LDO rises 9.75% in 24 hours: Will the growth last?

- Lido experienced a massive price surge amid growing interest in the liquid staking sector.

- Trader sentiment shaped the narrative for LDO’s evolving momentum.

Lido [LDO] has asserted its dominance in the liquid staking sector, garnering increased attention as interest in this space continues to rise.

The LDO token, a focal point of this growing interest, recently experienced a substantial price surge. The altcoin observed a noteworthy growth of 9.75% within the last 24 hours.

This movement of the LDO token revealed a pattern of establishing multiple high highs and high lows, contributing to a bullish trend.

This price behavior also indicated a positive trajectory, capturing the attention of both existing and potential investors. However, it remains to be seen whether this bullish momentum can continue.

Taking a closer look

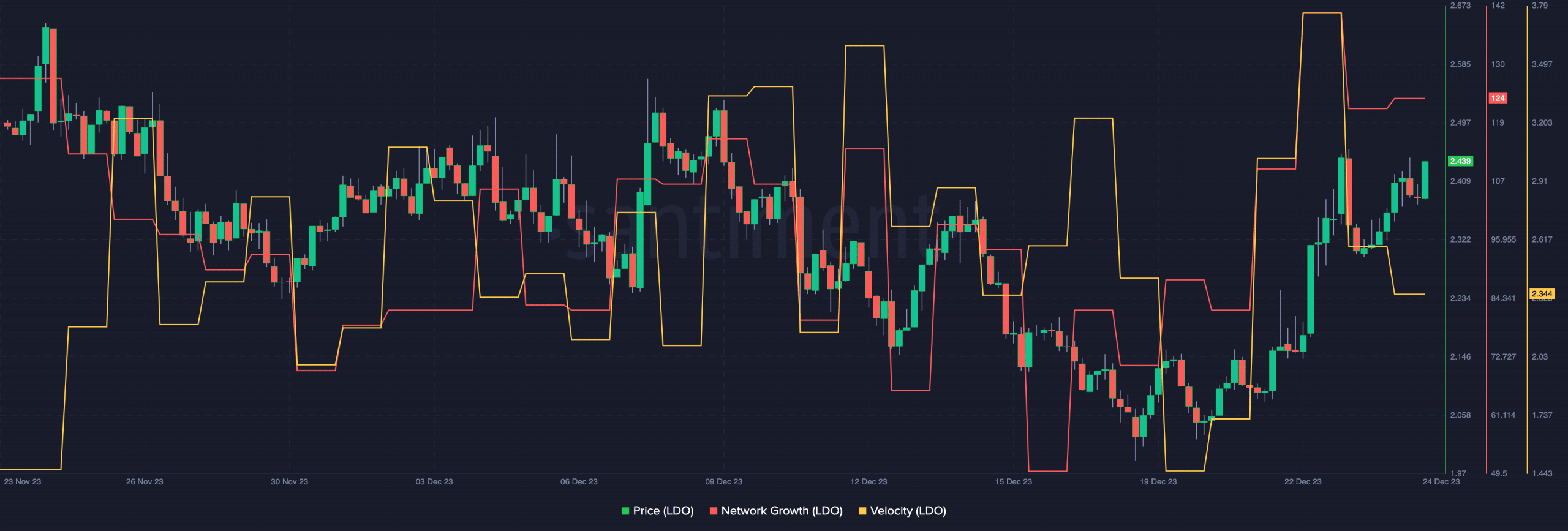

AMBCrypto’s analysis of Lido’s network dynamics showcased heightened interest from new addresses.

However, a simultaneous decrease in velocity implied a reduction in the number of transactions using the token. This signified a nuanced market response at the time of writing the report.

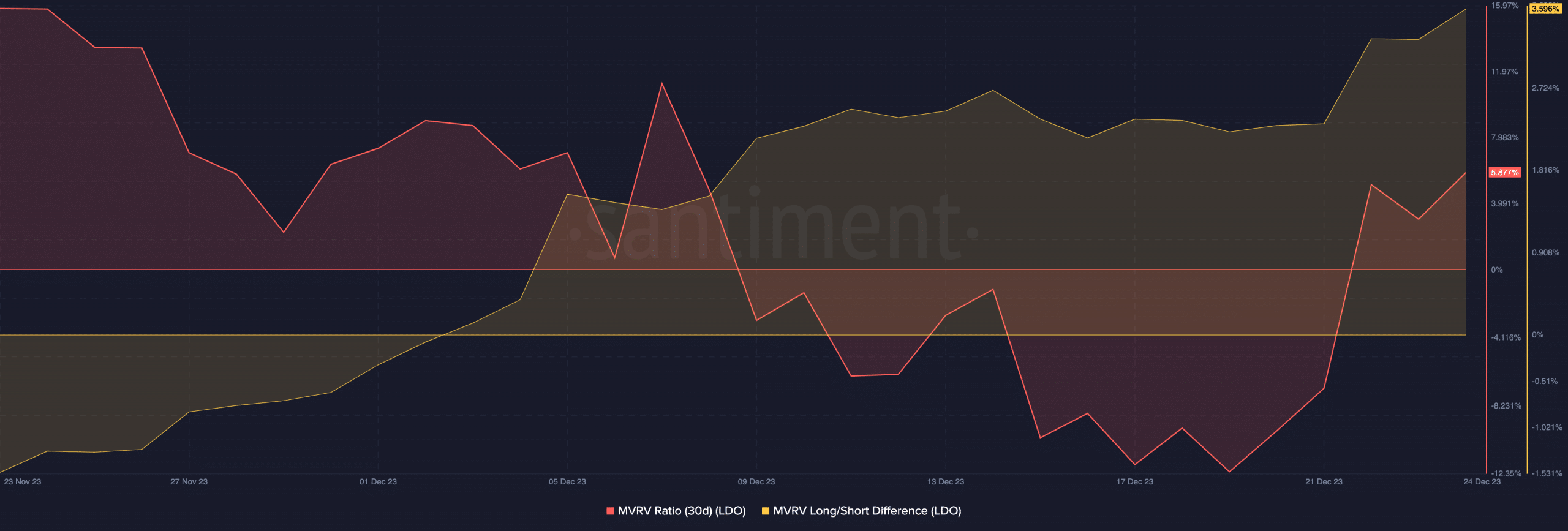

Delving into key metrics, the MVRV ratio for LDO witnessed growth, signaling that more profitable addresses were holding the token. This could potentially imply a higher incentive to sell.

Concurrently, a growing Long/Short difference indicated a significant presence of long-term holders, reflecting a resilient commitment among a substantial segment of investors.

Looking at trader sentiment

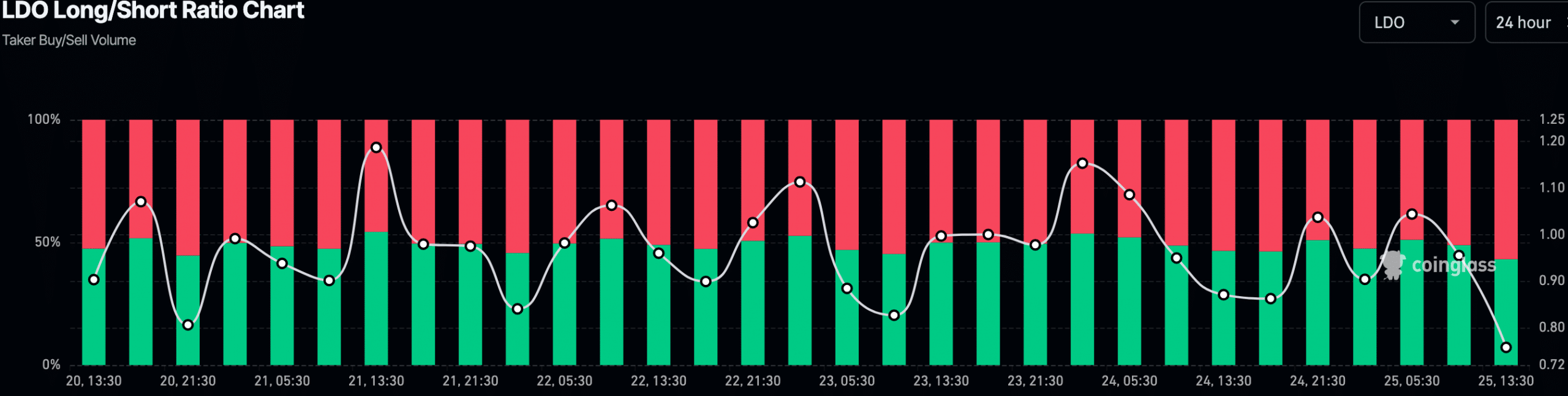

In terms of trader sentiment, the landscape, at press time, revealed short positions at 56.8%, outweighing long positions. This indicated a prevailing cautious stance among traders, possibly influenced by market uncertainties or strategic considerations.

Realistic or not, here’s LDO’s market cap in BTC’s terms

Rising short positions can potentially impact LDO by introducing increased selling pressure.

Traders betting against the token may seek to capitalize on potential price declines, influencing the overall market sentiment and contributing to heightened volatility.