Lido’s development activity registers unprecedented surge, here’s why

- Lido’s development activity surges over the last quarter.

- The price of the token goes down, thanks to the declining activity on the protocol.

According to recent data provided by Electric Capital’s developer report, it was discovered that Lido’s ecosystem ranked very high in terms of development activity in the crypto space.

Is your portfolio green? Check out the Lido Profit Calculator

The growth was measured by comparing the development activity of protocols from 2022 Q4 to 2023 Q1. The data suggested that the Lido protocol not only witnessed a spike in activity from full-time developers but also from part-time developers.

One of the contributing factors to the heightened level of development activity could be attributed to the introduction of Lido’s V2 protocol.

Notably, the V2 protocol is set to incorporate several new features, including GateSeal.

GateSeal is a contract used to pause other contracts for a specific period of time, with two important parameters: which contract(s) can be paused and which committee is responsible for the decision. It requires contracts that support time-limited pausing and expires within a year, motivating a long-term solution.

The use of GateSeal can have a positive impact on the Lido Protocol by enabling the community to quickly and effectively address unexpected emergencies while constraining the powers of the committee.

One of the more interesting parts of Lido V2 is GateSeal.

GateSeal is a one-time use contract which can be used by a committee to temporarily pause another contract for a predetermined amount of time.

As of last week the factory for GS has been deployed:https://t.co/9hp5ApM7pZ pic.twitter.com/jFHbwx17dl

— Lido (@LidoFinance) April 21, 2023

Can Lido build its way out of its challenges?

Despite making large amounts of improvements to its network, the protocol still encountered issues. Data provided by the token terminal suggested that the number of daily active users on the protocol fell significantly.

Coupled with that, the overall TVL on the Lido protocol also went down.

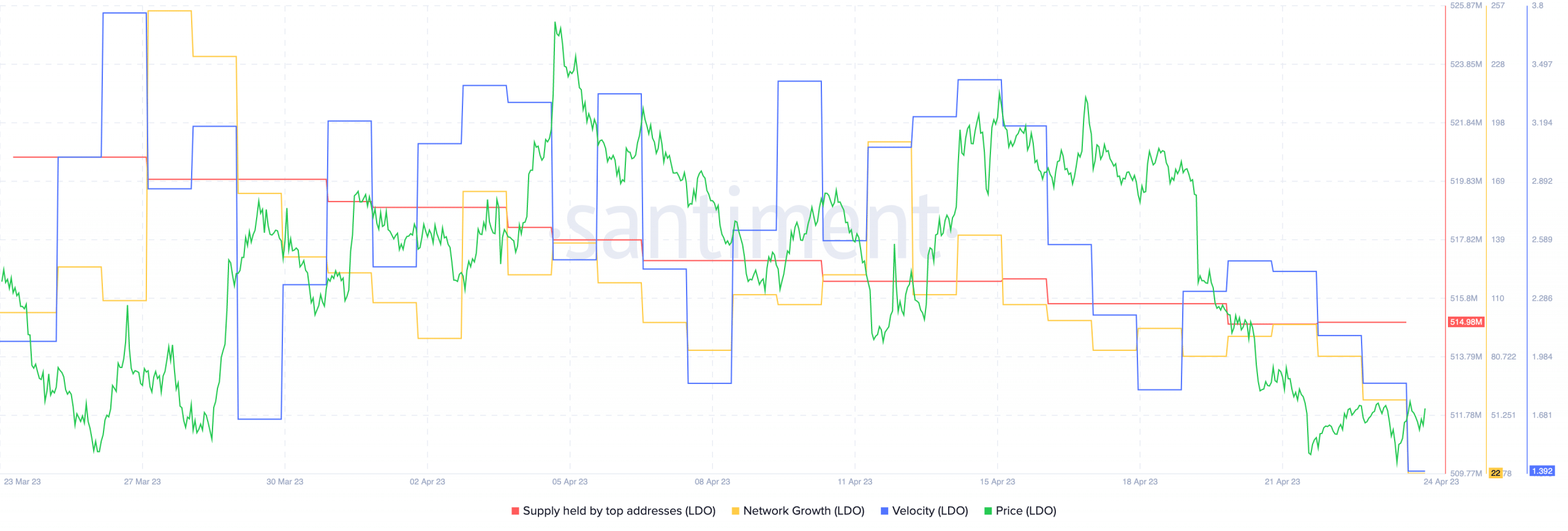

In fact, the Lido token’s price too took a tumble. The decline in price could be attributed to the falling interest from large addresses holding LDO.

Additionally, the token’s network growth went south, indicating that new addresses were not interested in purchasing the token despite the lower prices.

The velocity of the token also tumbled, suggesting that the frequency with which LDO was being traded fell.

Realistic or not, here’s LDO market cap in BTC terms

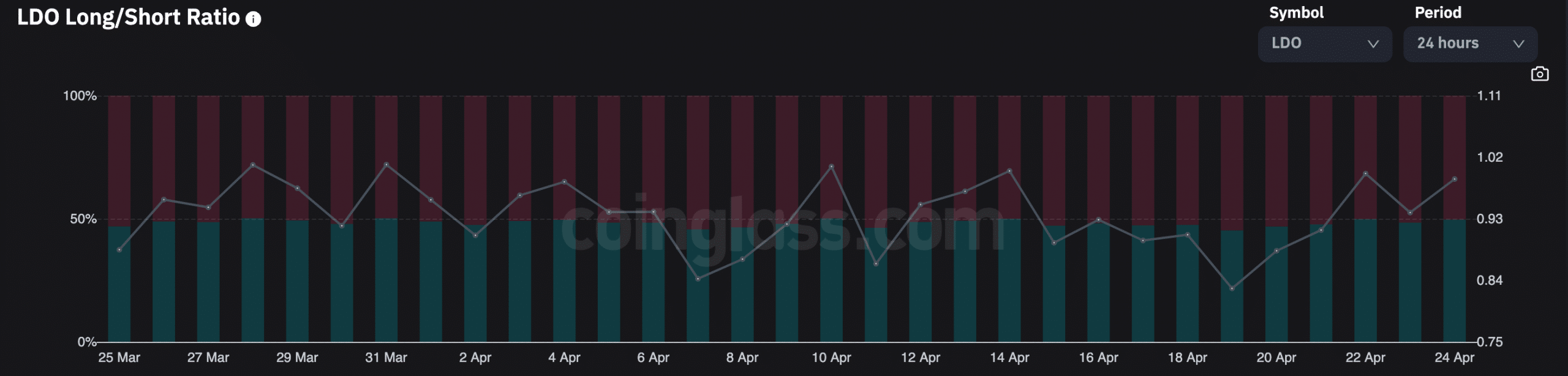

However, despite these factors, traders continued to show optimism around the LDO token. Coinglass’ data indicated that the number of long positions taken in favor of LDO increased despite the volatility of its price.