LINK, AAVE, SUSHI, CAKE, YFI: These alts are positioned to move in this direction

DeFi tokens are rallying, offering double-digit returns in the past week. Less popular DeFi projects with low market capitalization, like Enzyme [MLN], Strike [STRK] and Lido DAO token [LDO] have offered upwards of 15% in the past week. These tokens have gained popularity given the drop in Bitcoin’s price and dominance. The altcoin rally that was triggered following this drop is being led by DeFi projects.

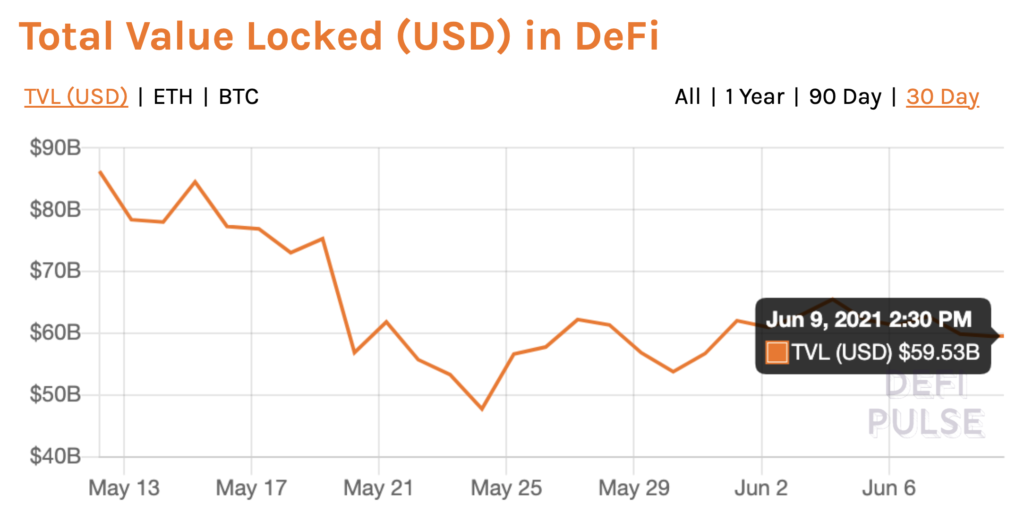

DeFi TVL | Source: DeFiPulse

The above chart showed a steady TVL since June 2, at the $59.3 Billion level. TVL has dropped in the past 30 days, however, the recent aggressive correction has wiped out millions from the overall crypto market capitalization. Relative to altcoins, DeFi recovery was faster.

LINK, AAVE, SUSHI, CAKE, YFI, the popular DeFi tokens haven’t rallied yet since the price drop, however, as investment inflow in these projects increases, while it tapers in altcoins, a rally is likely.

Rising TVL, trade volume, and active wallet addresses, together, these metrics signaled a bullish summer for DeFi. Though social volume for DeFi tokens dropped significantly, there was scope for recovery and an upward trend.

Further LINK, YFI, CAKE, SUSHI, CRV and AAVE are expected to rally this week though the daily social volume for these DeFi projects was hit; in the case of YFI there was a drop of over 30% in a single day.

YFI Daily Social Volume | Source: Lunarcrush

The drop in social volume signaled that there may be accumulation; the price may increase this week, given that the peak in social volume corresponds with a drop in price. The previous peak in social volume led to a drop below the $38400 level. YFI was trading at the $39000 level, and was likely to maintain this level in the following weeks and rally towards the $41000 level.

The daily social volume has hit a local low in the case of several DeFi projects and it is likely that the rally, which is currently led by low market capitalization tokens, may be replaced by popular and mainstream DeFi projects with higher market cap.