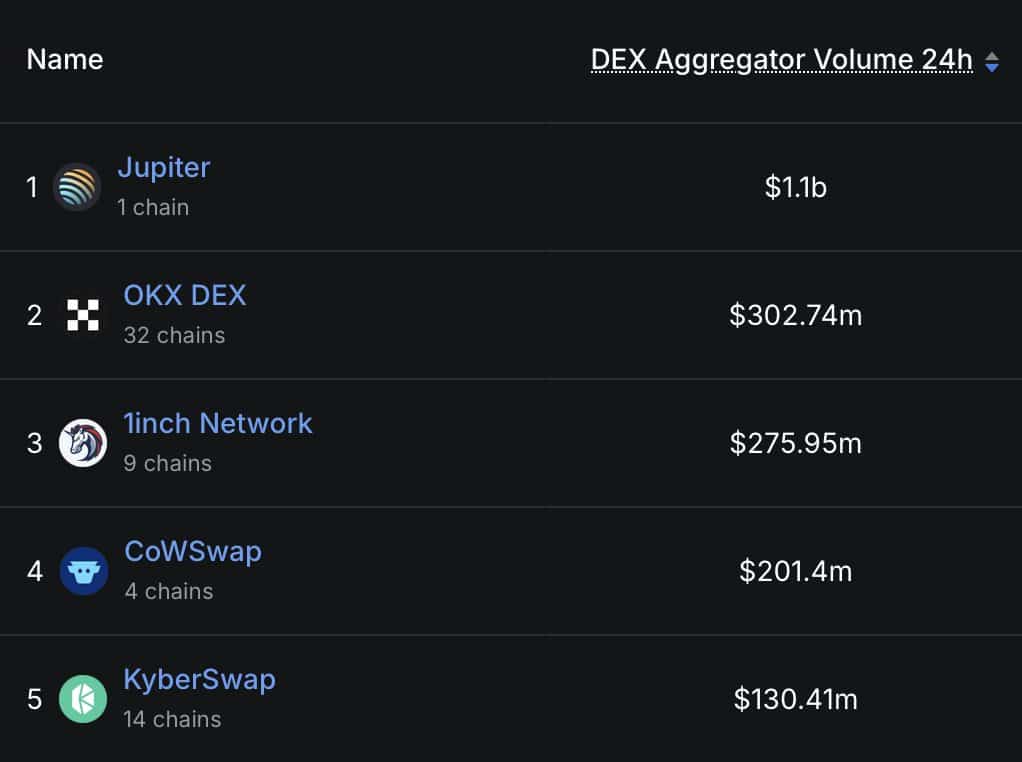

- Solana-based Jupiter Exchange records the highest 24-hour volume among all aggregators across chains.

- Rising network activity and user growth may position SOL for a move toward $150.

Jupiter [JUP], a decentralized swap aggregator built on Solana’s [SOL], has just surpassed all other chain-based aggregators in 24-hour trading volume.

This is a noteworthy achievement, especially since Jupiter operates exclusively on the Solana blockchain, unlike competitors that span multiple networks.

The surge in volume isn’t just a milestone for Jupiter—it also reflects increasing trader confidence in Solana’s DeFi ecosystem.

Solana activity hits multi-month highs

Jupiter’s growing dominance aligns with a sharp rise in active addresses on the Solana network. According to The Block, Active Address numbers have reached their highest levels since May.

This surge signals rising user engagement across Solana’s DEXs, NFTs, and other DeFi applications—momentum that could potentially drive SOL prices higher.

That’s not all, the number of new addresses on SOL are also witnessing a significant surge since February this year.

Source: Block

That’s not all, new address creation on the Solana network has also surged significantly since February of this year.

Will SOL prices catch up next?

Historically, price action often follows network activity, and Solana’s on-chain fundamentals are currently flashing bullish signals. With on-chain momentum building, SOL has begun climbing on the charts.

Technically, the setup resembles a potential trend reversal. SOL is testing a confluence of trendline support and the Fibonacci golden zone—an area that has marked key turning points in the past.

If history repeats, this zone could once again trigger a reversal.

Adding to that, Solana is nearing a key psychological level at $150, which is closely aligned with its current trading range and deserves attention.

If network activity stays high and DEX volume continues to grow, Solana could gain the momentum needed for a strong breakout.

This spike, combined with rising trading volumes on Jupiter, has the potential to revive SOL’s DeFi ecosystem.