Keep tabs on these Ethereum developments to know how its market will evolve this week

Ethereum’s price has been quite resilient over the past few days and even showed greater determination in heading on a recovery run after last week’s losses even in comparison to Bitcoin. Over the past few days, ETH has seen its price rise by close to 30 percent and is once again close to its ATH.

Given the bullish momentum in the price, there have been quite a few notable developments in ETH’s ecosystem and traders may want to keep a tab on these developments to get a better understanding of how the market is going to evolve in the coming week.

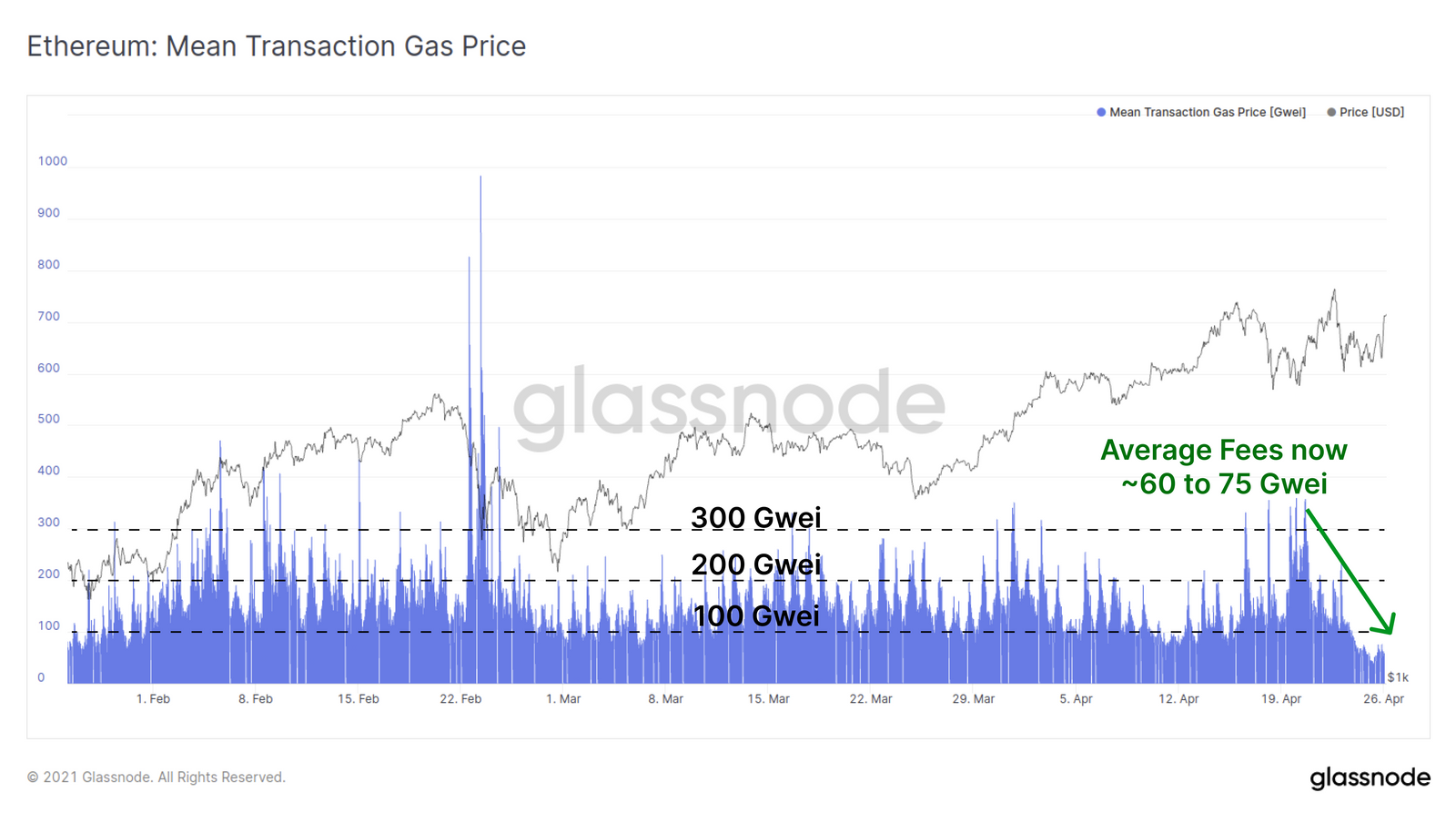

Ever since last year’s DeFi summer, high transaction fees have been an Achilles heel for ETH. Interestingly, network data provided by Glassnode highlighted a trend reversal in the recent past. Ethereum’s transaction fees have drastically reduced this week after a sustained period in which the average gas fees went above 100 Gwei. During the past few days, on the other hand, the average gas fees have dropped to around 60 to 75 Gwei – a welcome change for many Ethereum users when it comes to transaction fees.

According to the data provided by Glassnode, this reduction in transaction fees comes as a result of allowing more transactions per block. It noted, “The primary driver for reduced fees is the increased the gas limit from 12.5M to 15.0M by miners, effectively allowing more transactions per block”

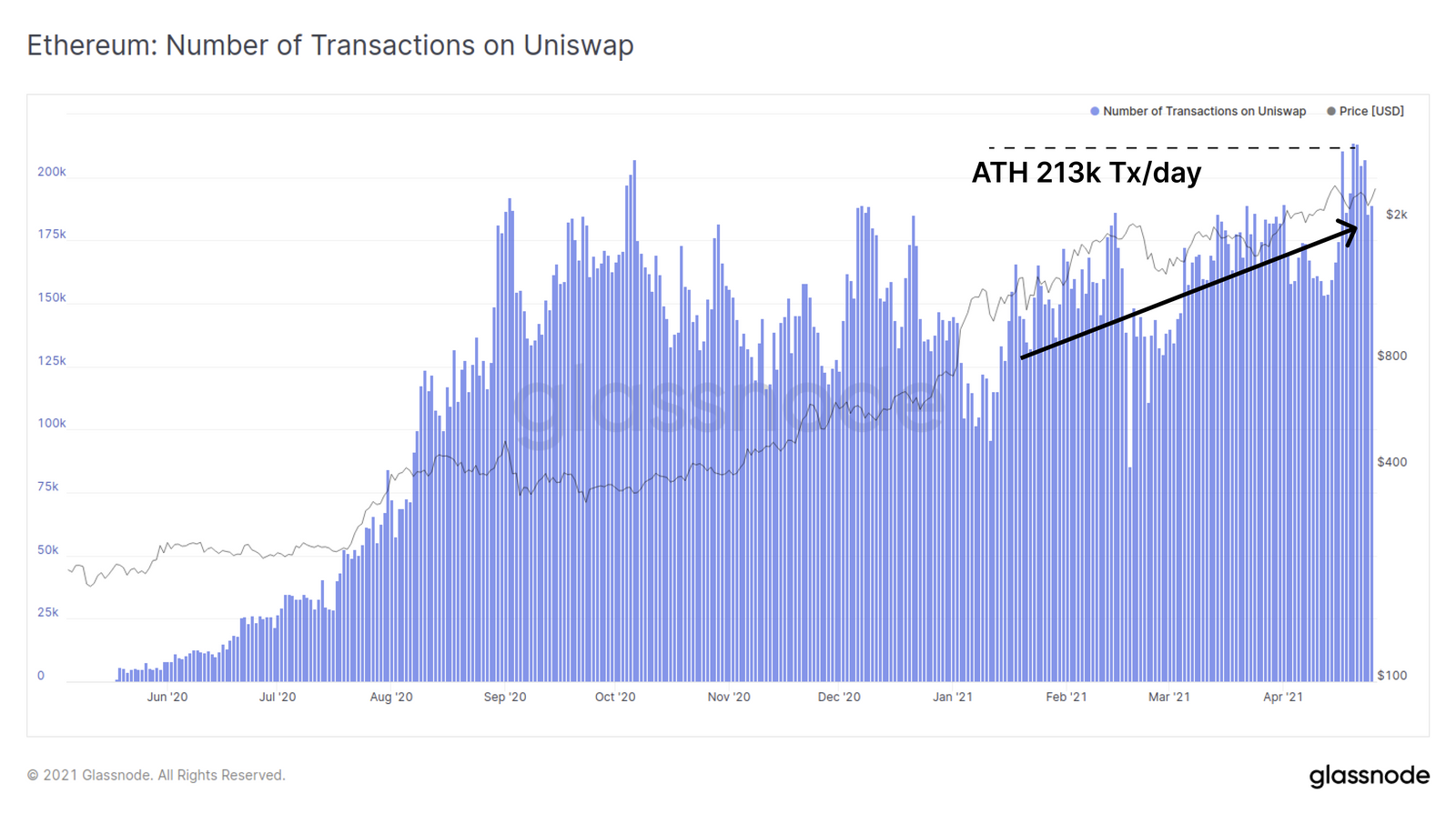

Popular decentralized exchange Uniswap on which ETH is traded saw transaction counts surge to a new all-time high of 213k trades per day this week as a result of lower transaction costs. Interestingly in the case of ETH, 2021 has seen a steady increase in transactions on Uniswap, and this uptrend is likely to continue in the coming months.

In addition to this, trade volume on Uniswap also rose dramatically and went over $1.8 billion in the past few days. Earlier in the week, ETH had fallen all the way down to the $2000 price level as Bitcoin also endured a substantial price correction. From how the market responded, and the surge in trade volumes of Dexs like Uniswap it was evident to see traders take advantage of a falling market and enter the buyer’s market.

Towards the end of the weekend, trade volumes rose and as the sentiment changed in the market, ETH saw renewed buyer interest. The past week illustrated the buy-low, sell-high principle and this has in turn pushed ETH’s price quite close to its ATH level. In the coming week, as interest pours into the market, it is quite likely that the world’s largest altcoin is going to remain fairly uninterrupted when it comes to its current uptrend and the 24-hour price hike of over 3.8 percent is likely to grow.