LINK whales step up accumulation activity after a brief pause

- LINK climbed to $7.40 over the last 24 hours before retreating back to $7.23

- Whale holdings rose, suggesting greater optimism about the asset in the near future

LINK, decentralized oracle network Chainlink’s native token, briefly touched the $7.40-level on Wednesday, before settling down to $7.23 at press time, according to CoinMarketCap.

During the ascent to $7.40, the crypto jumped by nearly 3% in value before few investors started to lock in gains. While price fluctuations remained the most intriguing component of market analysis, it is critical not to overlook investors’ behavior that likely contributed to it.

Realistic or not, here’s LINK’s market cap in BTC terms

Whales gobble LINK

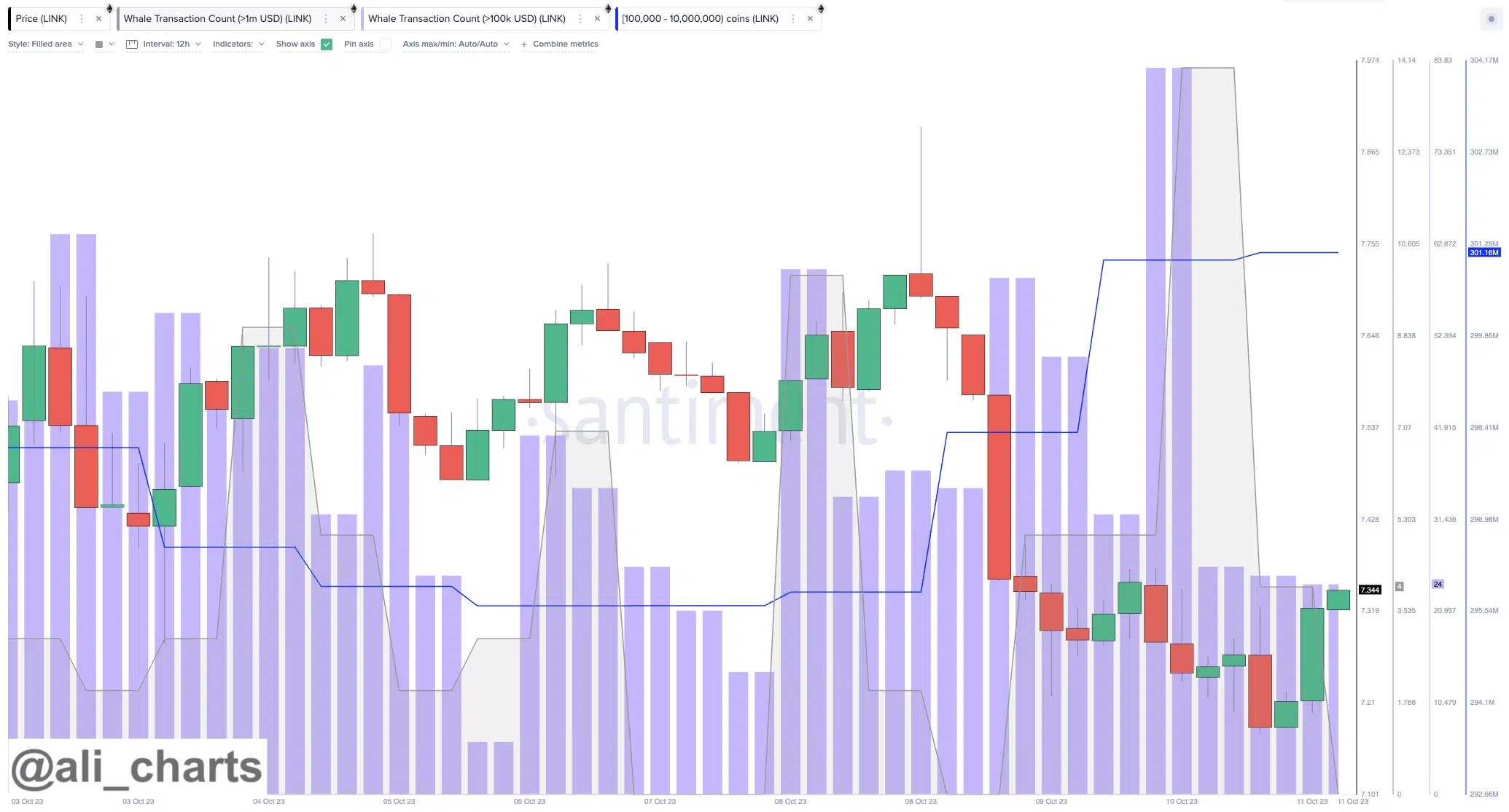

Notably, whale investors sprung into action over the last 24 hours. As per on-chain analyst Ali Martinez, transactions involving the transfer of more than $100,000 in LINK surged dramatically.

The transactions were most likely dominated by buyers. Wallets holding between 10,000 to 1 million coins added more than 3 million LINK tokens to their portfolios in the 24-hour period.

As they own a considerable portion of a crypto’s circulating supply, whale investors contribute significantly to price changes through their transaction activity. The buying binge indicated that there is optimism about the near-term outlook, and LINK’s price may swing to the north in the days to come.

Having said that, this shouldn’t be taken as investment advice and readers are advised to DYOR.

Retail investors give thumbs up to LINK

Heightened interest in LINK’s prospects wasn’t just restricted to large investors. Individual investors, who hold a tiny fraction of whales’ holdings, likewise opened their bags to accumulate more LINK tokens.

Retail accumulation, while not a key trigger in boosting prices in the short term, provides valuable insights into a cryptocurrency’s appeal and mainstream adoption.

Read LINK’s Price Prediction 2023-2024

LINK navigates ebbs and flows

LINK’s social activity has fizzled out since last week, however. This was evidenced by sharp drops in engagements on crypto-related social channels on Telegram and Discord, Santiment revealed.

The lack of interest could be attributed to LINK’s negative price action over the past week. In fact, as per the graph attached herein, LINK saw a depreciation of more than 5% in value over the last 7 days.

Intermittent drops notwithstanding, LINK has been one of the best-performing cryptos over the past month, according to CoinMarketCap. Driven by the expansion of Chainlink’s Cross-Chain Interoperability Protocol (CCIP), LINK has hiked by 20% in value in the last 30 days.