Layer 2 networks see jump in dApp migration; the reason might surprise you

- dApps have increased migration to layer 2 networks.

- Arbitrum continues to lead as the layer 2 network with the highest TVL

Gas fees spent by layer 2 (L2) Ethereum scaling solutions to settle proofs on Ethereum have clinched an all-time high as decentralized applications (dApps) native to layer 1 networks increase migration to L2s, a new report from Messari showed.

L2 networks are separate blockchains that extend the functionalities of the Ethereum network and inherit the security guarantees of Ethereum. Transactions are executed on these L2s and then batched up to the base layer, Ethereum.

To settle proofs of these batched-up transactions on Ethereum, L2s are required to pay gas fees for the network’s security.

Therefore, as more applications and their users migrate to these L2s, ramping up the number of transactions processed and batched, the amount paid as gas fees to settle proofs by L2s has also rallied to an all-time high.

For example, in September, leading NFTs marketplace OpenSea announced support for leading L2 network Arbitrum. In the same month, the cryptocurrency trading platform Matcha, confirmed its deployment on Arbitrum. Likewise, in October, leading Ethereum [ETH] staking platform Lido Finance announced its launch on two L2 networks, Arbitrum and Optimism.

Arbitrum takes the lead

According to data from L2Beat, with a total value locked (TVL) of $2.30 billion, Arbitrum ranks as the top L2 platform in today’s market.

Due to its Nitro upgrade launched in August, Arbitrum “can support 7-10x higher throughput and has advanced compression techniques that allow for cheaper transactions, which attracts more activity,” Messari found.

This upgrade has led to a significant surge in the number of daily transactions processed on the L2 network.

Furthermore, as FTX’s unexpected collapse eroded investors’ trust in centralized cryptocurrency exchanges, many investors moved to decentralized exchanges.

This contributed to Arbitrum’s growth in the last month, as GMX, a “decentralized exchange (DEX) for perpetuals native to Arbitrum and Avalanche, experienced a significant volume increase during the FTX fiasco,” Messari reported.

On 7 November, GMX logged $5 billion in margin trading volume, a 75% rally from the previous day.

Following FTX's implosion, DEX tokens have been outperforming CEX tokens over the past week:

? DEX +26% vs. #BTC

? CEX -2.5% vs. #BTC pic.twitter.com/NBkLxNBBOb— Delphi Digital (@Delphi_Digital) November 17, 2022

Not far behind

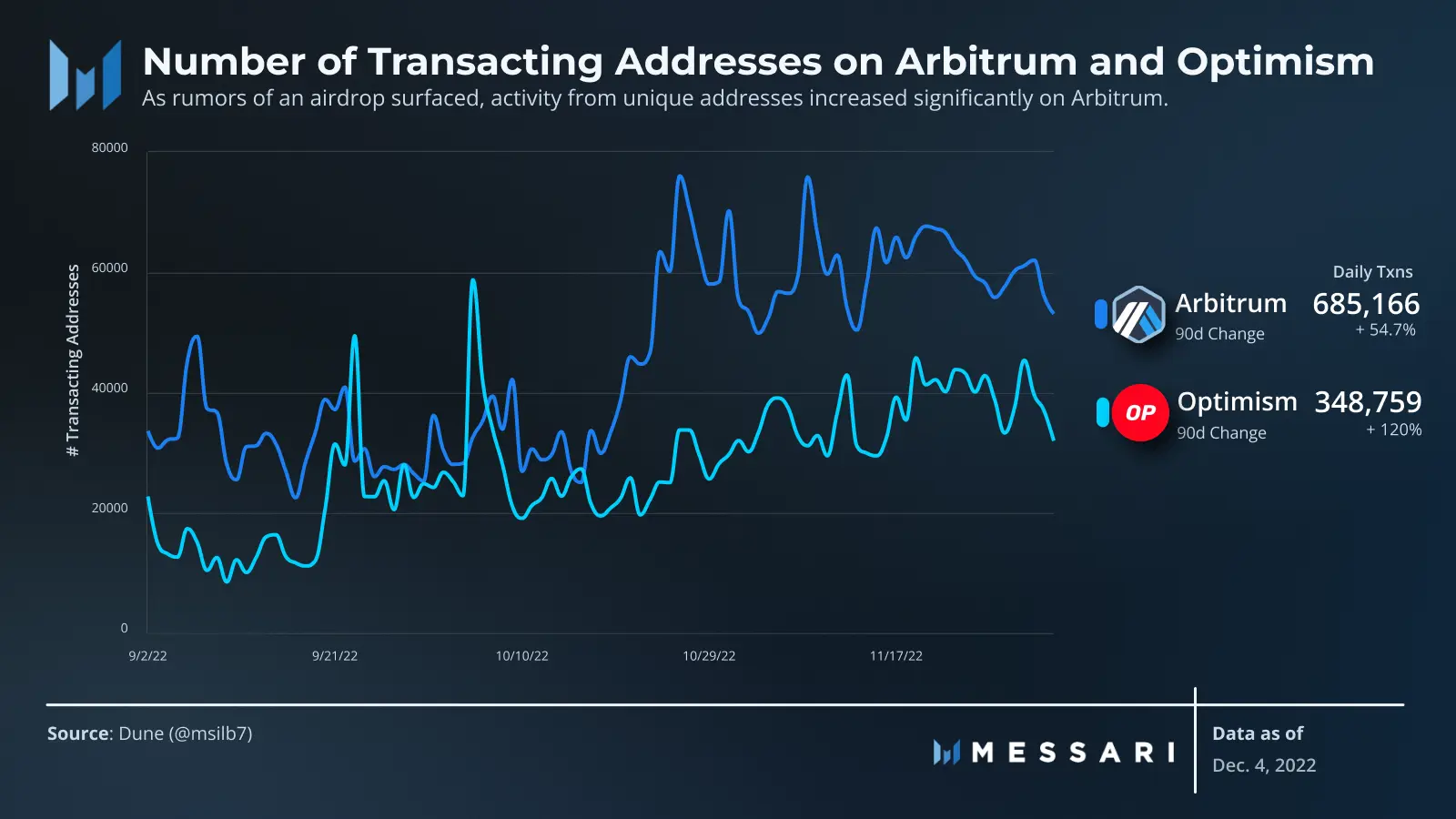

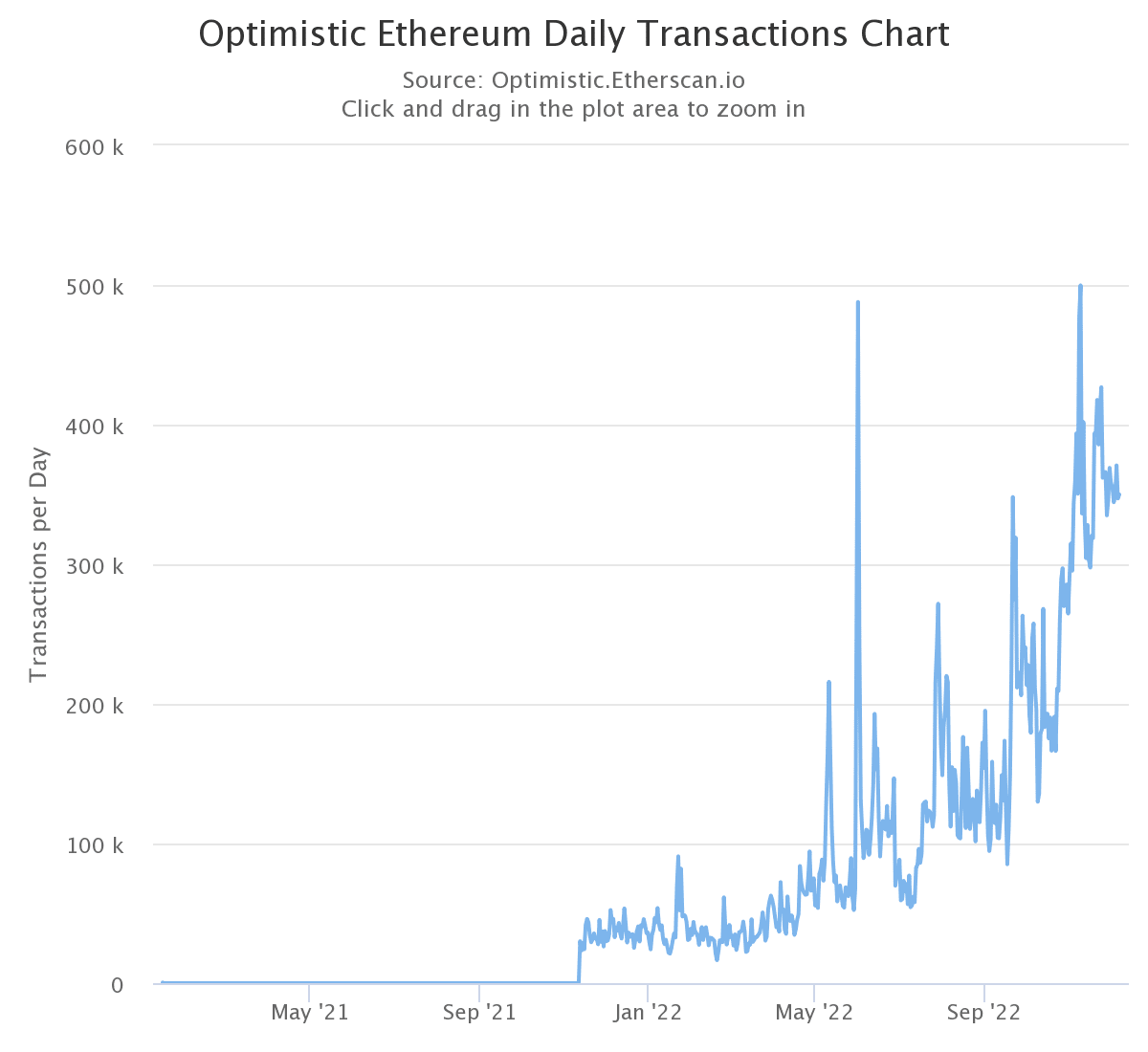

Optimism has also benefitted from the increased migration of dApps to L2 in the past few months. Messari found that in the last three months, the count of transacting addresses on the network rallied by 120%.

Per data from Etherscan, the network saw its highest daily number of transactions (499,720) on 9 November in the heat of the FTX saga.