LEO: Why investors need to be wary of hype behind Bitfinex’s token

Bitfinex’s LEO token has become the talk of the town, quite literally. Especially ever since it became the latest entrant into the top 20 cryptocurrencies list. However, quite frankly, it didn’t reach here by its own merit. It just managed to somehow retain its value while the rest of the market around it has been going haywire all through the month of May.

Behind the hype

Price action-wise, LEO can be accurately described as extremely boring. Looking at numbers, in a week when Bitcoin and Ethereum corrected by 1.5% and 10% respectively, LEO gained an odd percent.

Even if we were to look at its use cases – it hardly amounts to much. LEO token is the native coin of the Bitfinex cryptocurrency exchange. It is used as a “quote” currency to trade against multiple cryptocurrencies. Bitfinex also offers discounts and rewards for trades using the LEO token.

The reason behind LEO’s rise through the ranks of top cryptos cannot really be credited to the coin or its ecosystem entirely. Why? Well, while all the coins around it were beaten up black and blue, this coin managed to retain its value – thus automatically rising up the ranks. That in and of itself is an achievement – it doesn’t necessarily point to a very bright future for the coin.

And, quite possibly, this could be a one-off incident too. if we were to take a look at a few other exchange tokens like WRX, FTX, and the likes – we can see those coins are not necessarily impervious to price falls. The bloodbath through the month of May has been rough on all those coins too.

Not all bad news

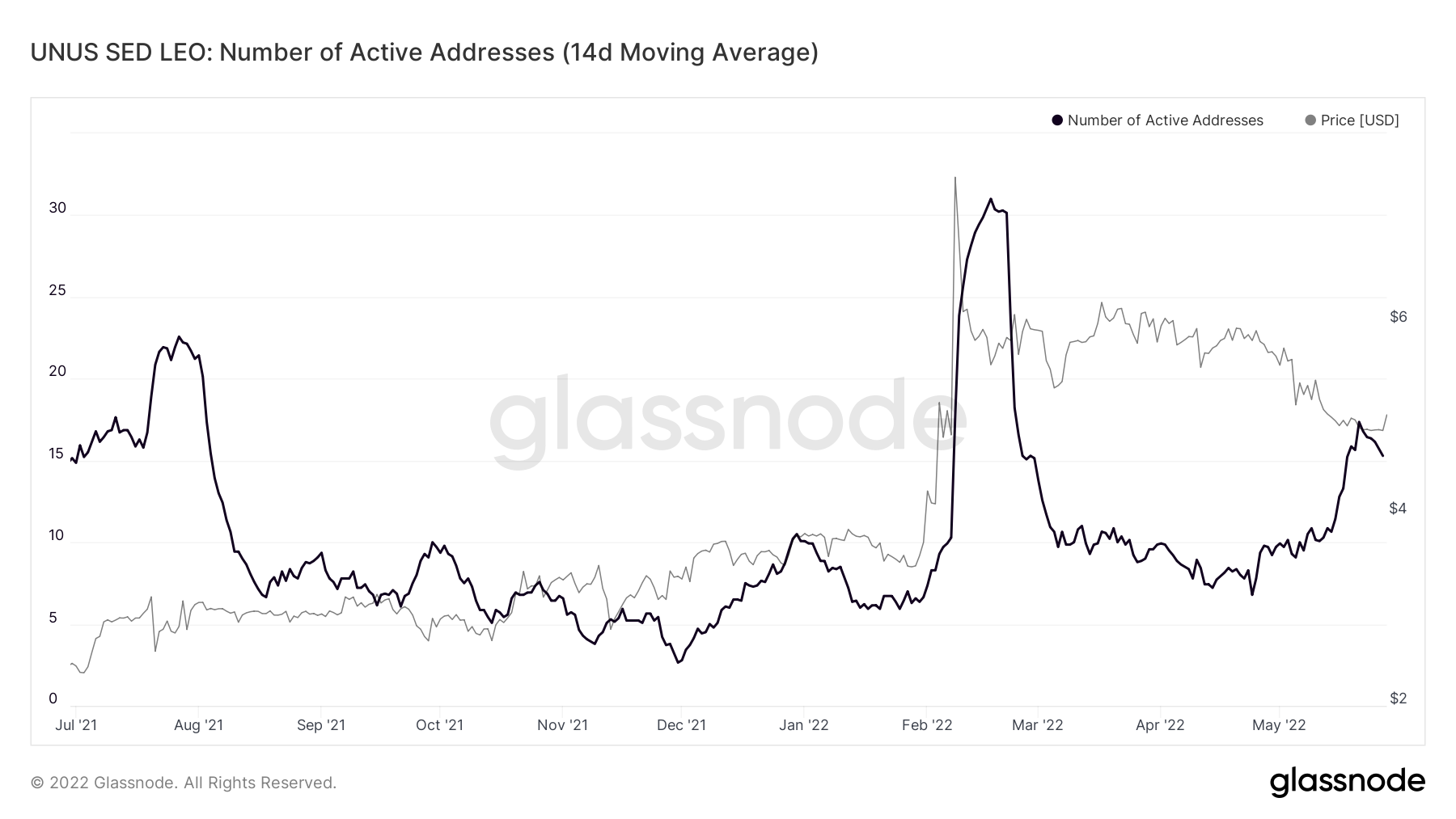

However, not everything looks bad for the coin. According to data from Glassnode, active addresses using the coin have been on a steady rise in the past couple of days – especially since the beginning of May. Albeit, this may be because of the fact that it has caught the attention of a lot of traders.

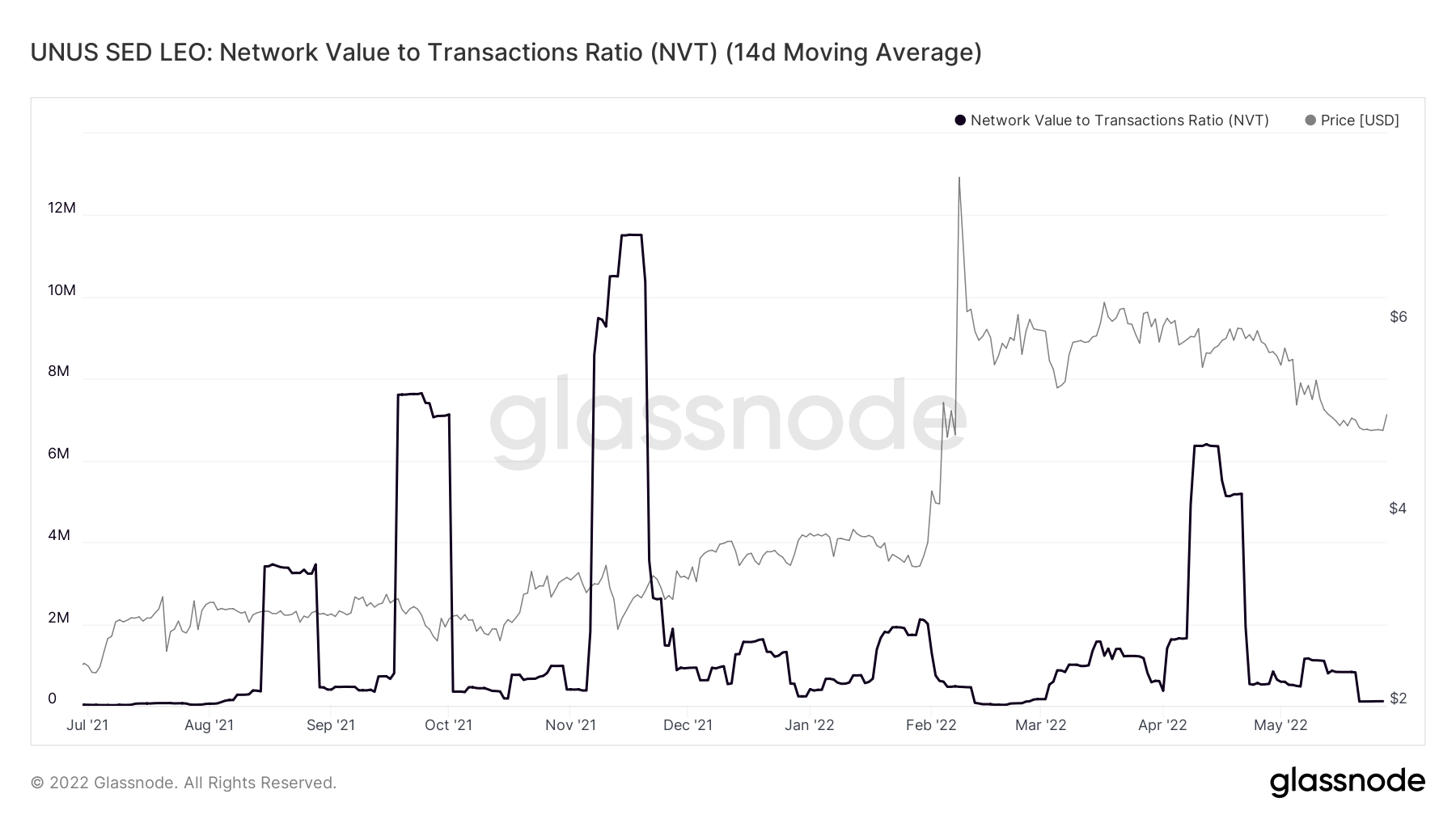

The NVT ratio for this particular coin is also reasonably low. This, therefore, points to the fact that the coin is at an attractive valuation when it comes to transacted value on the blockchain. Quite similar to the PE ratio in traditional equity markets, Network Value to Transactions Ratio (NVT Ratio) is defined as the ratio of market capitalization to the transacted volume in a specific time period.

Along with the above-mentioned points, considering how it was simply ignored in the October 2021 market-wide rally, going forward this coin can be expected to not perform too well either.

However, as a counter, it could act as a hedge against future crashes like it did this time. From the beginning of May, LEO corrected hardly 16% while Bitcoin has touched a low of over 30% in the same timeframe. This needs to stand the test of time- another crypto crash and other future developments in the coin.