Kusama traders can apply change in polarity principle at this level

Kusama’s native cryptocurrency KSM has finally managed to reclaim its May levels after its June crash.

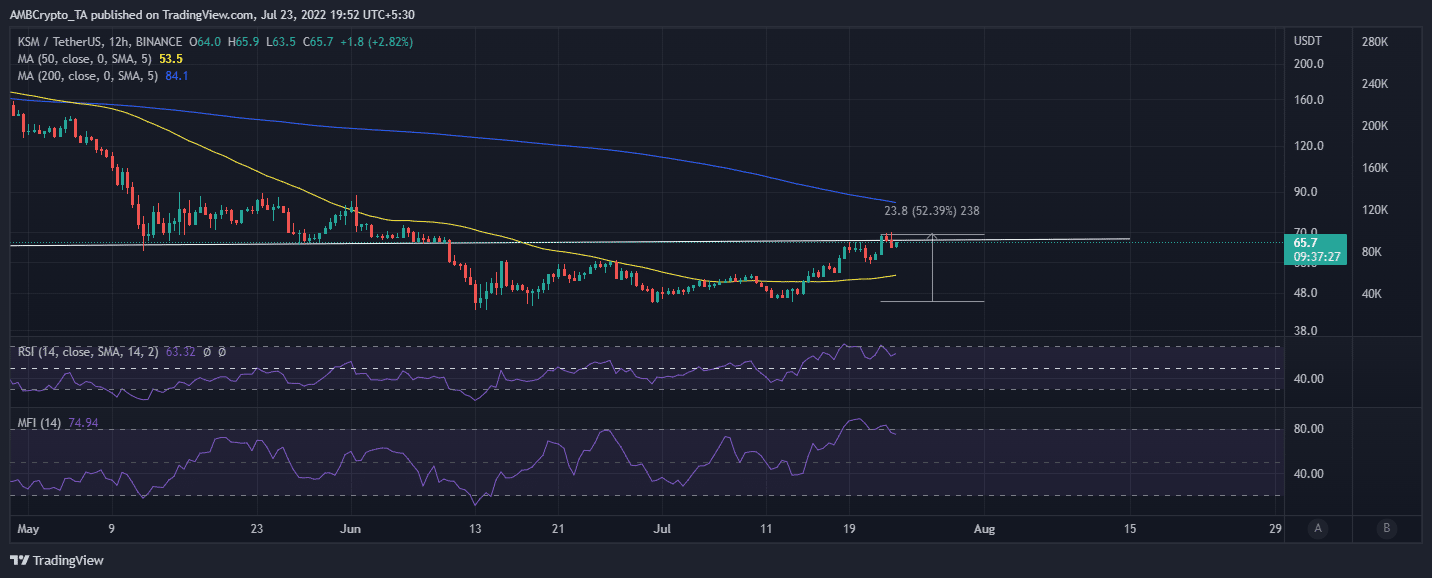

This is after delivering a healthy bullish performance. But, surprisingly, the previous support is now yielding resistance.

Not even para chain auctions could protect KSM from the downside it has experienced so far this year.

But then again, the entire crypto market has been on a losing streak and cryptocurrencies have been moving in tandem. The same case applies to the latest bullish relief.

KSM struggled to recover back above $60 ever since it crashed below the same price level in June.

However, the latest bullish conditions in the crypto market brought some good tidings for KSM.

The latter managed to rally by slightly over 50% from $45.3, its lowest price level in July.

The price pumped as high as $69.9, which is slightly over the May support, before pulling back to its $65.7 press time price.

KSM’s latest upside was capped by a bit of a sell-off as soon as it entered the overbought zone as indicated by the RSI.

Also worth noting is that it achieved a double top where the second top had a higher price level than the previous top. The RSI had a lower high, thus confirming bullish weakness.

The pullback in KSM’s price action in the last 24 hours of press time reflects a strong drawdown in whale balances.

The supply held by whales dropped by 0.41% to its press time level of 43.44% in the past day.

This was a confirmation that whales have been taking a profit after the price entered the overbought territory.

The drawdown in the supply held by whales aligns with the strong uptick in KSM’s volume to the highest level in the last four weeks.

KSM might be due for an extended drawback, perhaps to the 50% RSI level, given the magnitude of the outflows from whale supply.

Pushing forward regardless

Kusama has maintained healthy development activity since the start of July as the price embarked on its recovery.

This is a healthy sign that might be encouraging for investors but that remains to be seen.

KSM’s current price outlook suggests that it might experience some more selling pressure in the short term.

However, it is still relatively close to the recent bottom and a long way from its all-time high (ATH). KSM, therefore, has a long road to recovery ahead.