Key BTC mining pools’ crisis and everything you need to know

Bitcoin [BTC] miners, despite some bullish instances of mining operations, continue to face heavy losses. But things might just have gone from bad to worse. Here, one of the largest Bitcoin mining pools by hash rate might just have triggered this move.

Can’t pool-in anymore

Poolin, one of the largest Bitcoin mining pools by hash rate, froze withdrawals from its PoolinWallet due to liquidity problems. As a result, it suspended Bitcoin and Ether withdrawals from its wallet service due to “liquidity problems.” The firm, in an announcement on 5 September stated,

“As you may have known, Poolin Wallet is currently facing some liquidity problems due to recent increasing demands on withdrawals. But please be assured, all user assets are safe and the company’s net worth is positive.”

PoolinWallet would offer an update to the community and feasible solutions within a week. However, it stated that it is continuing to “explore strategic alternatives with various parties.”

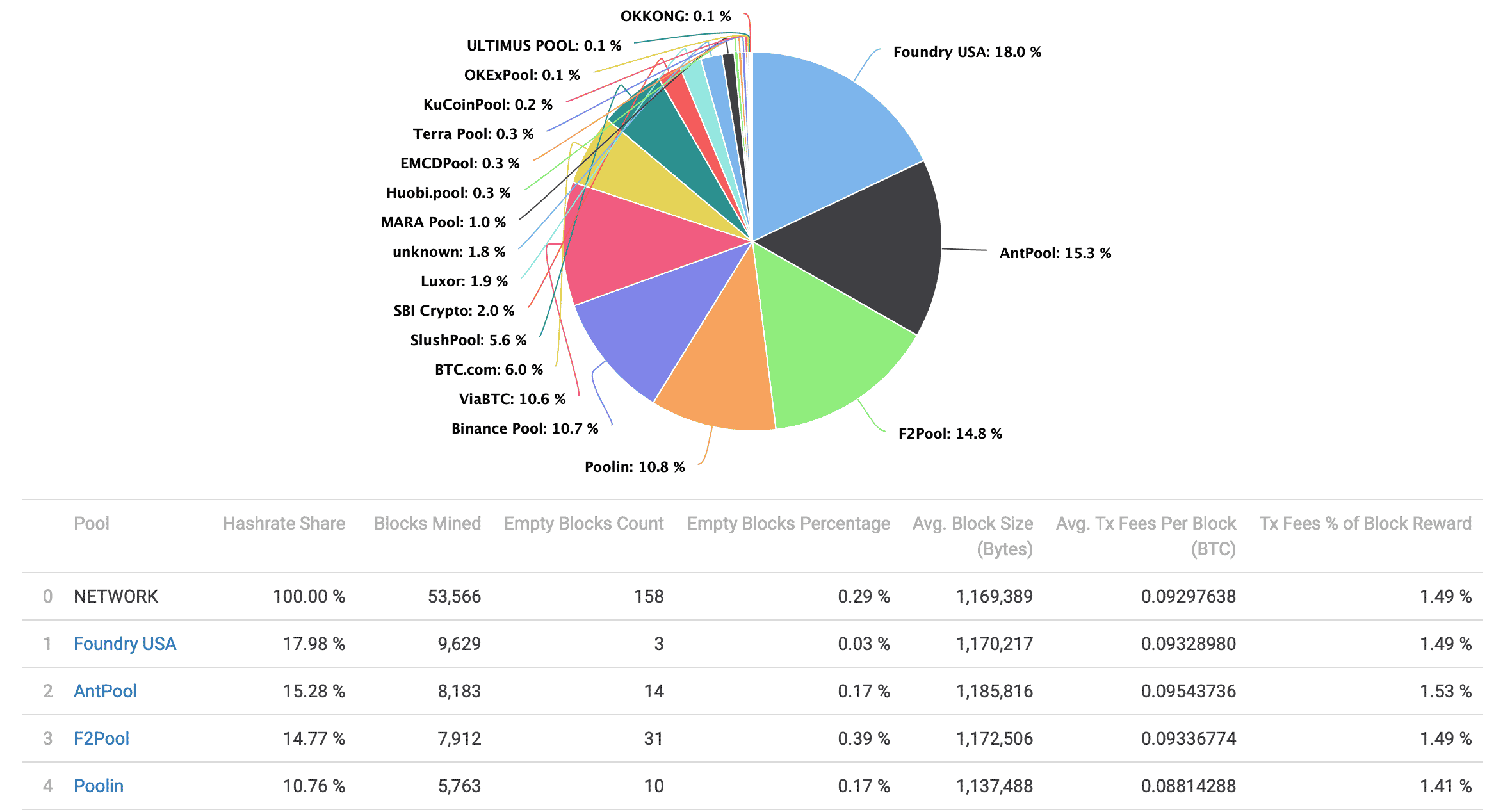

Just to understand the sheer size of a loss here, consider the following. According to data from BTC.com, the firm was responsible for roughly 10.8% of the BTC blocks mined over the last 12 months, coming in as the fourth-largest mining pool behind Foundry USA, AntPool, and F2Pool.

Although to provide some compensation to users, Poolin would offer zero fees for Bitcoin and Ethereum mining from 8 September to 7 December, along with other offers for users with higher pool balances.

Needless to say, a majority of miners contributing hash rate to Poolin switched to another pool. Soon, Poolin’s hashrate dropped over the past 24 hours.

Quantifying facts

Liquidity issues continued to plague multiple crypto firms, including major Bitcoin mining companies, following a market shakeout earlier in the year. Even though compensation plans were added, the loss remains a significant one.

As per known wallet figures, ~18,000 Bitcoin sat in Poolin’s wallet. Dylan LeClair, a famed crypto analyst, shed some light on Poolin holdings on the social media platform.

17.6k BTC currently in the known Poolin #bitcoin wallet.

One has to wonder much is currently owed to customers? https://t.co/L677tM1lR2 pic.twitter.com/t8qivf2kW5

— Dylan LeClair ? (@DylanLeClair_) September 5, 2022

This development comes at a time when mining operations wouldn’t reap many benefits (profitability). As per BitInfoCharts, mining profitability fell consistently since 18 August, when it stood at $0.109 per THash/s (based on a seven-day moving average).

At present, profitability dropped to just $0.082 per THash/s.

Overall, the aforementioned crisis just added fuel to the already lit fire. One could witness more exodus of Bitcoin miners from the network amidst such concerns in the coming days.