LDO staking on the cards? What Lido’s new proposal entails

- LDO staking was introduced in a proposal on the Lido governance.

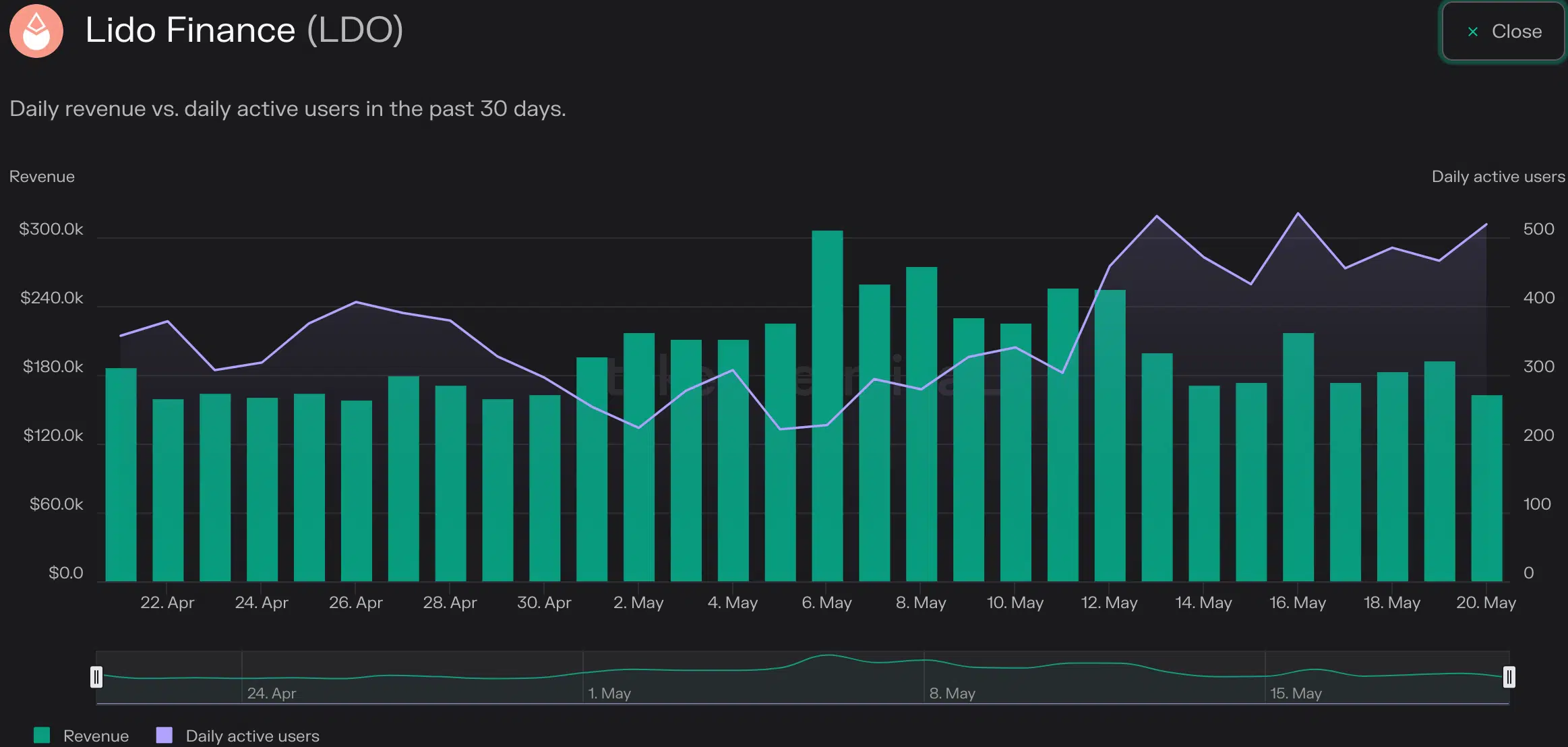

- Revenue declined despite activity on the network.

Lido’s [LDO] dominance over the DeFi market hasn’t slowed down the protocol’s progress. New proposals are constantly being pushed out to change and improve upon several aspects of Lido. One such recent proposal brought up the staking the Lido protocols native token, LDO.

Realistic or not, here’s LDO’s market cap in BTC’s terms

New proposals in town

The proposal presents two key initiatives aimed at enhancing the utility and sustainability of the LDO token. First, it introduces an LDO staking module and buyback program, enabling token holders to stake LDO in exchange for a portion (20-50%) of Lido’s future revenue.

This distribution will occur weekly in LDO tokens, and the earned tokens will be subject to a 6-month vesting period. Thus, token holders can actively participate in the Lido ecosystem while aligning their interests with the platform’s success.

Secondly, the proposal establishes a minimum size for the insurance fund, set at 6k Staked ETH [stETH]. Should the fund fall below this threshold, all revenue generated from stakers will be directed towards replenishing the insurance fund until it reaches the minimum required size.

This measure ensures the fund’s adequacy in mitigating potential risks and providing financial security for stakers.

Will this translate into revenue?

According to Delphi Digital’s data, in the given scenario, assuming Lido retains 30% of all stETH, the current revenue run-rate is $68.1M. As validators queue and the amount of staked ETH increases, reaching 30M ETH staked would cause a revenue run-rate of $102.2M for Lido, assuming a 30% market share.

If approved, the proposal grants governance the authority to determine a revenue share ranging from 20% to 50%, which will be allocated to stakers. Stakers will benefit from sustained buying pressure generated by buybacks and staking yields in vested LDO.

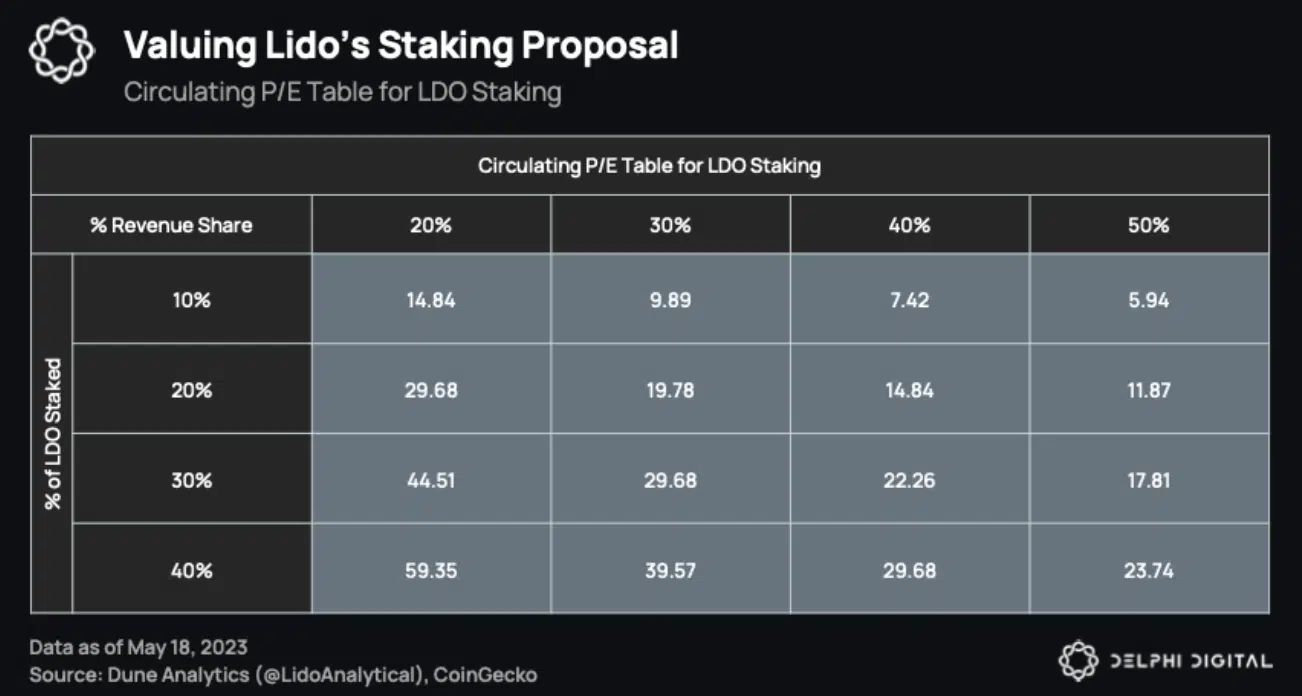

To evaluate the value of staking, Delphi Digital employed a circulating P/E ratio adjusted for the percentage of LDO staked. At a 20% revenue share and 10% LDO staked, the P/E ratio is 14.84, subject to parameters set by the DAO.

Is your portfolio green? Check out the Lido Profit Calculator

A lower revenue share would attract fewer stakers, while a higher revenue share would attract more stakers.

Sparking new interest in LDO?

The introduction of LDO staking could attract more users to the network and improve daily activity on the protocol. This in turn, could also help generate more revenue for the protocol, which declined by 25% in the last month.