Litecoin’s price can jump 22%, but not before THIS happens

- The liquidation levels indicated a bearish signal but $599,660 might be wiped out if LTC hit $91.78.

- Increasing falling and a falling price suggested a decline toward $85.40.

According to analyst Rekt Capital, Litecoin’s [LTC] price might continue its upswing in the coming weeks.

The analyst posted this on X (formerly Twitter), noting that the successful retest of the multi-year macro downtrend was a sign that the LTC’s price could increase.

From the chart he shared, the altcoin might experience a 22.72% jump. If this is the case, Litecoin might hit $110. At press time, LTC changed hands at $89.74, indicating a 27.99% increase in the last 30 days.

The price of the cryptocurrency also increased in the last 24 hours.

The coin might ascend, but first…

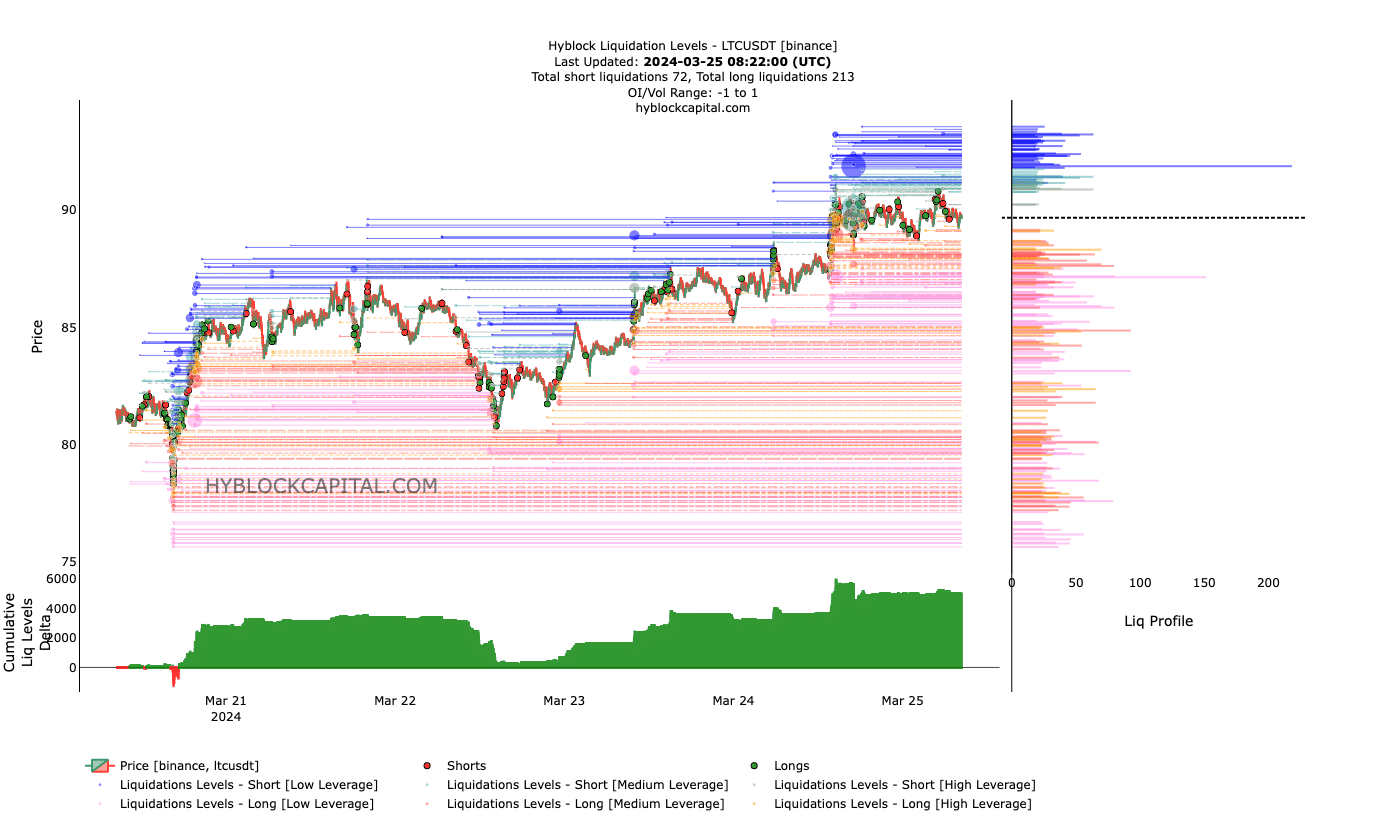

However, AMBCrypto decided to check the chances of a rise to the predicted price. To have a view of this, we employed the liquidation levels indicator provided by Hyblock.

This indicator shows the estimated price levels where large liquidation events might occur. For a trader, an idea of other traders’ possible liquidation levels might offer an edge.

At press time, there was a cluster of liquidity from $90 to $93, suggesting that LTC might move toward this region. Should the price hit this point, a lot of shorts might see their positions wiped out.

However, the Cumulative Liquidation Levels Delta (CLLD) displayed another signal. If the CCLD is positive, it means there are long liquidations.

On the other hand, a negative reading of the CCLD suggests short liquidations.

As of this writing, the CCLD was positive. For the price, this fuels a bearish bias, as Litecoin might undergo a full retracement and erase its recent gains.

If this is the case, the value of the cryptocurrency could tap new lows before it heads toward $110.

Large liquidation looms

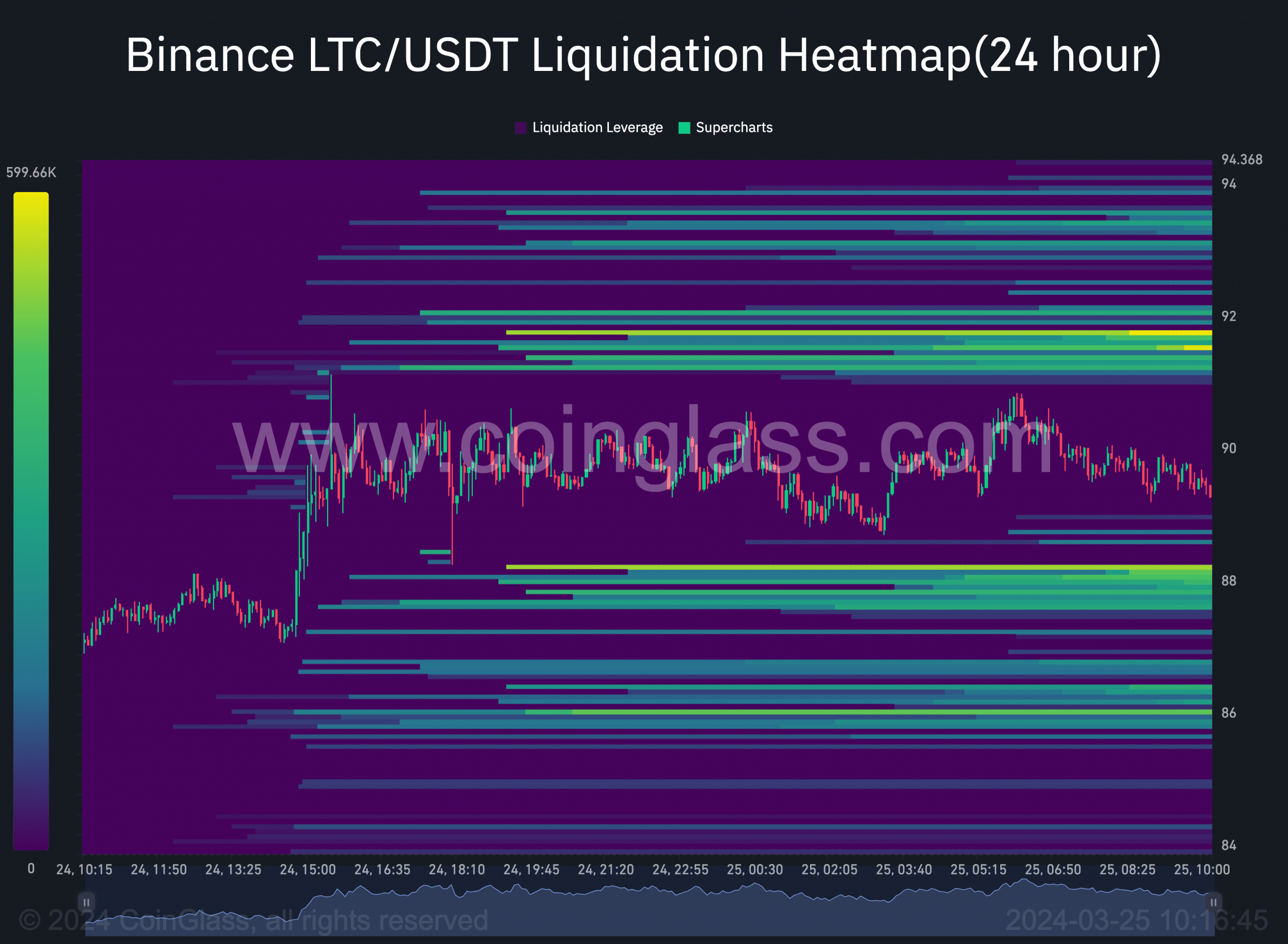

Furthermore, we also considered the liquidation heatmap. According to Coinglass, many positions risk liquidations if LTC continues to increase.

For example, if the price hits $91.78, contracts worth $599,660 would lose their funds. Also, if the price rises to $93.07, liquidations at that zone would be worth $128,200 on the Binance exchange.

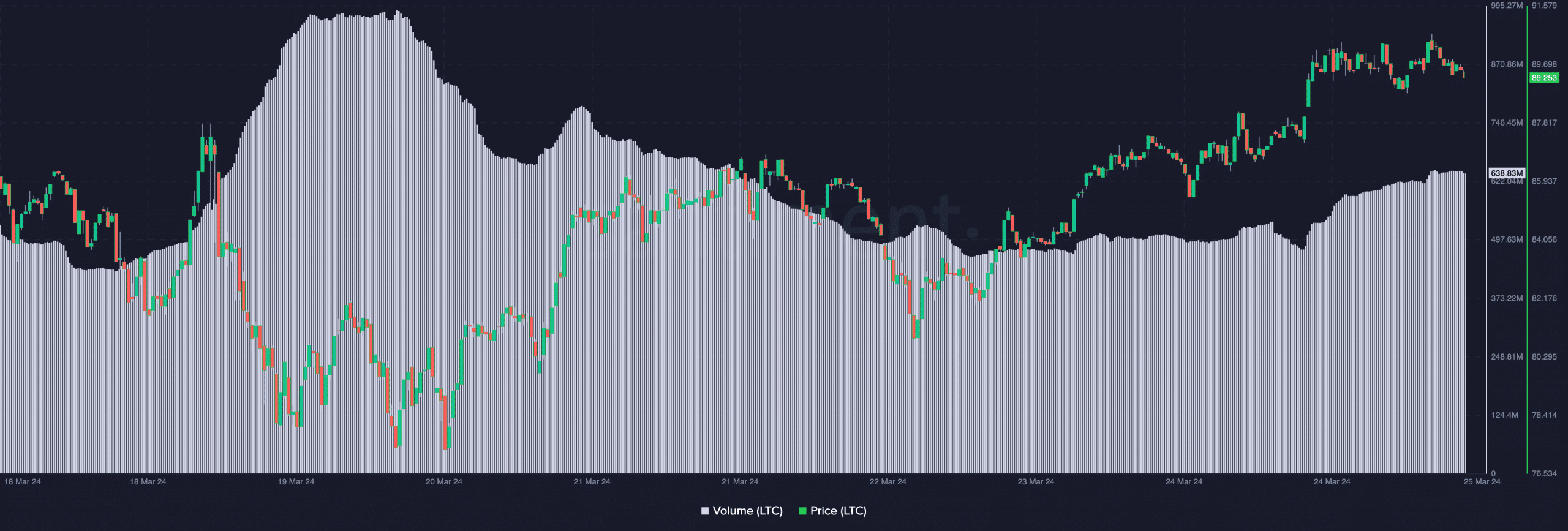

In terms of the volume, on-chin data from Santiment showed that it increased. At press time LTC’s volume had hit 638.83 million.

However, the price of the altcoin has been falling within the last hour. With the volume increasing and price decreasing, it means that the earlier upswing was not as strong as before.

Hence, the value of Litecoin might decrease. In the short term, LTC’s price might fall to $85.40.

Is your portfolio green? Check out the LTC Profit Calculator

Nonetheless, the prediction is no guarantee that the coin might evade climbing in the short term. Should a wave of buying pressure hit LTC, the price might revisit the $100 region within a short period.

If not, a decline could be imminent.