Lido [LDO] headed to a supply zone – Will shorting yield gains?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Lido [LDO] posted an impressive weekly return by the time of writing. It had rallied over 12% in the past seven days, as per CoinMarketCap. Put differently, it has reversed almost all the losses incurred in mid-May after dropping from $2.5 to $1.95.

How much are 1,10,100 LDOs worth today?

Unfortunately, the price action was headed to the same bearish zone and price ceiling it encountered in mid-May. With a weak Bitcoin [BTC], >27k, sellers could regain control and extend gains to lower support levels.

Are shorting gains imminent?

Despite recent fluctuations, LDO’s market structure on the four-hour chart was on an uptrend momentum, as illustrated by the ascending channel (orange). The $2.50 – $2.77 supply zone (red) has been a critical price ceiling since late March.

Besides, the supply zone could also be considered to have a bearish order block (OB) on the four-hour chart, formed on 18 March. So far, the supply zone has inflicted three price rejections since late March. LDO could face another price rejection at the supply zone if the trend repeats.

The drop could ease at the range low of $2.2 or the demand zone of $1.89 – $2.06 (cyan). The demand zone was also a bullish OB formed on the 12-hour chart on 19 January. If the demand zone cracks, too, LDO could settle at $1.62.

The Relative Strength Index (RSI) headed to the 50-mark, while the On-Balance Volume (OBV) fluctuated since mid-May. This highlighted ease in buying pressure and wavering demand.

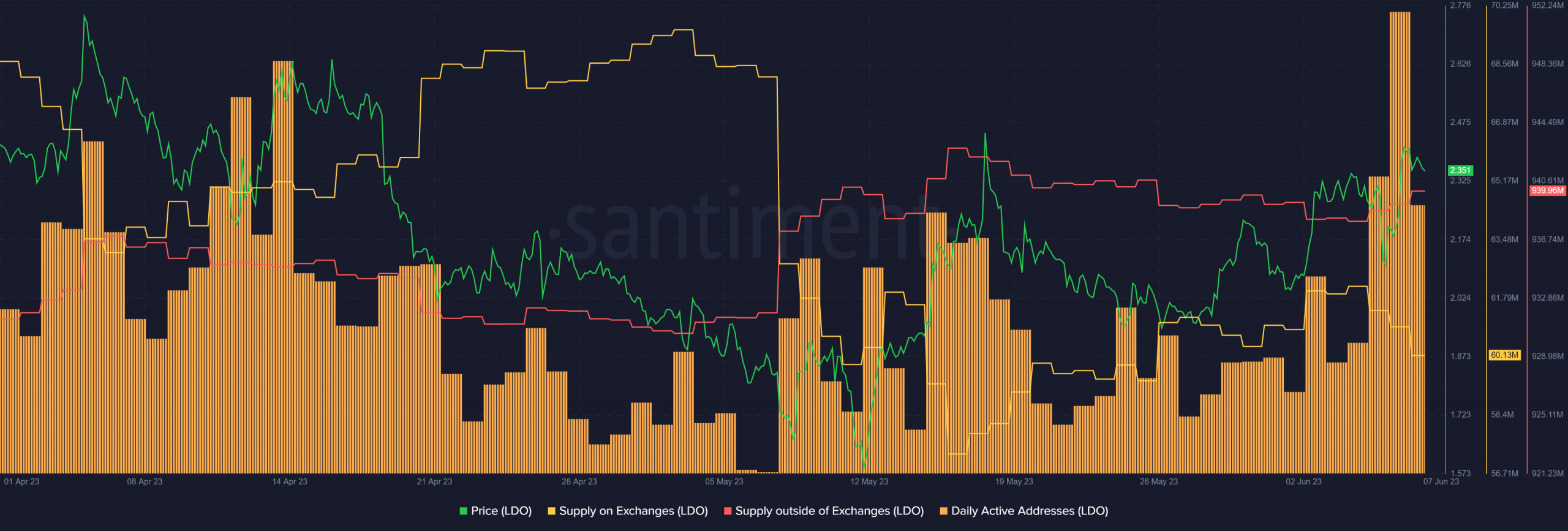

Supply on exchanges spiked

Is your portfolio green? Check out the LDO Profit Calculator

From 4 June, supply on exchanges witnessed a dip – a decline in selling pressure. On the other hand, the supply outside exchanges increased – a short-term accumulation trend for LDO. The buying pressure was matched by an uptick in daily active addresses, indicating improved volume.

Nevertheless, a weak BTC alongside the bearish zone above $2.5 could complicate matters for bulls.