Lido releases update about state of staking deposits, details inside

- Lido sees weekly uptick in staking deposits despite sluggish market conditions.

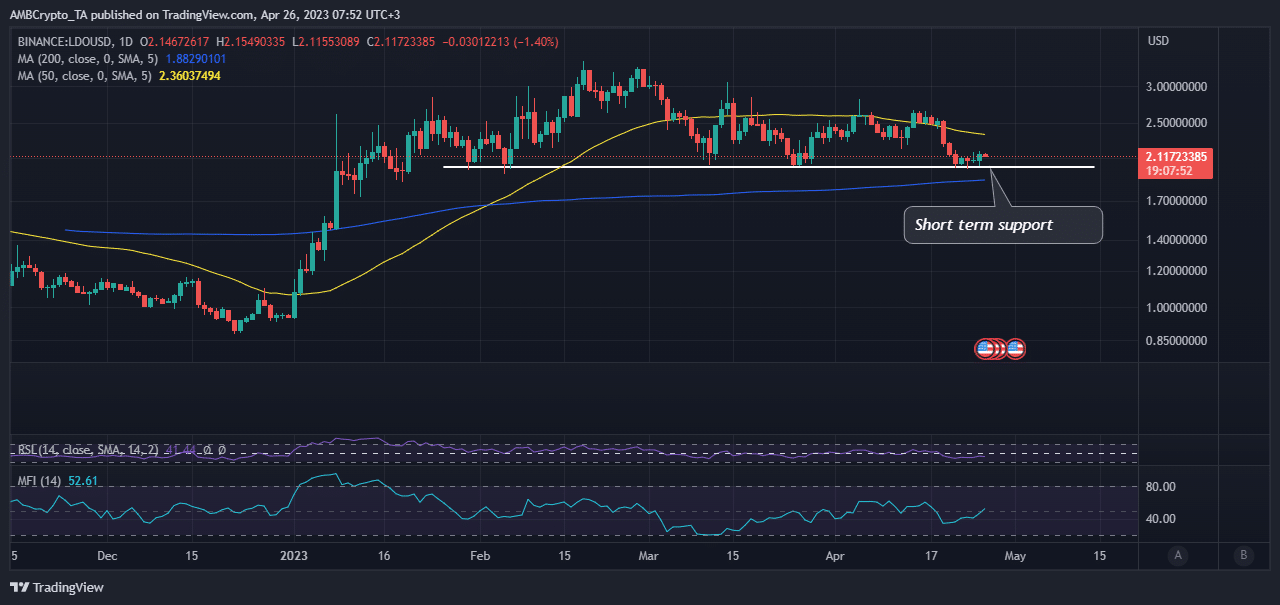

- LDO struggles to bounce off short-term support as investors lean on the cautionary side.

Lido Finance has certainly been the network to keep an eye on for the last few weeks especially after staking unlocks. Unfortunately, for the network, the timing may not be favorable because the market has been experiencing a cool-down, especially since mid-month.

Is your portfolio green? Check out the Lido Profit Calculator

Lido revealed in its latest update that the current market conditions have had a negative impact on its TVL. The latter shaved off over 10% but the network confirmed that this outcome was largely due to the discounts that tokens received, courtesy of the bearish market conditions.

? Lido Analytics: Apr 17 – Apr 24, 2023

TLDR:

– Lido TVL saw a -10.07% correction due to drop in token prices.

– Lido took in 19.4% of this week’s ETH staking deposits, with a total value of 111.0k ETH.

– stETH/ETH remains stable and currently sits at 0.9988. pic.twitter.com/SBwpykrXMO— Lido (@LidoFinance) April 24, 2023

The update also reported some good news regarding staking deposits which increased by 19% this week. Thus, confirming healthy demand for the staking platform. But is this enough to support favorable investor sentiment for LDO?

LDO’s short-term support to the rescue

The good news (at least for holders) is that LDO has so far managed to hold on to most of the gains that it achieved in January. Not so good news for short sellers.

Previous bearish attempts in February and March were thwarted near the $2 price level, confirming strong support at this range.

As fate would have it, LDO bears embarked on another assault in mid-April, leading to a retest of the same $2 support. There was significant consolidation at the same support level in the last five days.

LDO’s money flow indicator registered a mid-week pivot last week and has since achieved some upside, confirming that liquidity is flowing in.

However, LDO has been struggling to bounce back and this confirms weak buying pressure in the last few days.

How many are 1,10,100 LDOs worth today?

The weak buying pressure correlates with the overall market conditions which have been characterized by a wave of uncertainty. LDO’s current support may give out if the same market conditions prevail.

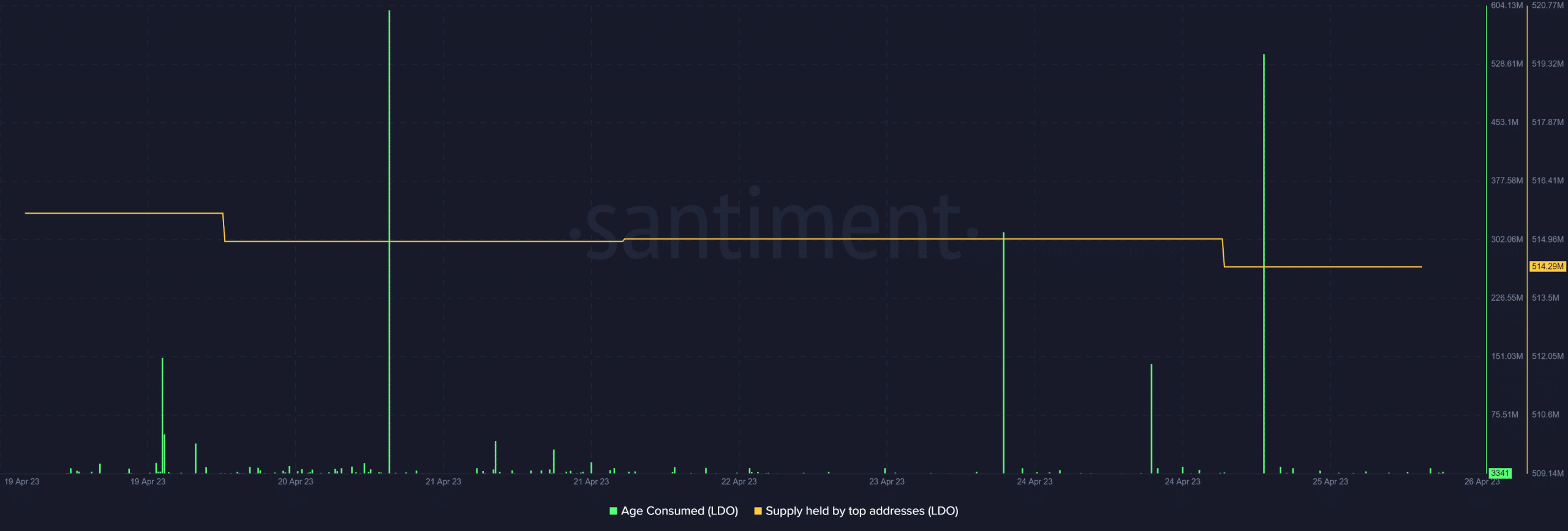

Some on-chain metrics are in favor of such an outcome. For example, the supply held by top addresses indicates that more sell pressure came from top addresses during Tuesday’s (25 April) trading session.

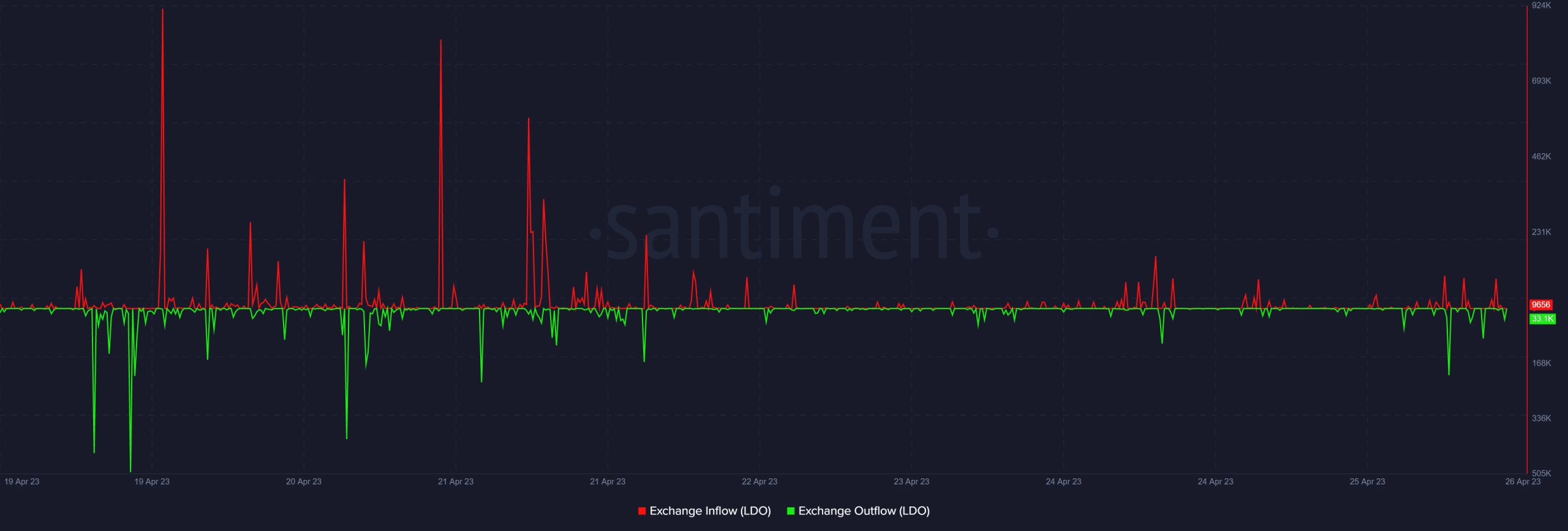

There was also a spike in the age consumed metric which indicates that a substantial amount of LDO was moved. This is consistent with the outflows from top addresses. Exchange flow data confirms a slowdown in the last seven days on both sides.

In summary, LDO may lose its current support if the current market conditions persist. On the other hand, another significant bounce from the current level may boost investors’ confidence.