Latest BTC downturn presents El Salvador this crisis but Nayib Bukele…

The entire crypto market is trying to recover from the latest crash. Meanwhile, El Salvador president Nayib Bukele looks undefeated. Recently, he shared a “cool” jab on social media despite the latest Bitcoin shortcomings. It’s worthy to note that his government is facing a mounting crisis with the legal experimentation of Bitcoin.

Notably, Bukele grabbed international headlines after his nation legalized Bitcoin as the official currency. He has been a documented Bitcoin maximalist across the community since.

It’s important to note here that El Salvador is the latest in the long line of countries suffering from economic turbulence. Even Bitcoin has endured a stop-start month of May with the Terra collapse inflicting heavy damage on the crypto market.

Assessing the crisis

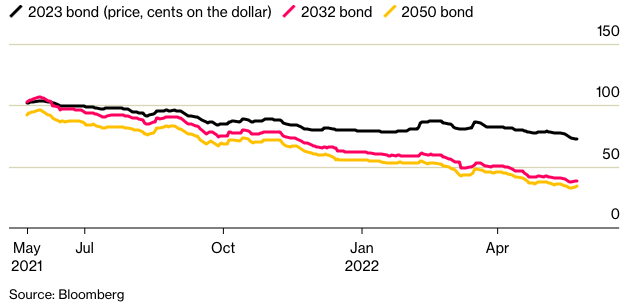

Bukele’s government has already lost 35% of the initial $40 million investment on 2,301 Bitcoin purchased from public funds. This is a significant haul for the nature of the experimentation with growing international distrust over the legalization of Bitcoin. El Salvador’s dollar bonds have taken a massive hit after their recent financial troubles with their dollar bonds trading at record lows.

According to Bloomberg, worse yet, the gambit seems to have cost his administration a much-needed program with the International Monetary Fund, which urged him to drop his crypto push.

The rating agencies aren’t impressed either and have downgraded the nation deep into junk territory. “If there isn’t potential for bitcoin-growth dividends or innovative bitcoin-financing, then the Bukele administration will have to prioritize spending priorities and identify financing options,” according to Siobhan Morden, head of Latin America Fixed Income Strategy at Amherst Pierpont.

There are persisting implementation issues as well. Nine months after the launch of the Bitcoin tender, most businesses avoid it because of its high volatility.

Those going ahead with Bitcoin transactions reported around 5% sales in Bitcoin. The Central Bank says fewer than 2% of remittances were sent using digital wallets since September. Note that the nation’s Chivo digital wallet has been difficult to operate with constant bugs.

What now?

Bukele continues to go along with his Bitcoin fanaticism with the full force of Bitcoin enthusiasts. He even tweeted pictures of a mock- “Bitcoin City” with geo-thermal energy powering crypto mining. The futuristic model of Bitcoin City was indefinitely aimed to ease the tensions over concerns regarding Bitcoin.

#Bitcoin City at night. pic.twitter.com/n6RXn9BkU0

— Nayib Bukele (@nayibbukele) May 10, 2022

But for now, Bukele must learn to adapt and survive in the growing turbulences emerging in these painful economic times.