Level: Omnichain liquidity marketplace launches on Arbitrum

Since its inception, Level has designed a protocol to serve as a functional alternative to centralized counterparty risk. After half a year of product testing, it’s finally time to expand and the Level DAO has determined that Arbitrum is the next ecosystem where Level will be deployed on.

Level’s success story

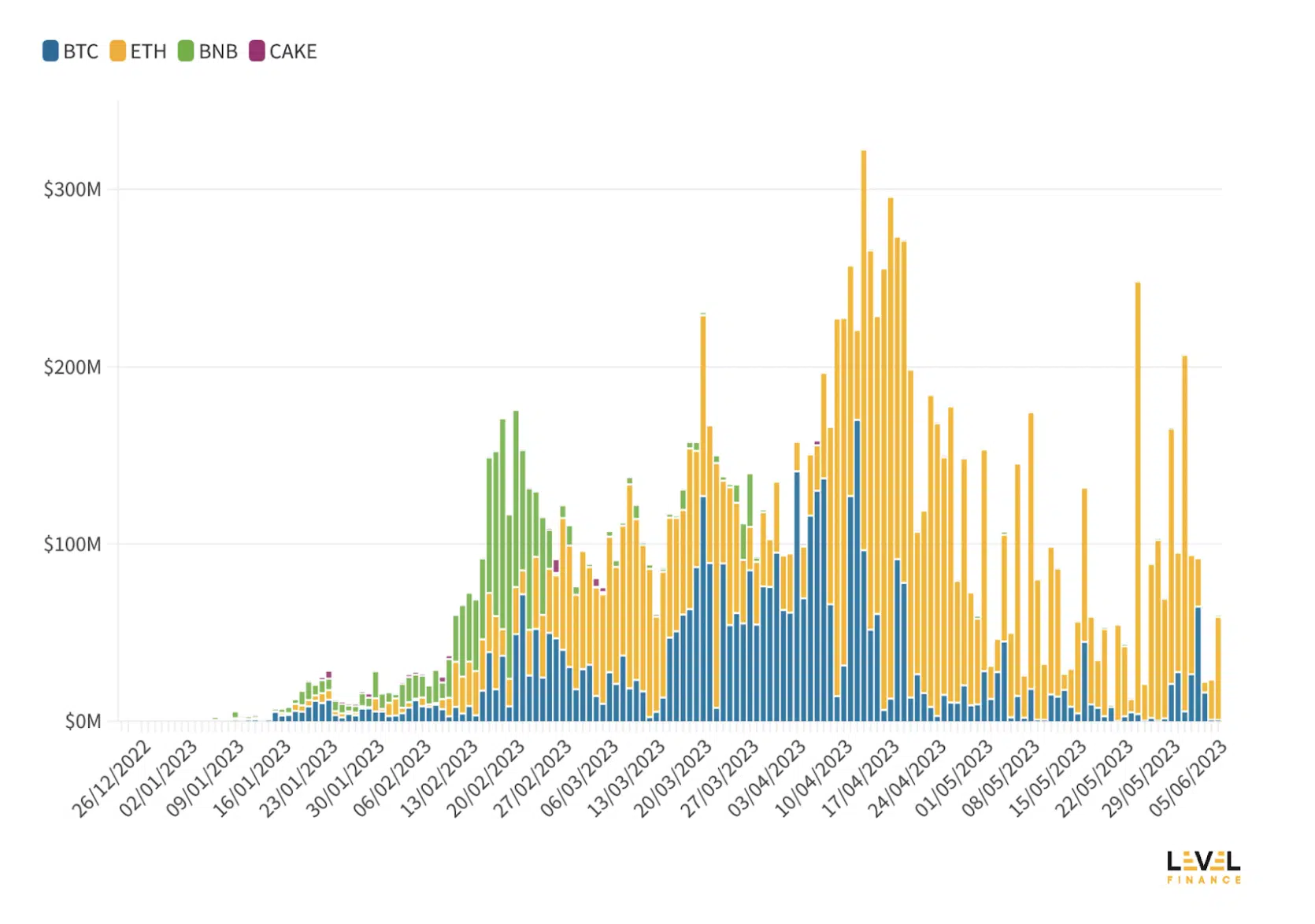

The level has experienced phenomenal growth. In just the first month, Level witnessed a notable $320 million in volume traded, generating over $400,000 in fees and bringing in more than 1,000 community members.

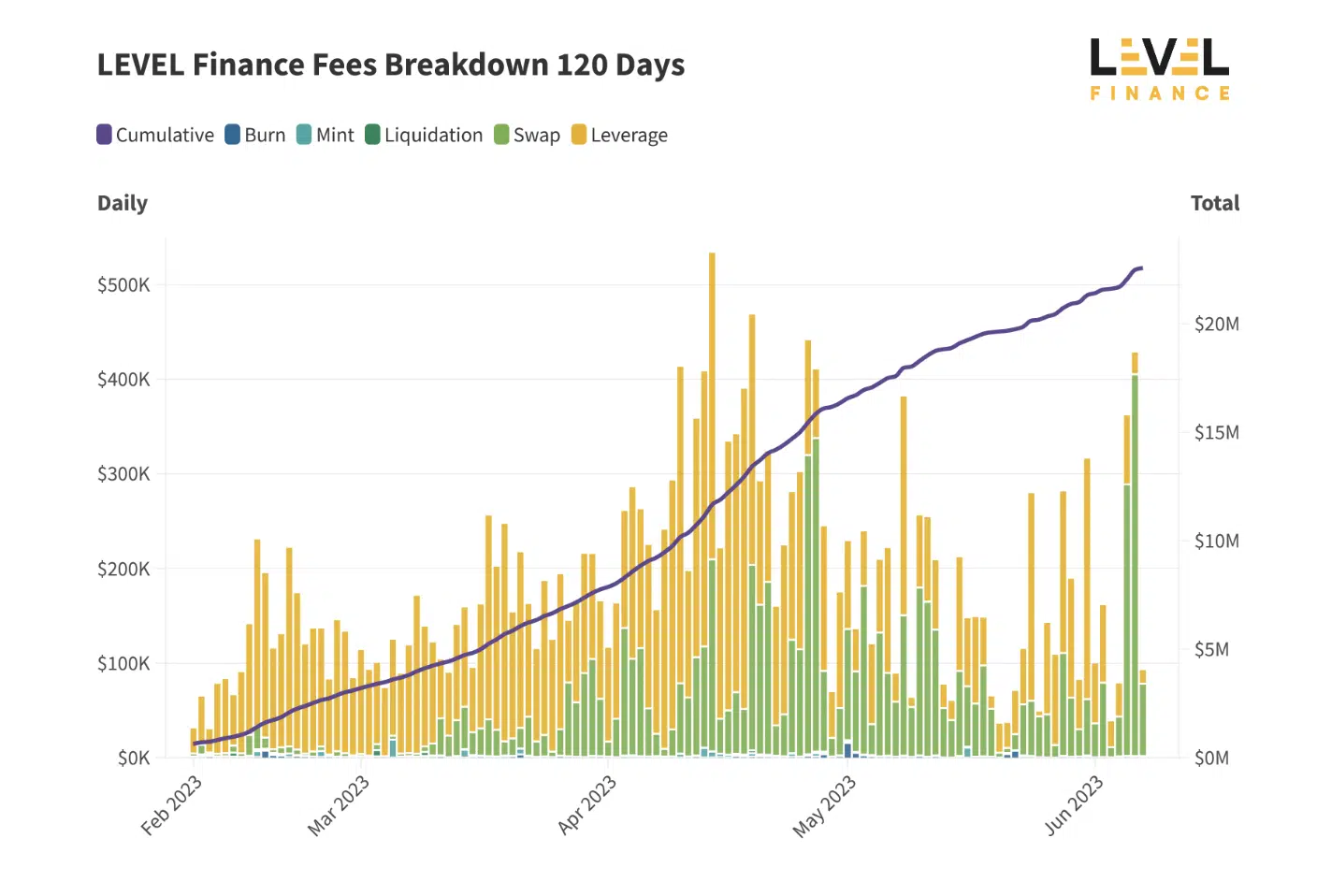

As a testament to the product–market fit they found, it took just 55 days for the ecosystem to hit $1 billion in trading volume, leading to collecting $8.3 million in fees during that time — going from strength to strength with over $20 billion traded in the first half of 2023 alone.

Impressively, the most significant daily trading volume was $339 million on April 14, 2023, accounting for around a third of the total volume across Perp DEXs (Delphi Digital).

A quick look at on-chain

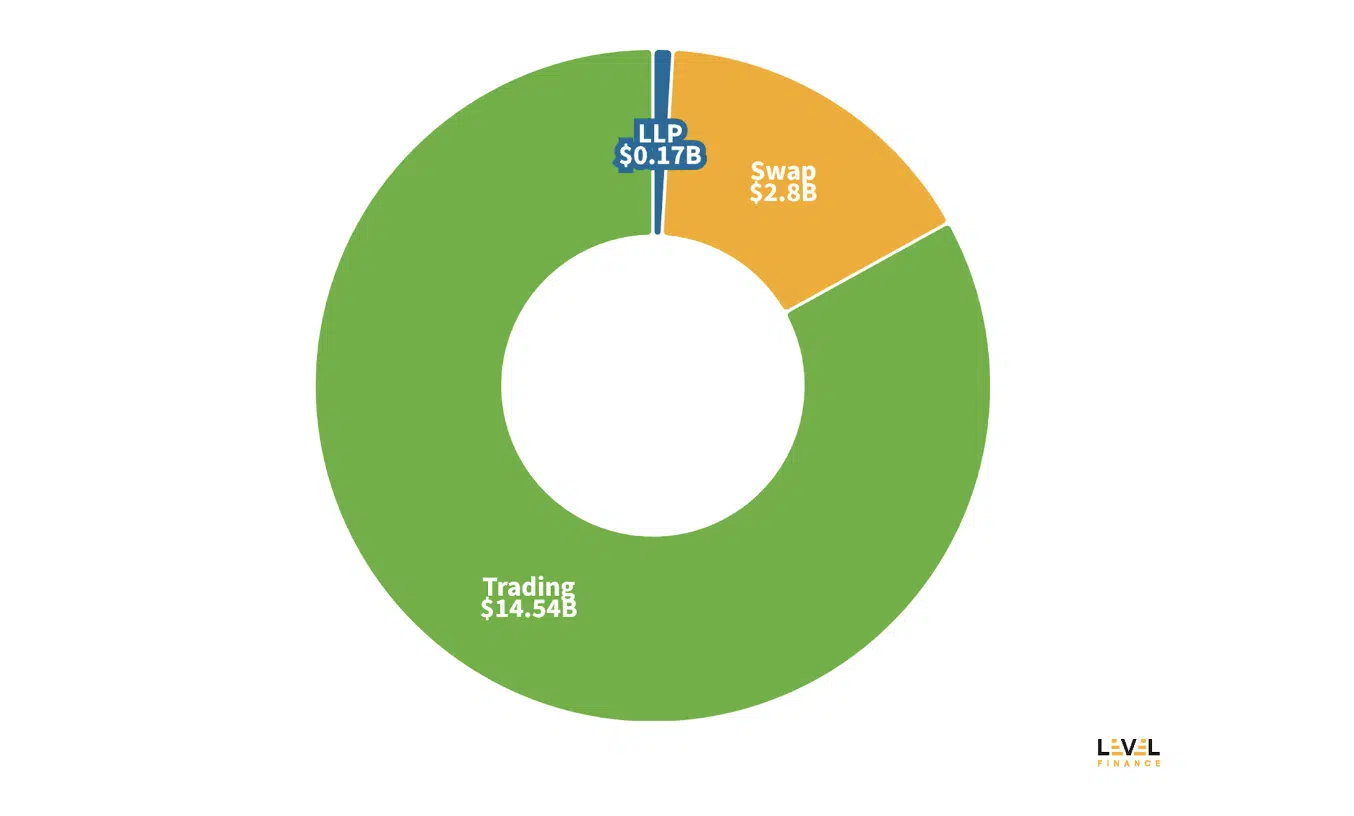

Total volume: $17.4 billion, of which leverage trading volume accounts for $14.5 billion

Total collected fees: Less than $22 million

Interestingly, these collected fees are distributed to:

- LLPs (supply-side revenue) — 45%

- LVL stakers (protocol revenue) — 10%

- LGO stakers (protocol revenue) — 10%

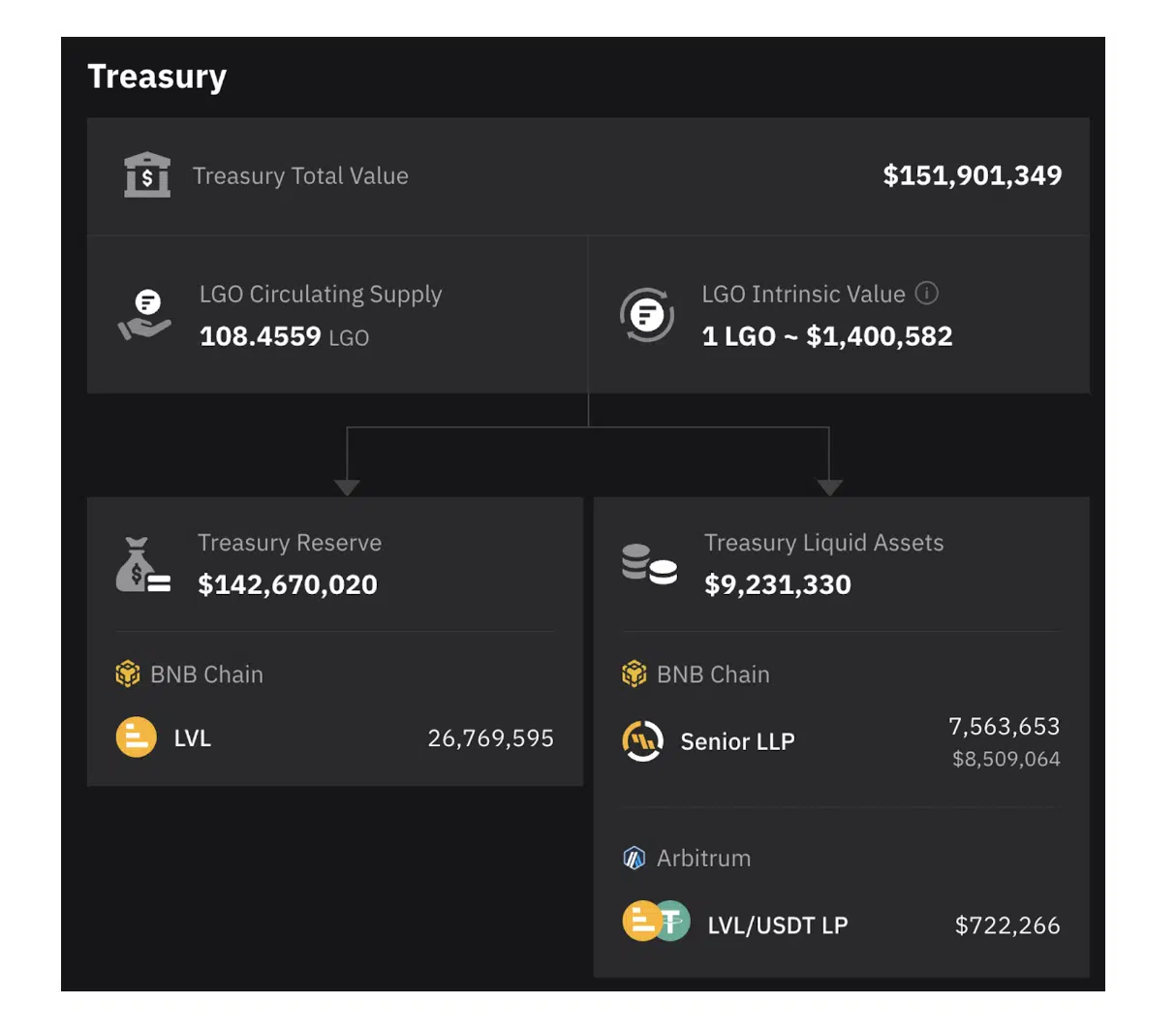

- DAO treasury (protocol revenue, redeemable against LGO) — 30%

- Reserved for protocol development — 5%

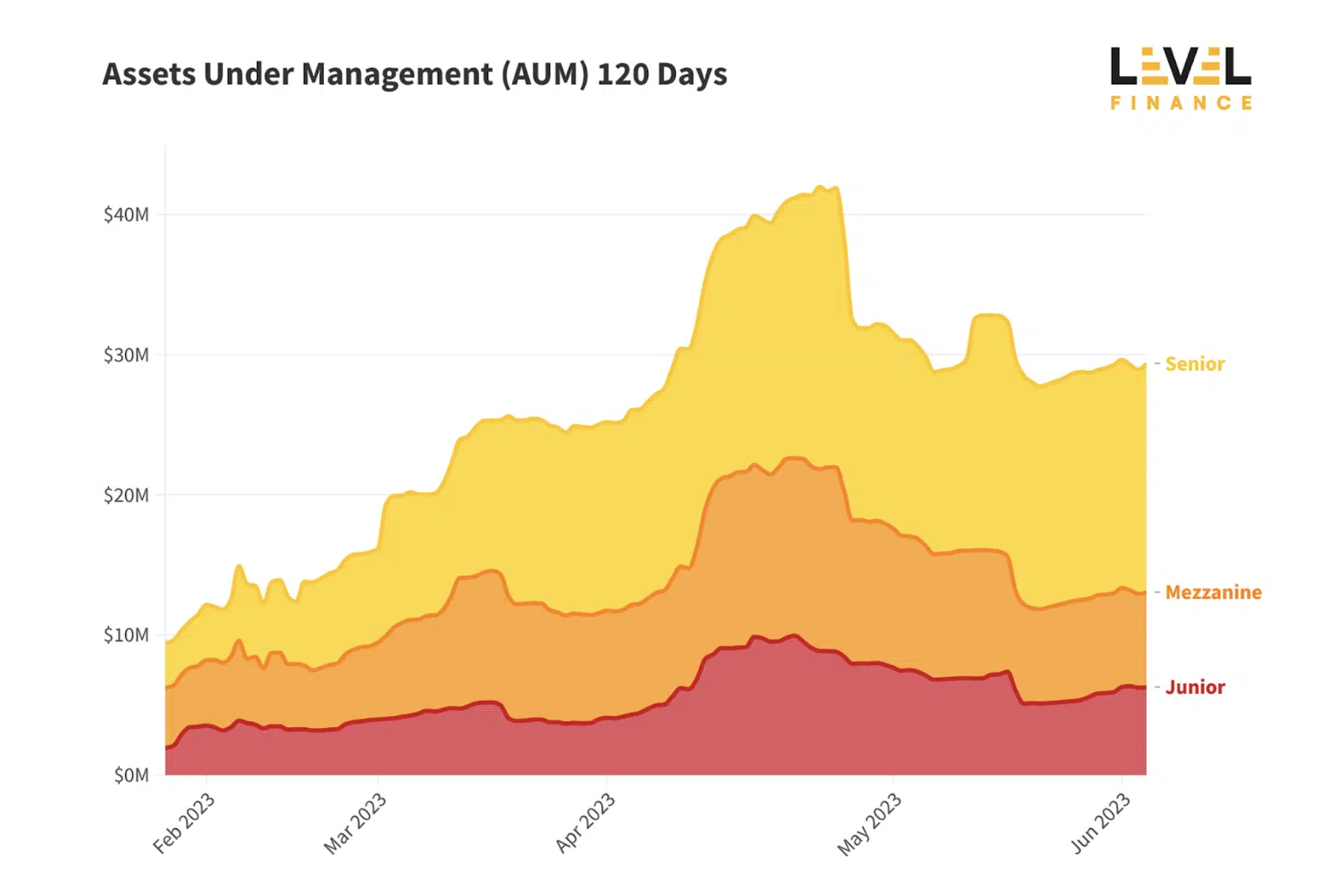

Assets under management (AUM): $30 million.

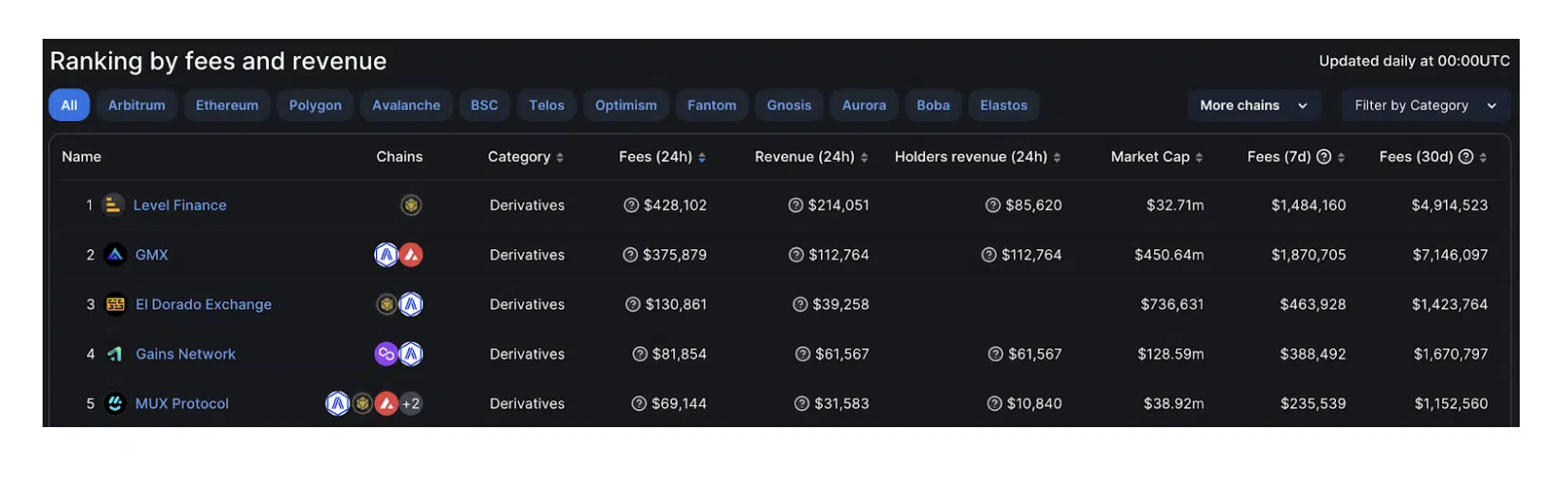

During this time, Level has established itself as the leading perpetual decentralized exchange (DEX) on BNB Chain, rivaling even the likes of GMX — a significant achievement considering the difference in total value locked (TVL) and market cap.

Setting itself apart from competitors, Level wrote its own codebase from scratch and pioneered the tranche system in DeFi. By leveraging its innovative dual tokenomics model (LVL and LGO), which perfectly fits a perpetual DEX platform, LEVEL has created a strong protocol growth value momentum-based model, reflected in the simultaneous growth of platform volume and treasury assets. This has resulted in achieving close to $10 million in treasury liquid assets.

Last but not least, Level is taking DeFi on-chain governance to the next level, with more than 19 DAO proposals submitted. This is truly decentralized governance, driving rapid iteration in product and incentive models for a fast-paced marketplace.

Why Arbitrum?

Even at a glance, Arbitrum looked like the most immediate choice for Level, and this sentiment resonated with the majority of its community.

All new possible chains were evaluated according to their:

- Liquidity

- User profile

- Daily active users

- Daily transaction volume

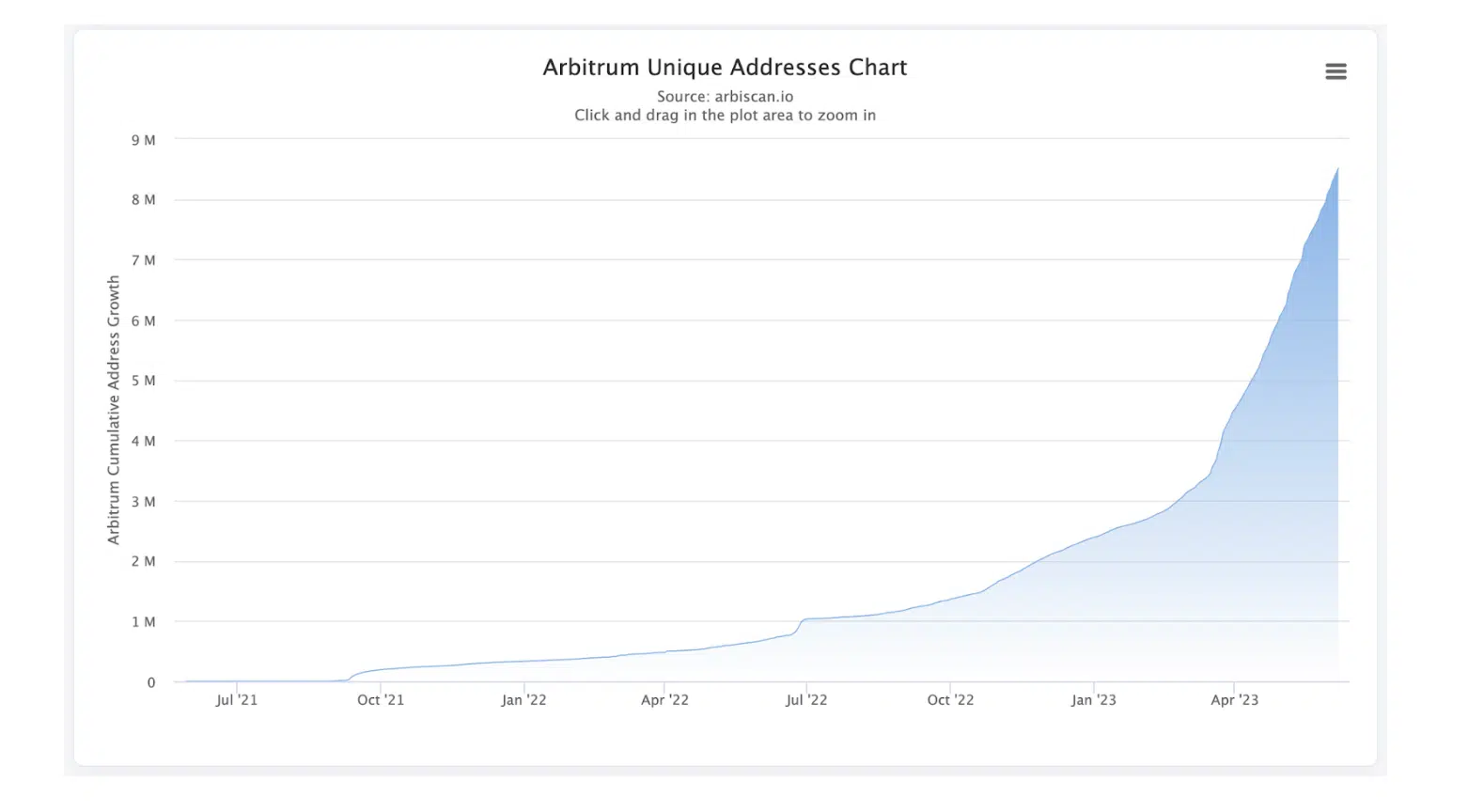

Arbitrum meets all of these criteria, securing itself as the fourth chain by TVL thanks to its deep liquidity and a DeFi-native user base. An equally important factor included the sustained growth of unique addresses in the network, even after the ARB Airdrop.

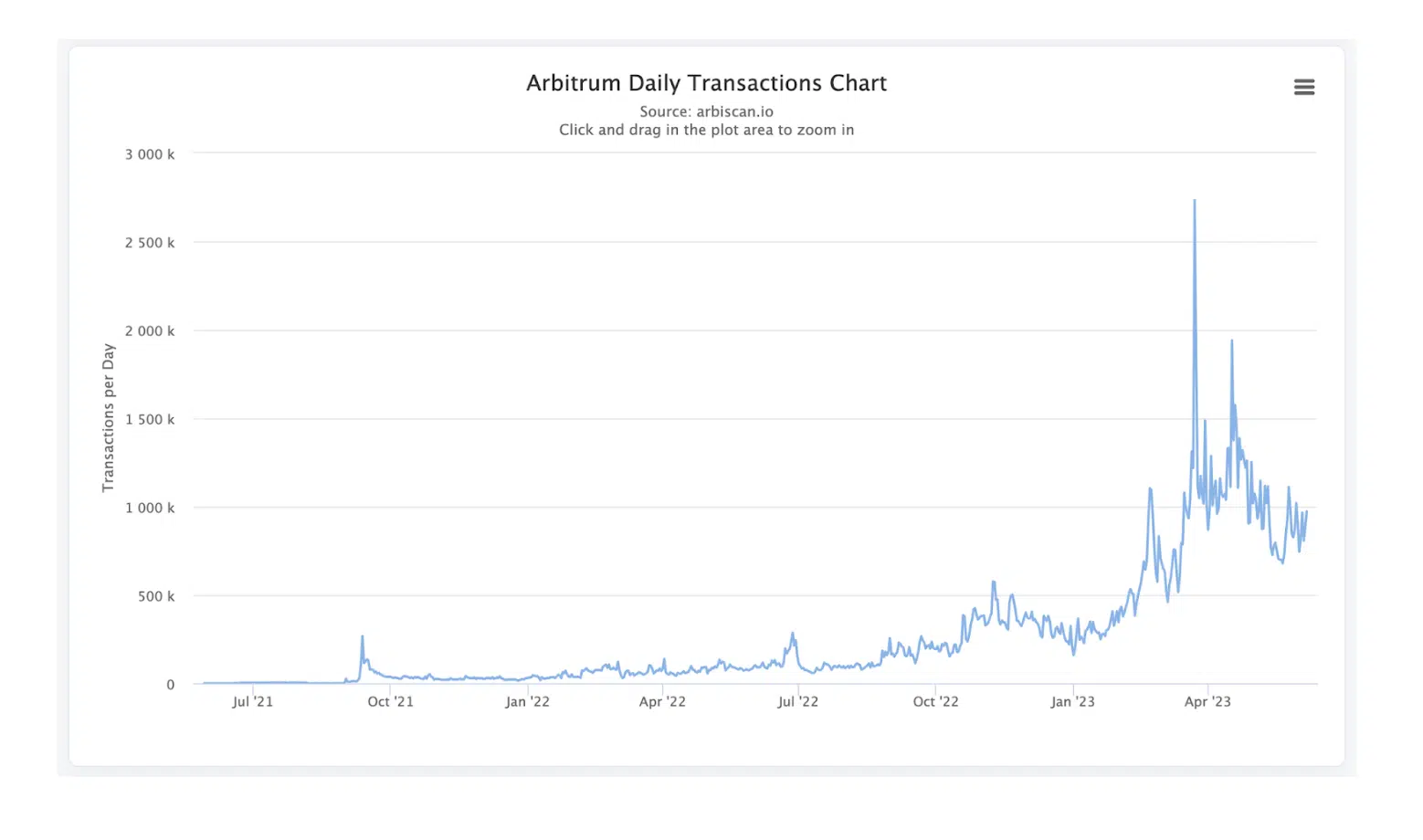

Many critics speculated that activity on Arbitrum would sink after the airdrop. Nonetheless, daily transaction volume on the network is steadily increasing, averaging around 1 million per day — close to its all-time high if one doesn’t take the airdrop period into account.

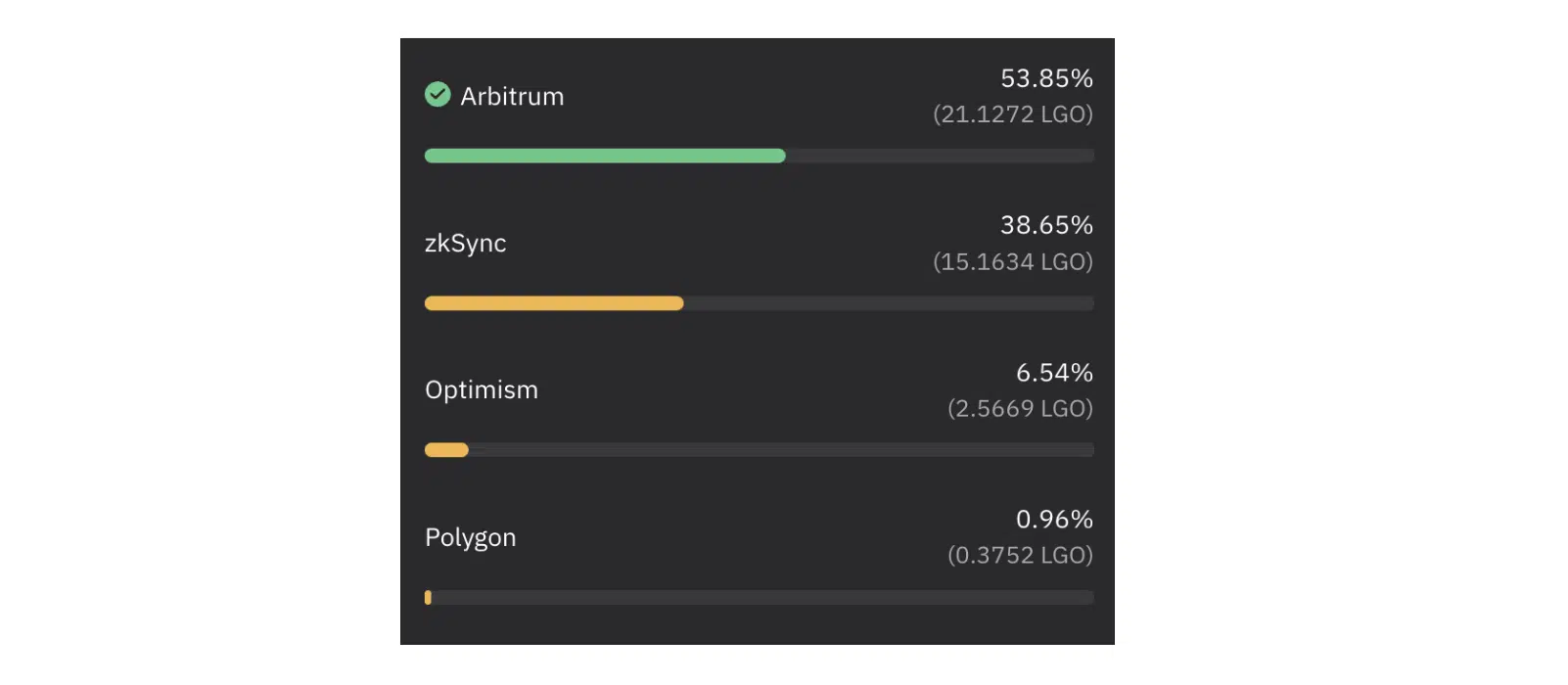

Considering these factors, it’s understandable why the DAO voted for Arbitrum, securing 53% of the total votes across four options.

Arbitrum is the home of DeFi, and a place full of open collaboration. The composable nature of DeFi on Arbitrum offers endless possibilities for new products and partnerships with other protocols. Some remarkable examples include:

- Yield aggregators

- Money markets

- Other derivatives (e.g., hedging, structured products, etc.)

Furthermore, this layer-2 protocol is a fantastic fit for Level, as it houses a native niche of perpetual DEX traders who can benefit from the ecosystem’s incentivized program for traders, shrewdly configured to drive protocol and treasury growth.

While the expansion to Arbitrum is the project’s main priority, Level is not stopping there. It will continue to expand in its goal to become a key piece of the wider omnichain infrastructure.

Future plans

When it comes to future footprints, a key priority for Level protocol is for the DAO to steer Level’s journey toward exceptional growth. Further solidifying its position in the DeFi space, Level is actively seeking, discussing, and moving forward with several partnerships with additional tier-1 projects, enabling them to expand its reach and utility across the industry.

Level’s vision is to become a leading omnichain trading platform, and its recent expansion to Arbitrum marks the first step toward realizing this goal. Expanding its services into other DeFi sectors is another avenue being explored. The goal is to become a multi-chain liquidity aggregator where fragmented liquidity across different ecosystems can be unified in a single pool, allowing users to trade, swap and borrow seamlessly.

The level is excited to embark on this omnichain journey, transforming the way people engage with DeFi and revolutionizing their trading experience.

Step into the Level ecosystem

- Trade a range of blue chip assets on Level

- Buy LVL and begin participating in the ecosystem

Disclaimer: This is a paid post and should not be treated as news/advice.