Litecoin bulls to target $125 next?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

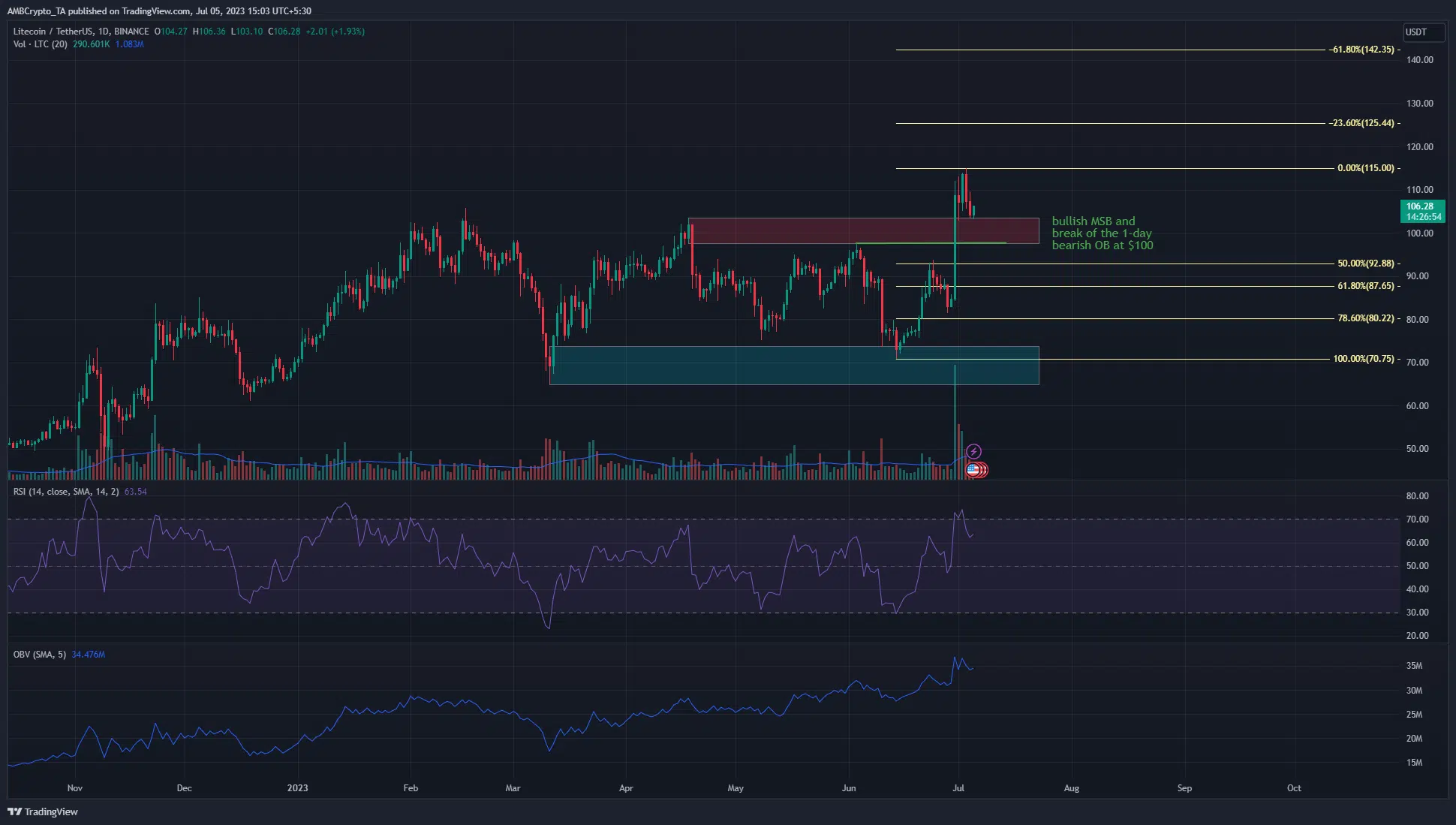

- The Fibonacci extension levels presented likely targets for Litecoin in July.

- The evidence present pointed toward further gains for LTC after the strong breakout past $100.

The Litecoin [LTC] halving event is less than a month away. In the past, the price of Litecoin peaked shortly before the date of the halving before beginning to trend downward. Hence LTC bulls must be prepared for such an outcome in the coming months.

Read Litecoin’s [LTC] Price Prediction 2023-24

The evidence at hand showed that further gains were on the cards. The indicators showed demand behind Litecoin, and momentum was bullish on the 1-day timeframe as well. To the north, the $125 and $140 levels could be tested in July.

Litecoin resumes the uptrend from early 2023, demand remains strong

The daily timeframe market structure was flipped bearish once more on 10 June. This came after LTC breached the recent higher low at $83 and fell toward the $70 region. It reached the low of $70.75 but encountered a bullish order block from March, highlighted in cyan. This occurred on 14 June.

The bulls were able to slowly push prices higher since then. On 30 June the buyers took no prisoners and succeeded not only in breaking the market structure but also in defeating the 1-day bearish order block in the $100 area within a day.

This showed strong bullish intent. The OBV has also trended upward since March, despite the pullback seen in April. In early 2023 Litecoin noted sizeable gains alongside the rest of the market. This appeared likely to continue.

The Fibonacci retracement levels plotted based on the move that led to the break in structure suggested that a retracement to the 50% level at $92.88 was possible. However, the bearish order block at $100 will likely serve as a bullish breaker upon retest and could see LTC move higher.

Is your portfolio green? Check the Litecoin Profit Calculator

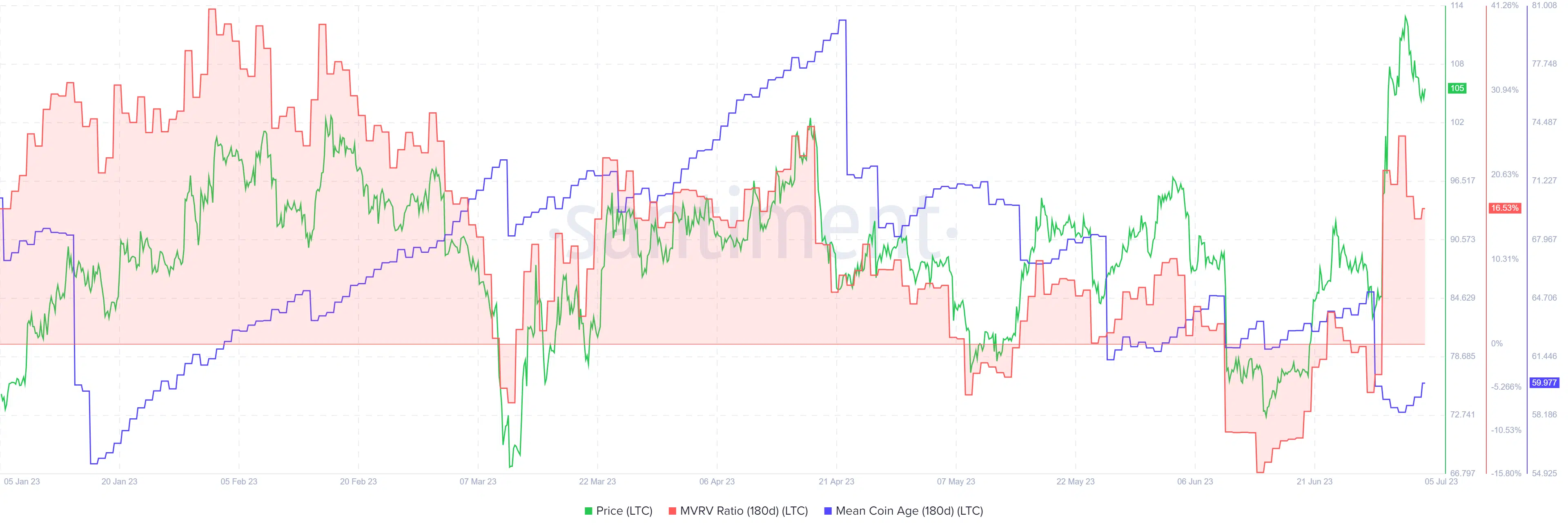

On-chain metrics suggested the uptrend was not backed by accumulation

Source: Santiment

The MVRV ratio climbed to the April high and suggested a wave of selling in the form of profit-taking could commence. More concerning for long-term bulls was the finding from the mean coin age.

This metric showed that since April Litecoin movement between addresses has been on the rise. This was in contrast to the rising OBV and the expectation that investors would be accumulating the asset across the network.