Altcoin

Lido Finance [LDO] emerges as the king of DeFi, but there is a problem

![Lido Finance [LDO] emerges as the king of DeFi, but there is a problem](https://ambcrypto.com/wp-content/uploads/2023/02/ldo-aniket-pexels-1000x600.jpg)

- The total value locked on Lido Finance went past $8 billion in January.

- Despite the feat, the protocol’s native token was down 5.82% at press time.

Lido Finance [LDO] had a rollicking start to 2023 after it eclipsed MakerDAO [MKR] to become the biggest decentralized finance [DeFi] protocol, as per DappRadar. Moreover, the total value locked (TVL) of Lido’s smart contracts went past $8 billion in January 2023, which amounted to gains of over 36%.

4/ @LidoFinance has also overtaken @MakerDAO as the biggest DeFi platform on the market, with an increase of 36.77%. They now have more than $8B locked in their platform.

— DappRadar (@DappRadar) February 2, 2023

Read Lido’s [LDO] Price Prediction 2023-24

ETH 2.0 behind the growth?

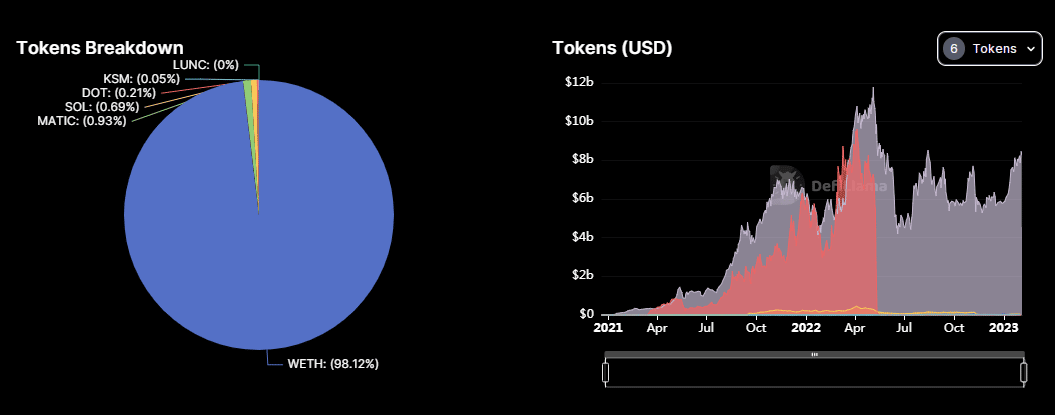

Lido’s growth could be attributed to the increasing popularity of liquid-staking protocols, which increased manifold following Ethereum’s [ETH] transition to the Proof-of-Stake (PoS) algorithm. Data from DefiLlama showed that about 98% of the TVL locked on Lido came from the locked ETH tokens, which surged by 30% during January.

Another notable development was the sharp increase in ETH staked with Lido Finance ever since Ethereum developers confirmed the roll out of

Shanghai Upgrade. The opportunity to earn rewards on their locked tokens could have escalated staking activity.As per IntoTheBlock, the ETH staked with the protocol was over five million at press time.

Staking rewards invites users

The protocol remained lucrative for staking, which was supported by the data from Token Terminal. The supply-side fees, or the rewards accrued to the stakers, rose by more than 30% in the 30-day period. At the same time, the protocol’s earnings jumped by 65%

However, Lido Finance’s diminishing market share in the ETH staking market was concerning. As per Dune Analytics, its share was just 29% at press time. Moreover, it faced increased competition from centralized exchanges like Coinbase.

Is your portfolio green? Check out the LDO Profit Calculator

LDO in red territory

The protocol’s native token didn’t react positively to this big milestone. LDO dipped by 5.82% at the time of writing with a substantial drop in trading volume as well, data from CoinMarketCap showed.

A look at technical indicators revealed the gloomy picture. The Relative Strength Index (RSI) had formed a bearish divergence with the price for the latter part of January. Though it was above neutral 50 at press time, there was a high chance of strengthening selling pressure in the coming days. The Chaikin Money Flow (CMF) was deep in the negative territory, which gave a strong indication of bearish sentiment.