Lido Finance: Negative sentiment overshadows double-digit growth

- LDO’s increase in value has not excited market participants.

- On-chain volume excelled in profit, but GitHub contribution decreased.

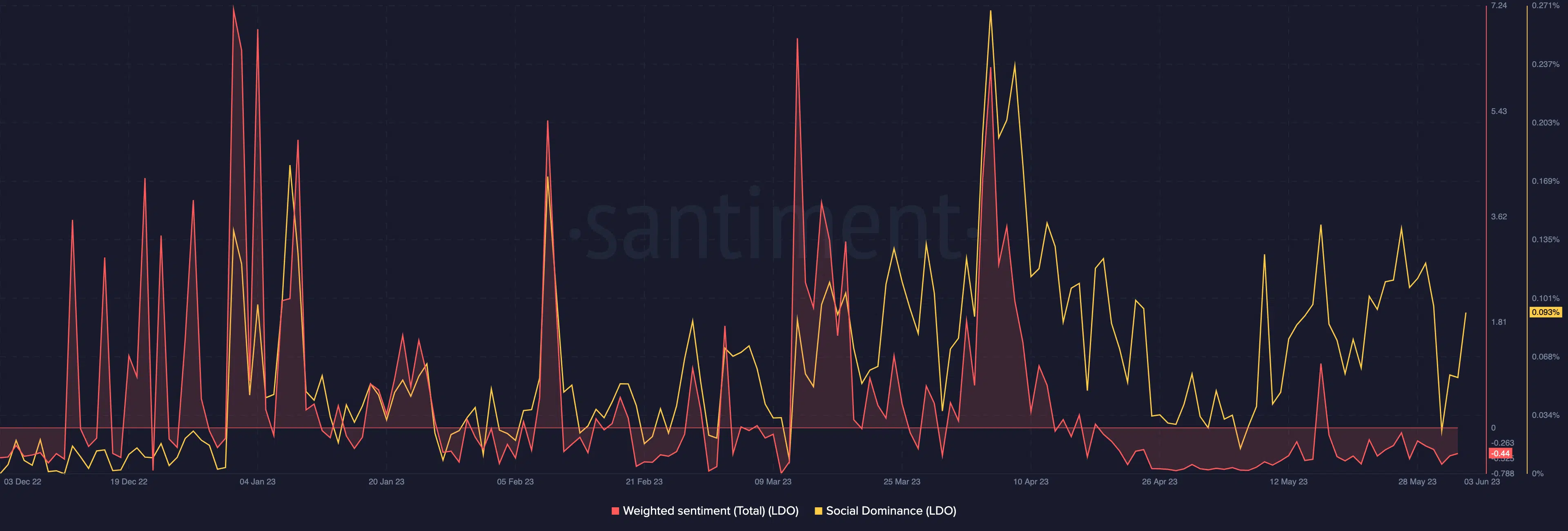

The sentiment surrounding the native token of Lido Finance [LDO] has been largely negative, according to on-chain data from Santiment. As of this writing, the weighted sentiment used to measure the average investor perception was -0.44.

This happened despite LDO’s performance in all of May. In the last 30 days, Lido Finance’s governance token price increased by 15.34%.

Enthusiasm has not yet peak

While LDO has experienced significant price appreciation, with a solid performance in terms of price and trading volume, several factors contributed to the prevailing negative sentiment.

A critical concern was the concentration of LDO tokens in the hands of a few large holders, which raised questions about decentralization and governance. Such concerns could undermine investor confidence and contribute to the project’s negative sentiment.

However, Lido’s social dominance took a sharp spike since 31 May and has maintained the increase until press time. The Social Dominance shows the share of discussion around an asset compared to other cryptocurrencies in the top 100 per market capitalization.

Hence, the increase in the metric suggested that LDO was one of the most talked about tokens in the crypto community at press time. However, growth in the Lido ecosystem has been wider than price action and social activity alone.

Rather, Ethereum’s [ETH] liquid staking protocol has maintained its top spot in Total Value Locked (TVL).

As a decentralized finance (DeFi) protocol that allows users to stake their earned staked Ether [stETH] rewards, the TVL increase means that investors have increased their appetite for depositing assets into the ecosystem.

Gains for holders but development brushed aside

Besides, the V2 upgrade also impacted the increase in confidence, as well as the hike in stETH.

Despite on-chain voting in favor of the upgrade deployment, Lido Finance’s development activity decreased. At press time, the metric was down to its lowest state in 2023.

Typically, when the development activity increases, it infers that GitHub repositories are active. But when it decreases like Lido was, at the time of writing, it suggested less commitment to upgrades on the network.

The ratio of the daily on-chain transaction volume in profit to loss was at 4.08 during the time of writing. The metric is calculated as the daily on-chain volume in profit divided by those in loss.

How much are 1,10,100 LDOs worth today?

A high ratio indicates that market participants have made more profits than losses. Irrespective of the acumen shown towards LDO, the liquid staking continues to lead smart contracts deposits in the DeFi space.

However, the token might need an increase in participation elation to continually impact the token positively.

![Lido Finance [LDO] on-chain volume in profit and loss and Lido development activity](https://ambcrypto.com/wp-content/uploads/2023/06/Lido-DAO-Token-LDO-11.54.49-03-Jun-2023.png.webp)