New ETH withdrawal processing milestone for Lido means…

- The withdrawals on Lido were processed using the ETH buffer, which still had a 37.4k supply available.

- Lido’s TVL managed to climb by 10% in the last month.

Lido Finance [LDO], the largest liquid staking protocol, processed nearly 98% of the withdrawal requests in a week’s time since the launch of its version 2. The launch enabled users to withdraw their Staked ETH [stETH] to Ethereum [ETH] at a 1:1 ratio.

As noted by research analyst Tom Wan, the withdrawals were processed using Lido’s ETH buffer. This means a supply of 37.4k was still available. This also meant that the remaining withdrawal amount was about 6.6k.

It could also be furnished without Lido having to exit any of the validators from the network.

You have to admit the buffer from @LidoFinance is quite smart

They have processed 446k $ETH withdrawals without exiting a single validator.

By stacking up daily deposits (0 ETH Staked from 13-17 May), partial withdrawals+execution layer reward, they had 450k+ ETH Buffer pic.twitter.com/nSe1P7LkjW

— Tom Wan (@tomwanhh) May 21, 2023

Is your portfolio green? Check out the Lido Profit Calculator

Expediting withdrawals on Lido

Lido makes use of a protocol buffer to enable faster withdrawals for stakers on the network. The execution layer rewards, partial withdrawals, and daily ETH deposits made by new stakers via Lido are what fund the buffer. If there is a large Beacon chain exit queue, the Lido protocol buffer can result in significant time savings. This could be the case for relatively large withdrawals as well.

For comparison, it takes two days for withdrawal requests fulfillment. This is if withdrawals are in the range of 1000 to 5000 ETH. In contrast, the standard Ethereum withdrawal process will consume anywhere between two and six days. This would be notwithstanding incidents with an exiting validator.

Moreover, since users receive tokens directly from the protocol buffer, they do not need to wait for 36 days associated with a slashing delay.

As per analyst Wan, Lido topped up the buffer with daily ETH deposits instead of staking them in Ethereum’s smart contracts, from the period of 13-17 May. This ramped up the capacity of the buffer to process withdrawal requests.

Current state of Lido withdrawals

According to analytics firm Nansen, total deposits on Lido would have easily outpaced total withdrawals, if not for the Celsius Network. Celsius Network, the bankrupt crypto lender, accounted for over 94% of the total stETH requested, according to Dune. At the time of writing, a total of 405k ETH has been locked on Lido while 455k was withdrawn.

If it wasn't for Celsius (not the first time anyone's said that, nor is it the last time) Lido deposits would be higher than withdrawals since they were enabled

282k ETH has entered Lido since last week, with 454k ETH withdrawn (Celsius accounts for around 420k ETH) pic.twitter.com/nFC89JnZ5L

— Nansen ? (@nansen_ai) May 22, 2023

Realistic or not, here’s LDO market cap in BTC’s terms

Lido pumps and how!

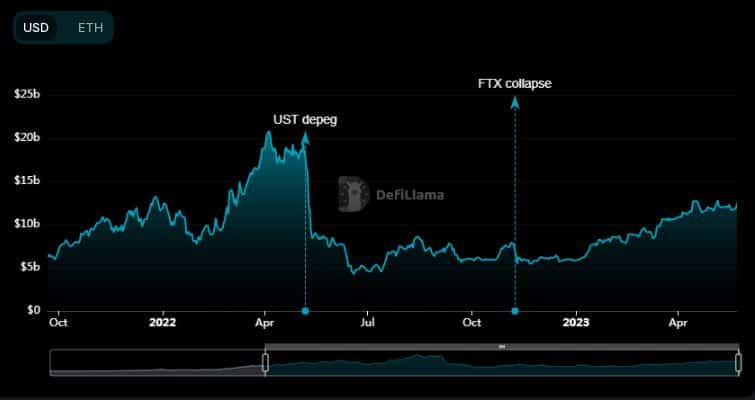

Lido remained the numero uno decentralized finance (DeFi) protocol at the time of publication, holding assets worth $12.5 billion. This stands to be nearly double the second-ranked MakerDAO [MKR], per data from DeFiLlama. Lido’s total value locked (TVL) has more than doubled on a year-to-date (YTD) basis, pumped by the hype and subsequent launch of the Shapella Upgrade.

Lido’s TVL has climbed by 10% in the last month, cementing it as one of the best performers among protocols with a minimum TVL of $1 billion. The native token LDO was valued at $2.07 at the time of writing, down by 0.52% in the last 24 hours, data from CoinMarketCap showed.